你还在为考试焦头烂额?找我们就对了!

我们知道现在是考试月,你正在为了考试复习到焦头烂额。为了让更多留学生在备考与学习季更轻松,我们决定将Gold会员限时免费开放至2025年12月31日!原价£29.99每月,如今登录即享!无门槛领取。

助你高效冲刺备考!

题目

FINA2720.MERGED.202610 Final Exam- Requires Respondus LockDown Browser

简答题

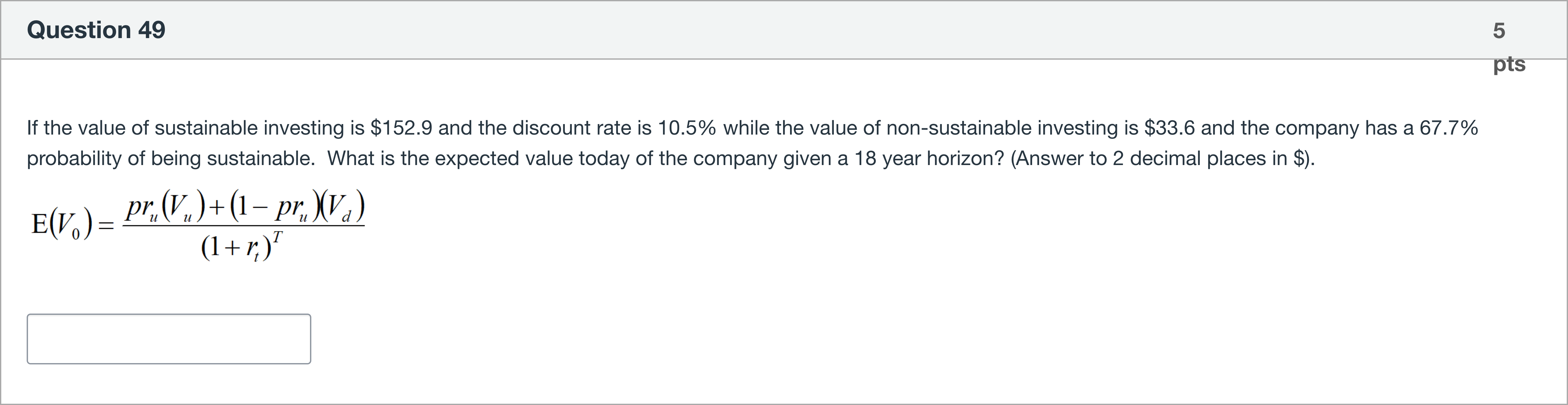

If the value of sustainable investing is $152.9 and the discount rate is 10.5% while the value of non-sustainable investing is $33.6 and the company has a 67.7% probability of being sustainable. What is the expected value today of the company given a 18 year horizon? (Answer to 2 decimal places in $).

查看解析

标准答案

Please login to view

思路分析

We are given the following values for the calculation: Vu = 152.9, Vd = 33.6, pr = 0.677 (67.7%), r = 0.105 (10.5%), and horizon T = 18 years. The formula provided for the expected value today is E(V0) = [pr * Vu + (1 - pr) * Vd] / (1 + r)^T.

Step 1: Compute the weighted payoff in the n......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

A client offers you the following deal: You will receive $6,000 for the next three years, one payment per year (that is, $6,000 at Year 1, Year 2, and Year 3). In exchange, you will pay $15,000 at Year 4. The current market prices of the following zero-coupon bonds (each with $100 face value) are: Bond A (1-year): price $95.24 Bond B (2-year): price $89.00 Bond C (3-year): price $81.63 Bond D (4-year): price $73.50 Using these bond prices, compute the net value today (Year 0) of the client’s deal to you. Enter your final answer rounded to two decimal places. For example, enter 1.23 if your answer is $1.234, and enter -1.23 if your answer is -$1.234.

Consider a $1,000,000 cash flow to be paid in 5 years. How would you compute the present value? Assume the five-year USD swap rate is 3.5%.

If the value of sustainable investing is $136.5 and the discount rate is 5.6% while the value of non-sustainable investing is $28.7 and the company has a 43.8% probability of being sustainable. What is the expected value today of the company given a 5 year horizon? (Answer to 2 decimal places in $).

If you receive $439 each 6 months for 1 year and the discount rate is 0.07, what is the present value?

更多留学生实用工具

希望你的学习变得更简单

为了让更多留学生在备考与学习季更轻松,我们决定将Gold 会员限时免费开放至2025年12月31日!