题目

单项选择题

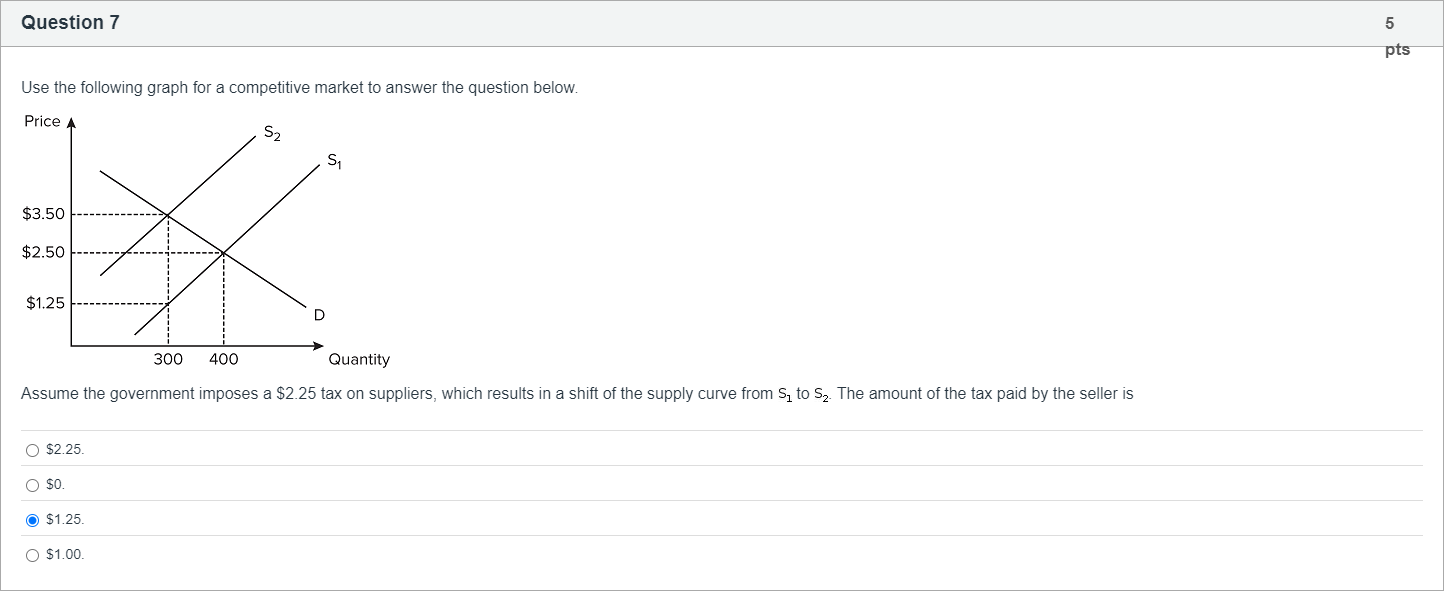

Use the following graph for a competitive market to answer the question below. Assume the government imposes a $2.25 tax on suppliers, which results in a shift of the supply curve from to . The amount of the tax paid by the seller is

选项

A.$2.25.

B.$0.

C.$1.25.

D.$1.00.

查看解析

标准答案

Please login to view

思路分析

First, observe that a tax on suppliers shifts the supply curve upward by the amount of the tax, from S1 to S2, leading to a higher price for buyers and a lower (net) price to sellers at the new equilibrium quantity.

Option-by-option analysis:

- Option $2.25: If the seller paid the entire tax, the price to buyers would rise by the full tax and the price received by selle......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

If the market demand for a good is inelastic and the supply is elastic, which of the following is true when there is an increase in sales tax?

After the government imposed a $0.20 per gallon tax on gasoline, the price of a gallon of gasoline increased from $1.00 to $1.15. Which of the following statements is true?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!