题目

MCD2170 Foundations of Finance - Trimester 3 - 2025

多项填空题

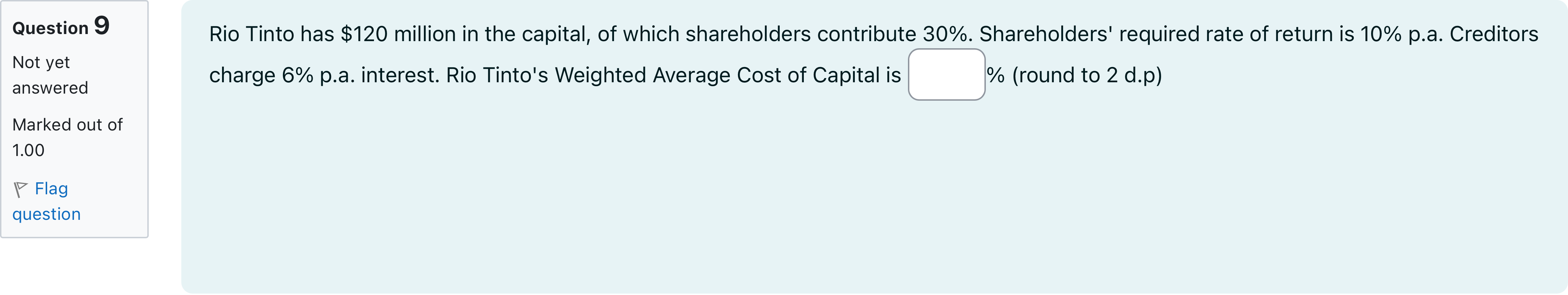

Question textRio Tinto has $120 million in the capital, of which shareholders contribute 30%. Shareholders' required rate of return is 10% p.a. Creditors charge 6% p.a. interest. Rio Tinto's Weighted Average Cost of Capital is Answer 1 Question 9[input]% (round to 2 d.p)

查看解析

标准答案

Please login to view

思路分析

First, separate the capital structure into equity and debt using the given information. The total capital is 120 million, and shareholders contribute 30%, so Equity (E) = 0.30 × 120 = 36 million. Debt (D) then makes up the remaining 70%, so D ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Sixx AM Manufacturing has a target debt—equity ratio of 0.68. Its cost of equity is 16 percent, and its cost of debt is 9 percent. If the tax rate is 34 percent, what is the company’s WACC?

Now, instead of giving you information about dividend and the growth rate, assume that the beta of the firm's stock is 1 and the risk free-rate is 5%, and the market premium is 10%. What is the firm's WACC?

Nuttenhall Corporation has a target capital structure of 70 percent common stock, 5 percent preferred stock, and 25 percent debt. Its cost of equity is 14 percent, the cost of preferred stock is 7 percent, and the pretax cost of debt is 7 percent. The relevant tax rate is 22 percent. What is the company's WACC?Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

Part 1WACC. Grey's Pharmaceuticals has a new project that will require funding of $4.04.0 million. The company has decided to pursue an all-debt scenario. Grey's has made agreements with four lenders for the needed financing. These lenders will advance the following amounts at the interest rates shown:Click on the following link in order to copy its content into a spreadsheet.[table] Lender | Amount | Interest Rate Steven | $1,500,0001,500,000 | | 1111% | Yang | $1,200,0001,200,000 | | 99% | Shepherd | $1,000,0001,000,000 | | 77% | Bailey | $300,000300,000 | | 88% | [/table]What is the weighted average cost of capital for the $4,000,0004,000,000? Part 1What is the weighted average cost of capital for the $4,000,0004,000,000? (Round to two decimal places.)[input]enter your response here %

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!