题目

单项选择题

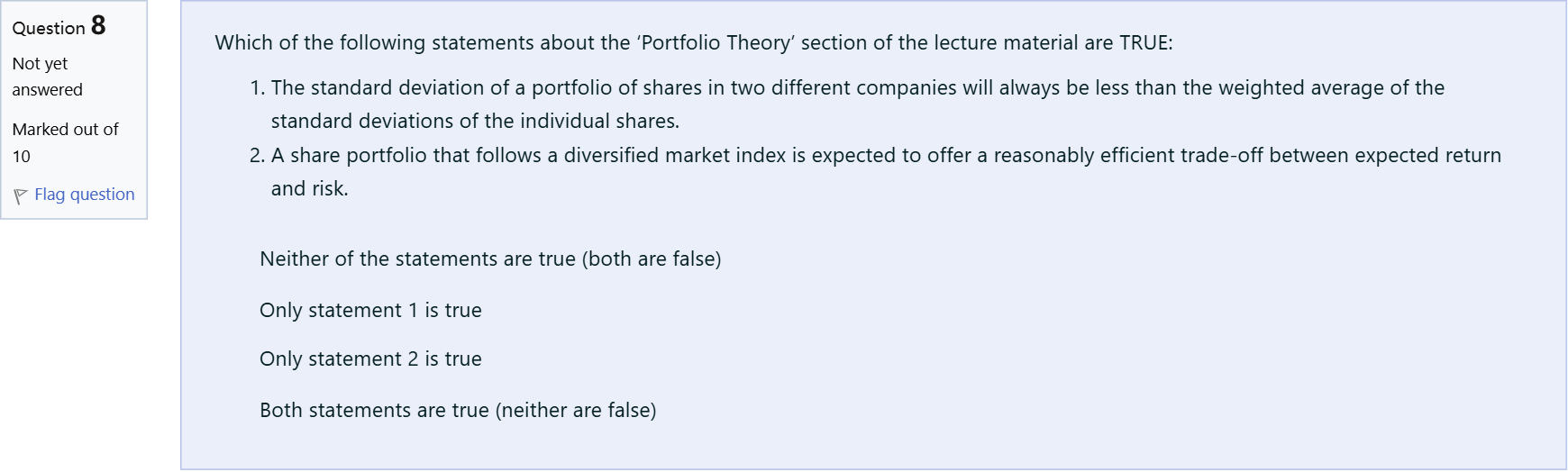

Which of the following statements about the ‘Portfolio Theory’ section of the lecture material are TRUE: The standard deviation of a portfolio of shares in two different companies will always be less than the weighted average of the standard deviations of the individual shares. A share portfolio that follows a diversified market index is expected to offer a reasonably efficient trade-off between expected return and risk.

选项

A.Neither of the statements are true (both are false)

B.Only statement 1 is true

C.Only statement 2 is true

D.Both statements are true (neither are false)

查看解析

标准答案

Please login to view

思路分析

Let's break down each statement and evaluate it against portfolio theory concepts.

Option 1: 'The standard deviation of a portfolio of shares in two different companies will always be less than the weighted average of the standard deviations of the individual shares.'

- This claim asserts a universal inequality that the portfolio’s risk (standard deviation) is always smaller than the simple weighted average of the individual ris......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

The market portfolio has an expected return of 10% and a standard deviation of 24%. The risk-free rate is 4%. What is the standard deviation of the returns of a complete portfolio with an expected return of 19%? Round your final answer to a percentage with two decimal places and do not use the “%” sign, i.e. if the answer is 1.23% then write 1.23

The expected return and standard deviation (risk) of two financial assets (Alpha Pty Ltd & Beta Corp) are as follows:Investor A develops a RISKY portfolio comprised of 70% of Alpha Pty Ltd and 30% of Beta Corp. The correlation coefficient between the returns from Alpha and Beta is 0.80. Assume the risk-free rate of return is 4% per annum.[Fill in the blank]

Which of the following statements regarding the capital allocation line (CAL) is false?[Fill in the blank]

Question text 6Marks Tina has the following additional information regarding Stock X and Y [table] Stock | Expected Return | Standard Deviation X | 10% | 15% Y | 15% | 20% [/table] Stock X and Y are perfectly negatively correlated offering a hedged position. If Tina wants to construct a risk-free portfolio consisting Stock X and Y, what must be the weight for each stock in the portfolio? Weight of Stock X: Answer 5[select: , 57.14%, 42.86%, 62.84%, 44.55%, 35.28%] Weight of Stock Y: Answer 6[select: , 57.14%, 42.86%, 37.16%, 64.72%, 55.45%] What must return of this risk-free portfolio? Answer 7[select: , 12.14%, 11.75%, 12.86%, 15.33%, 13.5%] Notes Report question issue Question 9 Notes

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!