题目

简答题

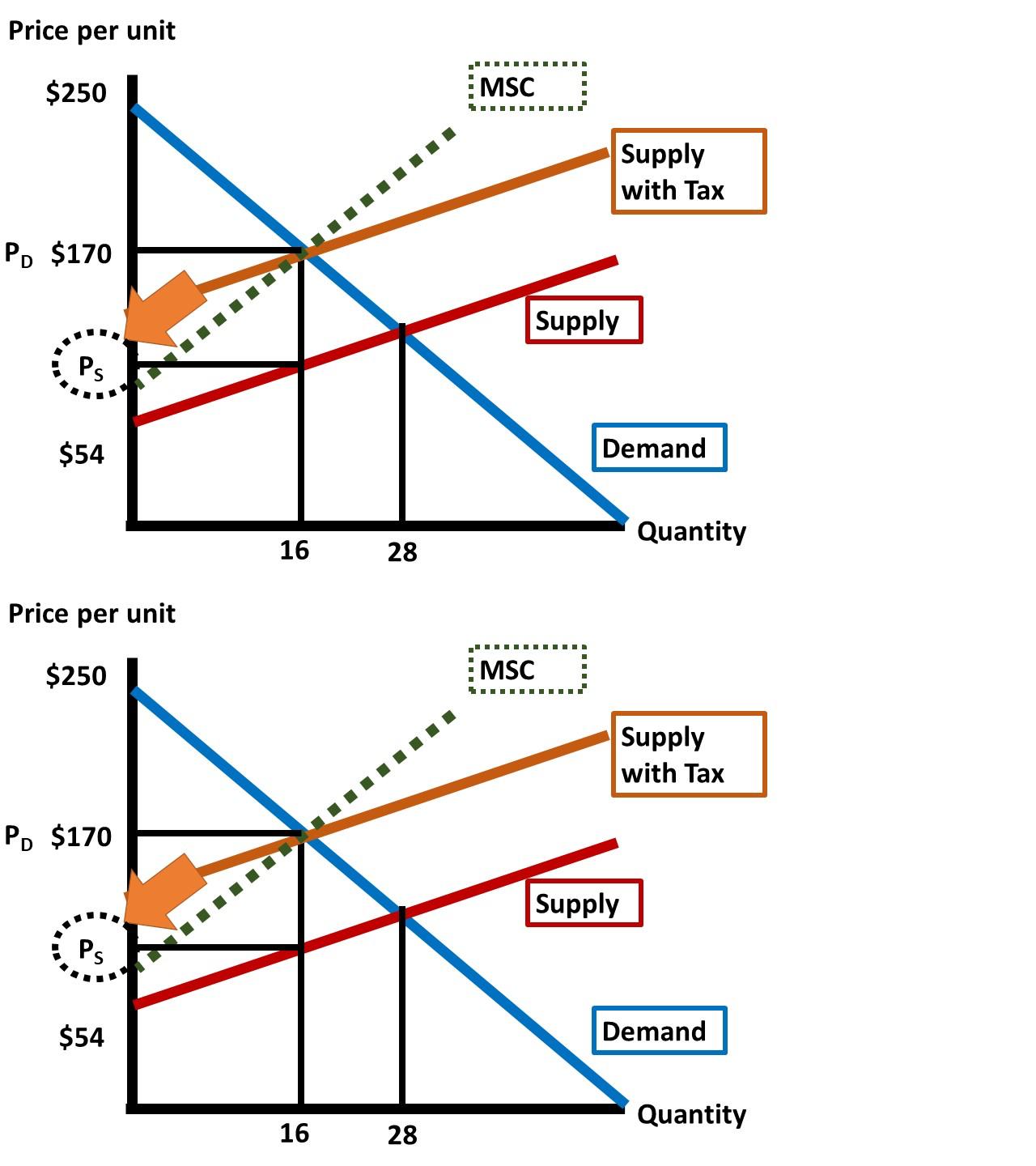

Question at position 6 Think about the production of cattle. There are private costs to this action in raising and feeding the cattle. There are also spillover costs from the cattle in the form of methane emissions. The Total Spillover Cost of the methane is given by: TSpC = 20Q + 2Q2. The Marginal Spillover Cost of methane is given by: MSpC = 20 + 4Q. The demand for cattle is given by: QD = 50 -0.2P. The supply of cattle is given by: QS = 0.5P -27. The inverse demand function is given by: P = 250 -5Q. The inverse supply is given by: P = 54+2Q. The marginal social cost function is given by: MSC = 74 +6Q. The market quantity (QMKT)of cattle is 28 units while the efficient quantity (QE) is 16 units. The optimal Pigovian tax is $84 per unit. The supply function with tax is given by: QSTAX = 0.5P - 69. Calculate the price suppliers keep (PS) now that there is a tax. (Do not include "$" sign in your response.) Hint: Subtract the tax from the price demanders pay (PD)Answer Think about the production of cattle. There are private costs to this action in raising and feeding the cattle. There are also spillover costs from the cattle in the form of methane emissions. The Total Spillover Cost of the methane is given by: TSpC = 20Q + 2Q2. The Marginal Spillover Cost of methane is given by: MSpC = 20 + 4Q. The demand for cattle is given by: QD = 50 -0.2P. The supply of cattle is given by: QS = 0.5P -27. The inverse demand function is given by: P = 250 -5Q. The inverse supply is given by: P = 54+2Q. The marginal social cost function is given by: MSC = 74 +6Q. The market quantity (QMKT)of cattle is 28 units while the efficient quantity (QE) is 16 units. The optimal Pigovian tax is $84 per unit. The supply function with tax is given by: QSTAX = 0.5P - 69. Calculate the price suppliers keep (PS) now that there is a tax. (Do not include "$" sign in your response.) Hint: Subtract the tax from the price demanders pay (PD)[input]

选项

A.

查看解析

标准答案

Please login to view

思路分析

To begin, restate the setup: there is a Pigovian tax of 84 per unit imposed on cattle production, and the question asks for the price suppliers keep (PS) after the tax is applied. The relationship between the price paid by buyers (PD), the tax per unit, and the price received by sellers (PS) is: PD = PS + tax, whi......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Another policy approach to externalities is for government to levy a tax or place a charge specifically on the related good.

Question at position 5 Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. The optimal Pigovian tax is $60 per ton of SO2 emitted. Determine the total tax revenue generated by the tax. (Do not include "$" sign in your response.) Hint: Multiply the tax rate by the quantity with tax.Answer Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. The optimal Pigovian tax is $60 per ton of SO2 emitted. Determine the total tax revenue generated by the tax. (Do not include "$" sign in your response.) Hint: Multiply the tax rate by the quantity with tax.[input]

Question at position 4 Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. Determine the optimal Pigovian Tax. (Do not include "$" sign in your response.) Hint: Plug the efficient quantity into the inverse demand function.Answer Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. Determine the optimal Pigovian Tax. (Do not include "$" sign in your response.) Hint: Plug the efficient quantity into the inverse demand function.[input]

Question at position 1 Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. Determine the quantity of emissions if there is no Pigovian Tax. Hint: Plug a price of zero into the demand function because firms do not have to pay for a good with a missing market.Answer Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. Determine the quantity of emissions if there is no Pigovian Tax. Hint: Plug a price of zero into the demand function because firms do not have to pay for a good with a missing market.[input]

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!