题目

单项选择题

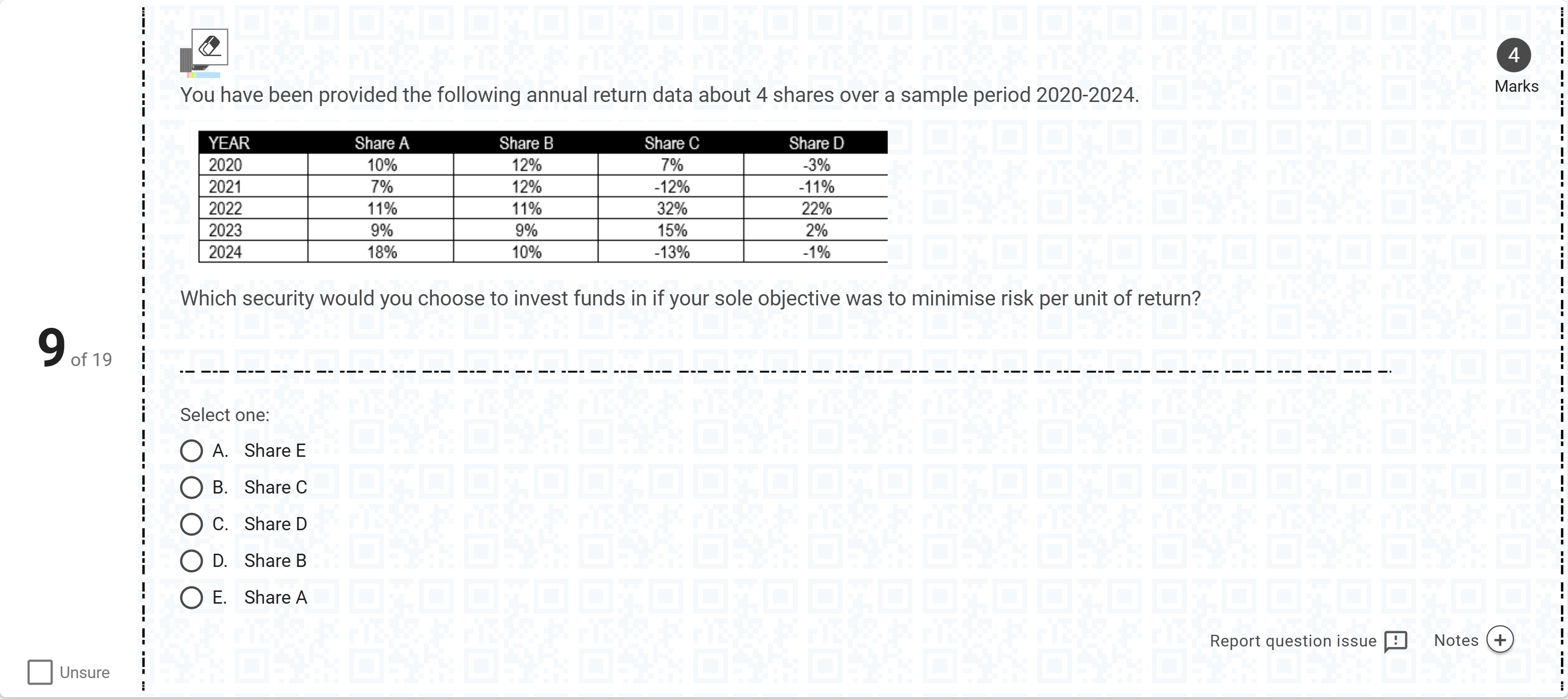

You have been provided the following annual return data about 4 shares over a sample period 2020-2024.Which security would you choose to invest funds in if your sole objective was to minimise risk per unit of return?[Fill in the blank]

选项

A.A. Share E

B.B. Share C

C.C. Share D

D.D. Share B

E.E. Share A

查看解析

标准答案

Please login to view

思路分析

We start by restating the data and the task to ensure clarity: you are given annual return data for four shares (A–D) over 2020–2024 and asked which security minimizes risk per unit of return. The goal is to pick the share with the smallest risk relative to its return, i.e., the lowest risk-to-return ratio (roughly, standard deviation of returns divided by mean return).

Option A: Share E. This option is not directly supported by the table provided, which only lists Shares A–D. Since Share E is not present in the data, evaluating......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

The following data has been collected to appraise the following four funds: Fund A Market Index Return 8.25% 8.60% Beta 0.91 1.00 Standard deviation 3.24% 3.55% Tracking error* 0.43% Tracking error is the standard deviation of the difference between the Fund Return and the Market Index Return. The risk-free rate of return for the relevant period was 4%. Use the above information to solve the following questions: The M2 is_______

The following data has been collected to appraise the following four funds: Fund A Market Index Return 8.25% 8.60% Beta 0.91 1.00 Standard deviation 3.24% 3.55% Tracking error* 0.43% Tracking error is the standard deviation of the difference between the Fund Return and the Market Index Return. The risk-free rate of return for the relevant period was 4%. Use the above information to solve the following questions: The M2 is_______

RAROC (Risk-Adjusted Return on Capital) is calculated as:

The Sharpe ratio

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!