题目

单项选择题

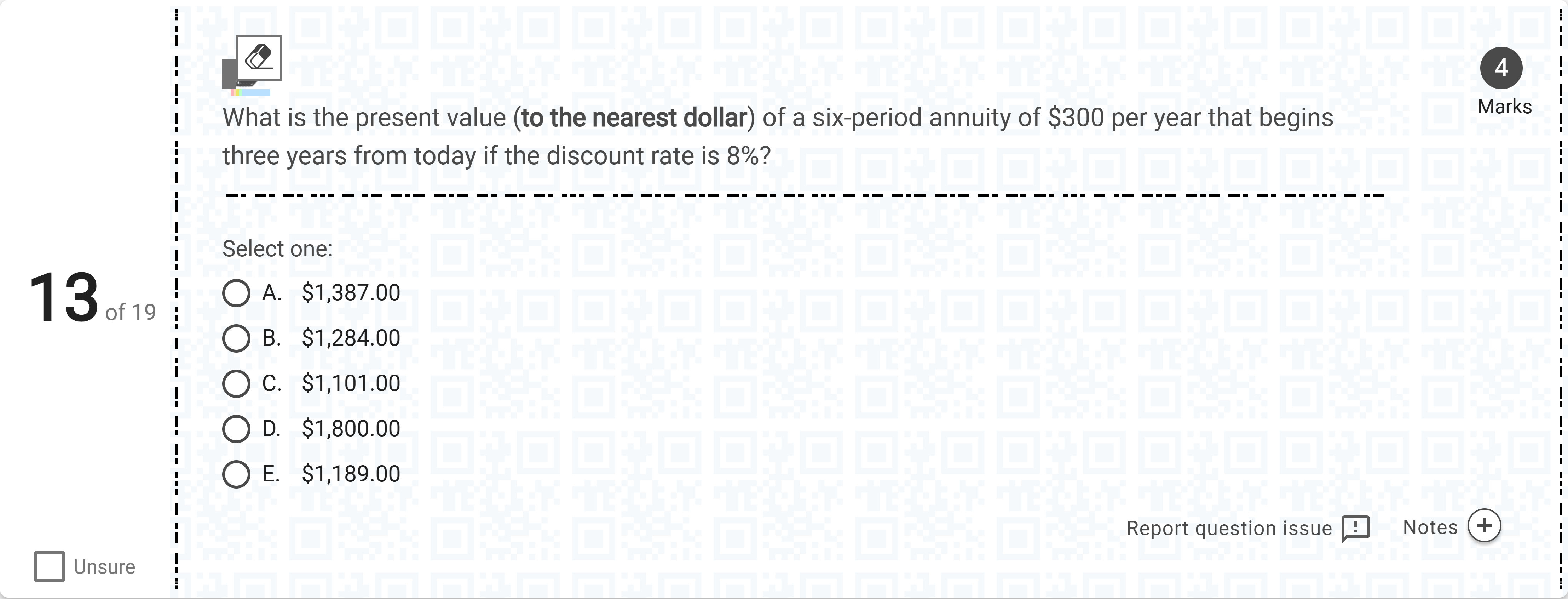

What is the present value (to the nearest dollar) of a six-period annuity of $300 per year that begins three years from today if the discount rate is 8%?[Fill in the blank]

选项

A.A. $1,387.00

B.B. $1,284.00

C.C. $1,101.00

D.D. $1,800.00

E.E. $1,189.00

查看解析

标准答案

Please login to view

思路分析

To tackle this problem, I’ll break down the cash flow timing and the present value calculation step by step.

First, identify the payment pattern: it’s a six-period annuity of 300 per year that begins three years from today. This means there will be six payments of 300 each, spread one per year, starting at year 3 and ending at year 8.

Next, compute the value of the six payments at the time just before their first payment (time 2) if we treat the six payments as a standard six-period annuity-immediate starting at time 3. The present value at time 2 of six payments of 300 each, wit......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

If you receive $99 each quarter for 8 years and the discount rate is 0.1, what is the present value?

If you receive $102 each month for 4 years and the discount rate is 0.06, what is the present value?

If you receive $223 each month for 12 months and the discount rate is 0.11, what is the present value?

If you receive $58 each quarter for 15 years and the discount rate is 0.09, what is the present value?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!