题目

单项选择题

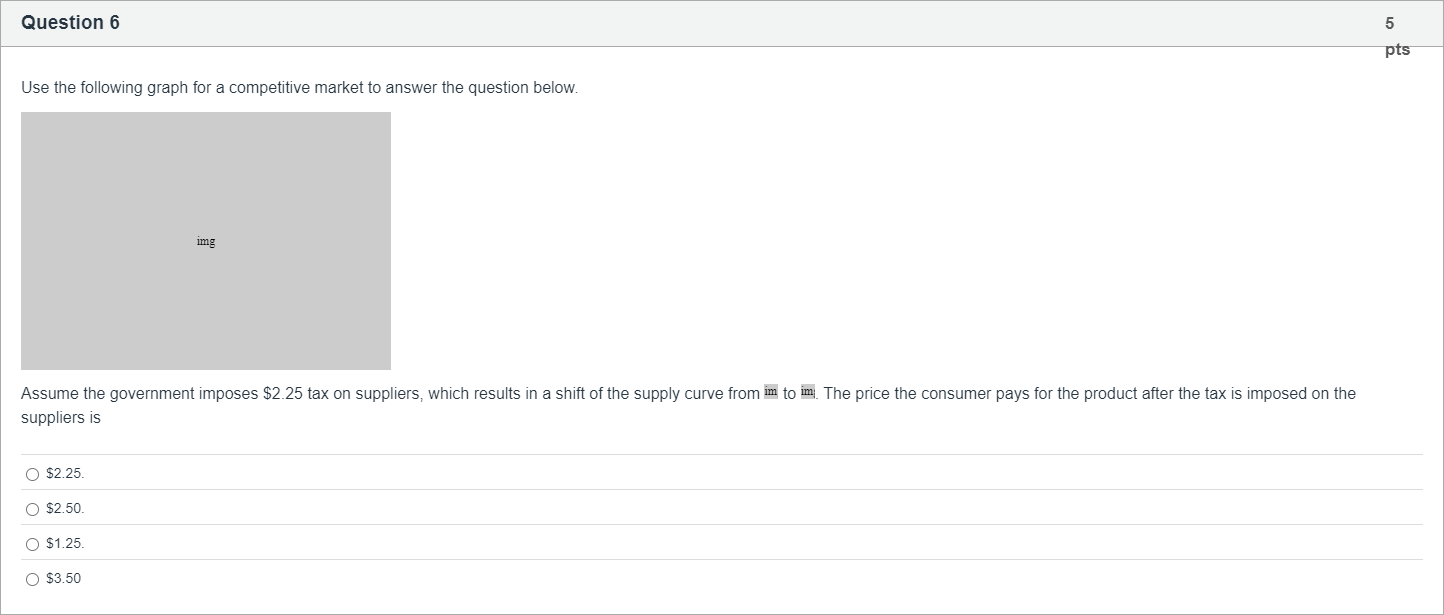

Use the following graph for a competitive market to answer the question below. Assume the government imposes $2.25 tax on suppliers, which results in a shift of the supply curve from to . The price the consumer pays for the product after the tax is imposed on the suppliers is

选项

A.$2.25.

B.$2.50.

C.$1.25.

D.$3.50

查看解析

标准答案

Please login to view

思路分析

To tackle this question, I’ll walk through each option and explain what the tax on suppliers does to the market price paid by consumers, using the idea of a tax wedge.

Option 1: $2.25

- This would mean the consumer price equals the tax per unit, which implies the entire tax is borne by consumers and the pre‑tax price to producers is unchanged. In a typical supply shift caused by a per‑unit tax on suppliers, the tax wedge is divided between buyers and sellers depending on relative elasticities. If the graph shows some sharing of the tax, this option would be incorrect ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

If the market demand for a good is inelastic and the supply is elastic, which of the following is true when there is an increase in sales tax?

After the government imposed a $0.20 per gallon tax on gasoline, the price of a gallon of gasoline increased from $1.00 to $1.15. Which of the following statements is true?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!