题目

ECON1-TTh Chapter 10 Assignment

单项选择题

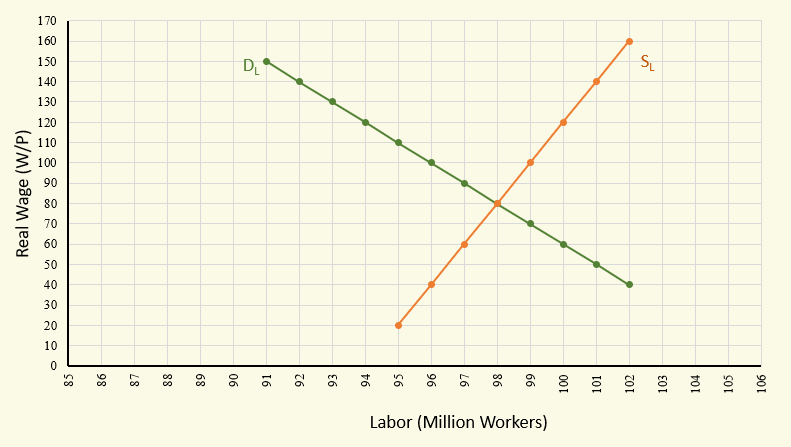

In order to reach the social optimum, the government could

选项

A.impose a tax of $8 per unit on plastics

B.impose a tax of $6 per unit on plastics

C.offer a subsidy of $6 per unit on plastics

D.impose a tax of $2 per unit on plastics

查看解析

标准答案

Please login to view

思路分析

To reach the social optimum in a market with a negative externality, government intervention often involves a tax (Pigouvian tax) equal to the marginal external cost at the socially optimal output, so that the private cost plus tax equals the social cost.

Option 1: impose a tax of $8 per unit......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Question54 Who wins from implementing an output tax on a good with negative environmental externality? Producers Government Consumers All of the other options ResetMaximum marks: 1 Flag question undefined

You have the following PMC, MD and SMB: PMC = 15 + 2Q MD = 1.2Q2 SMB = 70 - 3Q Find the Pigouvian tax t*

Assume that the extraction of water from an aquifer by a coal mining company imposes a cost on farmers that grow citrus crops. Assume that the supply curve for coal is given by the following: p = 240 +2Q. Further, assume that the demand curve for coal is given by the following: p = 900 – 3Q. If the marginal external cost (MEC) of coal mining is equal to 0.5Q, which of the following is true?

Now the government is considering imposing extra tax on polluting industry. From the first table, what is the optimal tax?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!