题目

单项选择题

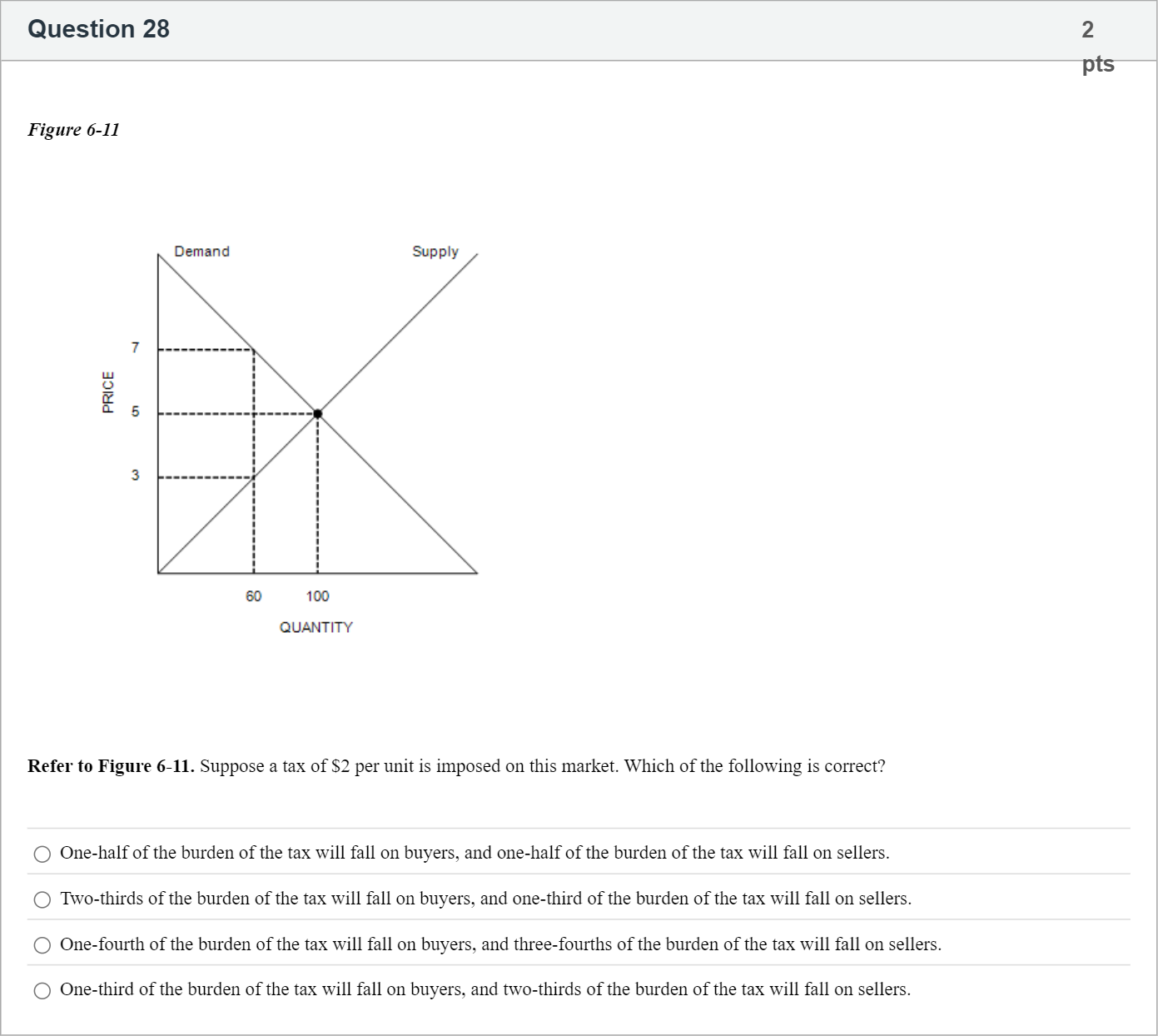

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

选项

A.One-half of the burden of the tax will fall on buyers, and one-half of the burden of the tax will fall on sellers.

B.Two-thirds of the burden of the tax will fall on buyers, and one-third of the burden of the tax will fall on sellers.

C.One-fourth of the burden of the tax will fall on buyers, and three-fourths of the burden of the tax will fall on sellers.

D.One-third of the burden of the tax will fall on buyers, and two-thirds of the burden of the tax will fall on sellers.

查看解析

标准答案

Please login to view

思路分析

In this question, we’re asked to evaluate the incidence of a per-unit tax in the market shown in Figure 6-11 and determine how the tax burden is split between buyers and sellers.

Option 1: 'One-half of the burden of the tax will fall on buyers, and one-half of the burden of the tax will fall on sellers.' This would imply perfectly equal sharing of the tax burden. Equal sharing occurs only when the elasticities of supply and demand are identical in magnitude, or when the curves are symmetric in a certain way. If the graph indicates different elasticities (a steeper supply or demand curve on one side), the burden will not be exactly 50-50. Without that symmetry, this option is unlikely.

Option 2: '......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

If the market demand for a good is inelastic and the supply is elastic, which of the following is true when there is an increase in sales tax?

After the government imposed a $0.20 per gallon tax on gasoline, the price of a gallon of gasoline increased from $1.00 to $1.15. Which of the following statements is true?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

Part 1The graph shows the market for tulips.Draw a point at the equilibrium price and equilibrium quantity. Label it 1.Suppose that tulips are taxed $6 a bunch and that the tax is on the sellers of tulips.Draw a curve that shows the effect of the tax. Label it.Draw a point to indicate the price paid by buyers and the quantity bought. Label it 2.Click toenlargegraph Part 1Sellers pay $[input]enter your response here of the tax. The tax revenue for the government is $[input]enter your response here per week. Part 1 020406080100120140681012141618202224Quantity (bunches per week)Price (dollars per bunch)1480Upper DDUpper SS 11 Upper S plus taxS+tax Edit coordinates interactive graph>>> Draw only the objects specified in the question.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!