题目

多项填空题

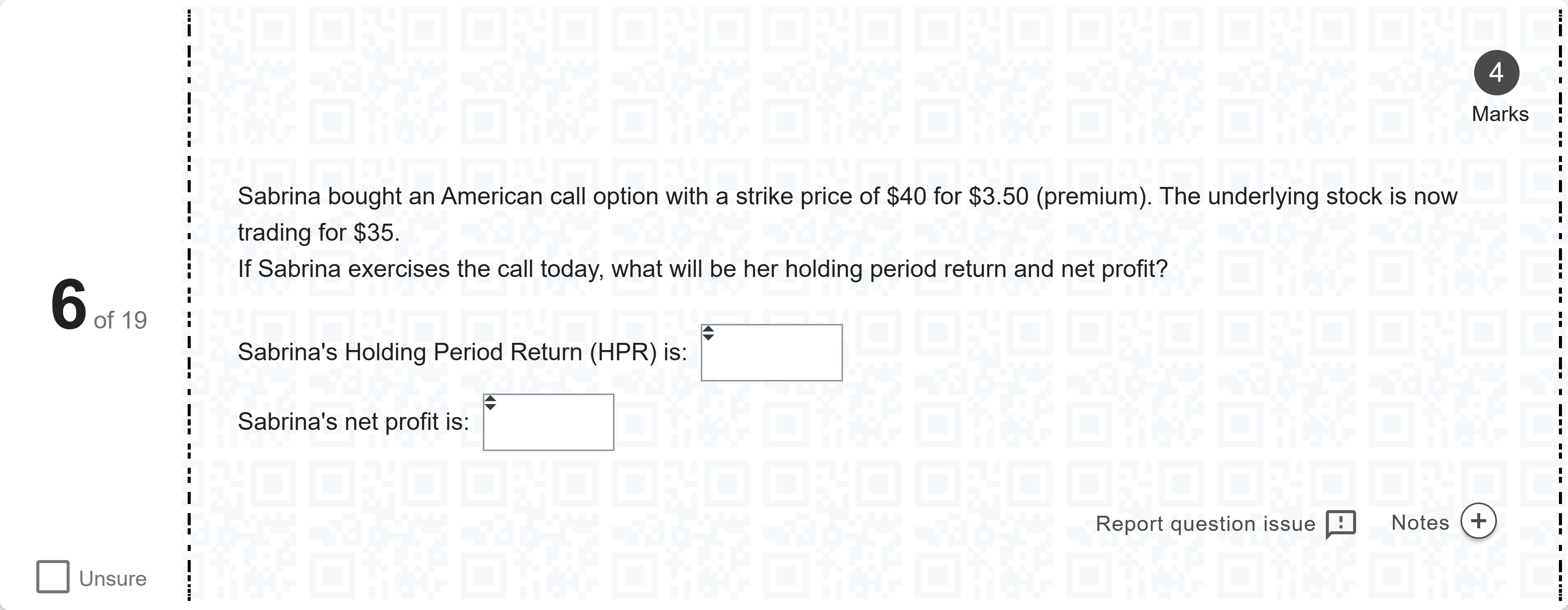

Question text 4Marks Sabrina bought an American call option with a strike price of $40 for $3.50 (premium). The underlying stock is now trading for $35. If Sabrina exercises the call today, what will be her holding period return and net profit? Sabrina's Holding Period Return (HPR) is: Answer 1[select: , 22.45%, 42.86%, 83.91%, 35.33%, 13.86%]Sabrina's net profit is: Answer 2[select: , $5, $1.50, $3.45, -$2.05, $8.05] Notes Report question issue Question 6 Notes

查看解析

标准答案

Please login to view

思路分析

Question restatement:

- Sabrina bought an American call option with a strike price of $40 for a premium of $3.50. The underlying stock is currently at $35. If Sabrina exercises the call today, what are Sabrina's Holding Period Return (HPR) and Sabrina's net profit?

- Sabrina's Holding Period Return (HPR) is: [13.86%]

- Sabrina's net profit is: [$-2.05]

Option-by-option analysis (even though the options list is not shown in the data you provided, I will address the general idea and then connect to the given numeric answers):

- About exercising a call option when S < X (here S = 35, X = 40):

The intrinsic value of the call is max(S - X, 0) = max(35 - 40, 0) = 0. Therefore, if Sabrina exercises immediately, the option provides no intrinsic payoff at exercise time. The "profit" from exercising, ignoring the premium you paid, would be 0, but you did pay a premium of 3.50 to acquire the option, so the economic result of exercising would factor in that premium.

- Net p......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

The right, but not the obligation, to buy shares of stock or a specific commodity for a set price within a set time period is called

A foreign currency ________ option gives the holder the right to ________ a foreign currency, whereas a foreign currency ________ option gives the holder the right to ________ an option.

Question11 Which options would make profits in a falling market?(i) Buying a call option written on live cattle(ii) Selling a call option written on the S&P500 index(iii) Buying a put option written on Tesla stock(iv) Selling a put option written on Bitcoin (i) and (iii) (i) and (ii) (ii) and (iv) (iii) and (iv) (ii) and (iii) ResetMaximum marks: 1 Flag question undefined

Question17 Which one of the following characterises a European option? The option can only be exercised at expiration The option grants its holder the right to sell at the strike price The option can be exercised at any time prior to expiration The option grants its holder the right to purchase at the strike price The option obligates its holder to buy or sell at the strike price ResetMaximum marks: 1 Flag question undefined

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!