题目

单项选择题

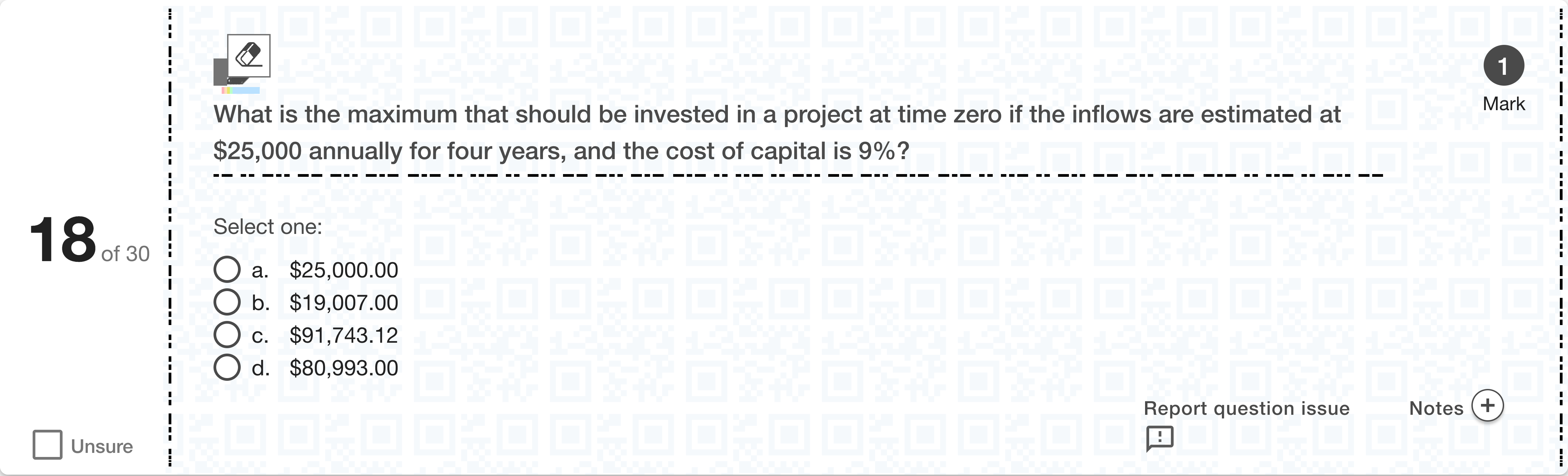

What is the maximum that should be invested in a project at time zero if the inflows are estimated at $25,000 annually for four years, and the cost of capital is 9%?[Fill in the blank]

选项

A.a. $25,000.00

B.b. $19,007.00

C.c. $91,743.12

D.d. $80,993.00

查看解析

标准答案

Please login to view

思路分析

We need the maximum amount to invest at time zero given a 9% cost of capital and four annual inflows of 25,000. This is the present value of an ordinary annuity with payment PMT = 25,000, i = 9%, n = 4.

Option a: $25,000.00

- This would imply that the project’s present value equals one year’s i......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

If you receive $99 each quarter for 8 years and the discount rate is 0.1, what is the present value?

If you receive $102 each month for 4 years and the discount rate is 0.06, what is the present value?

If you receive $223 each month for 12 months and the discount rate is 0.11, what is the present value?

If you receive $58 each quarter for 15 years and the discount rate is 0.09, what is the present value?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!