题目

FIN.256.M016.FALL25.Principles of Finance Final Prep LockDown Browser FIN.256.M016.FALL25.Principles of Finance Final Prep LockDown Browser

简答题

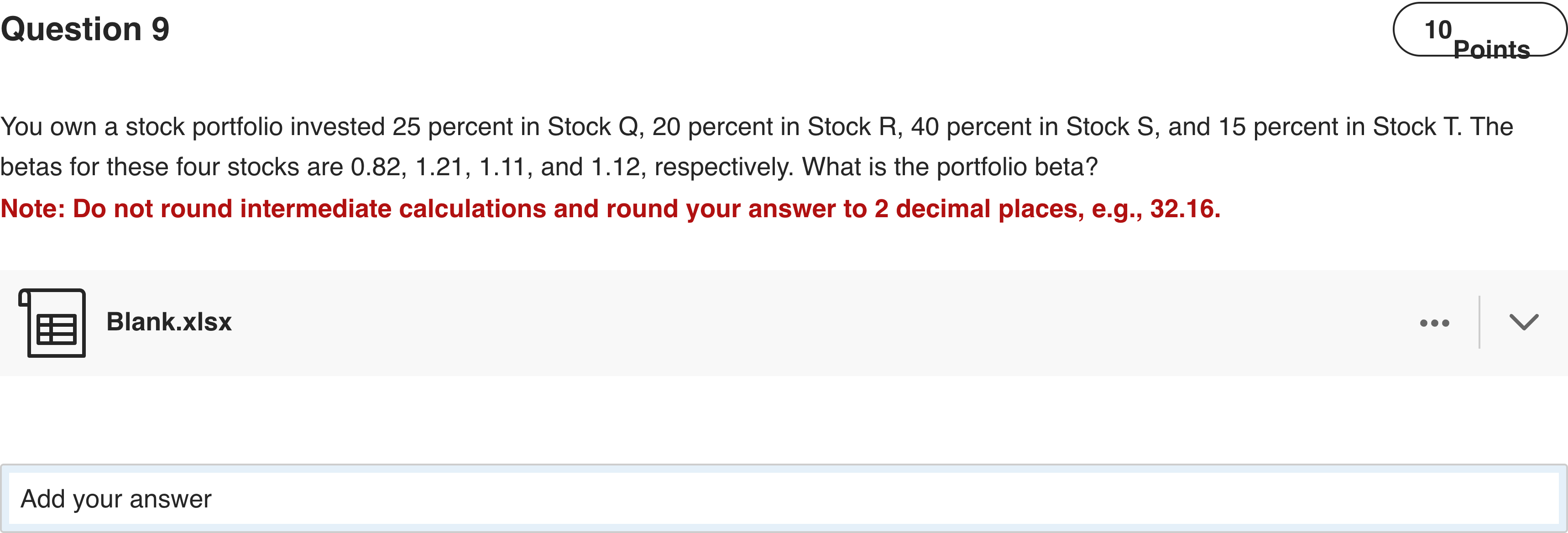

You own a stock portfolio invested 25 percent in Stock Q, 20 percent in Stock R, 40 percent in Stock S, and 15 percent in Stock T. The betas for these four stocks are 0.82, 1.21, 1.11, and 1.12, respectively. What is the portfolio beta?Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.Blank.xlsx

查看解析

标准答案

Please login to view

思路分析

Begin by understanding that portfolio beta is the weighted average of the individual betas: sum(weight_i × beta_i).

Compute each product:

-......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Question 1 of 2 What is the portfolio beta? Round your final answer to a number with two decimal places, i.e. if the answer is 1.2311 then write 1.23

Which one of the following statements is accurate?

You have a portfolio that is invested 20 percent in Stock R, 38 percent in Stock S, and the remainder in Stock T. The beta of Stock R is .75, and the beta of Stock S is 1.30. The beta of your portfolio is 1.18. What is the beta of the Stock T?

You have a portfolio that is invested 20 percent in Stock R, 38 percent in Stock S, and the remainder in Stock T. The beta of Stock R is .75, and the beta of Stock S is 1.30. The beta of your portfolio is 1.18. What is the beta of the Stock T?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!