题目

单项选择题

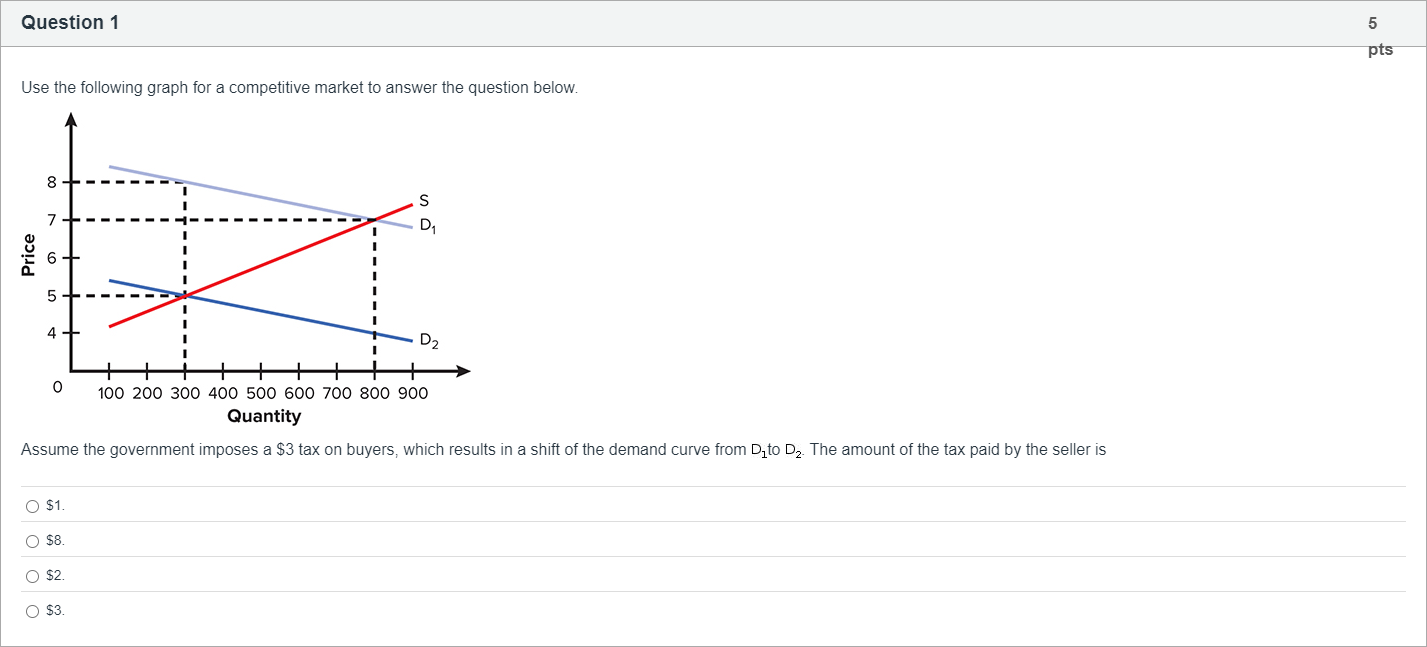

Use the following graph for a competitive market to answer the question below. Assume the government imposes a $3 tax on buyers, which results in a shift of the demand curve from to . The amount of the tax paid by the seller is

选项

A.$1.

B.$8.

C.$2.

D.$3.

查看解析

标准答案

Please login to view

思路分析

To analyze the tax incidence, we start by identifying the pre-tax equilibrium and the post-tax equilibrium from the graph. The tax is imposed only on buyers and shifts the demand curve from D1 to D2, which reduces quantity from the original equilibrium to a new one where the seller’s receipt changes.

Option A: $1. If sellers receive $1 less than before, that means the price they receive after th......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

If the market demand for a good is inelastic and the supply is elastic, which of the following is true when there is an increase in sales tax?

After the government imposed a $0.20 per gallon tax on gasoline, the price of a gallon of gasoline increased from $1.00 to $1.15. Which of the following statements is true?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!