你还在为考试焦头烂额?找我们就对了!

我们知道现在是考试月,你正在为了考试复习到焦头烂额。为了让更多留学生在备考与学习季更轻松,我们决定将Gold会员限时免费开放至2025年12月31日!原价£29.99每月,如今登录即享!无门槛领取。

助你高效冲刺备考!

题目

FINS3635-Options, Futures & Risk Mgmt - T3 2025

单项选择题

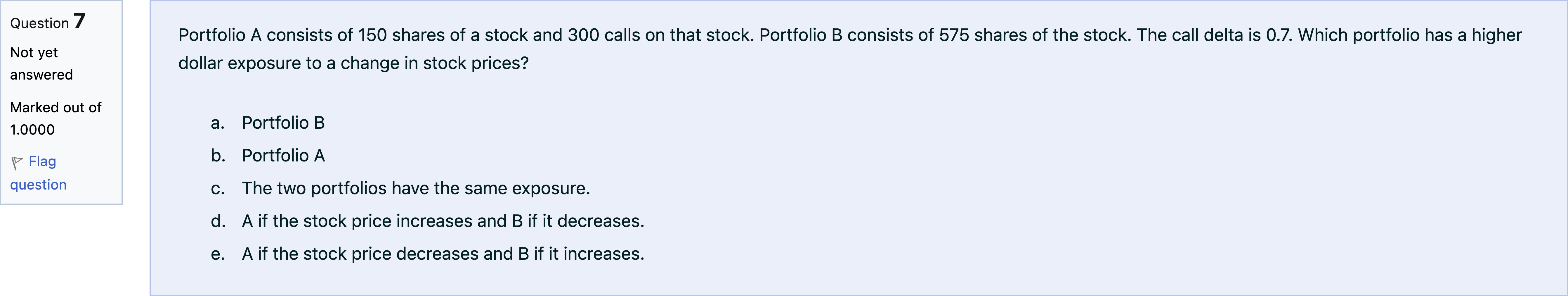

Portfolio A consists of 150 shares of a stock and 300 calls on that stock. Portfolio B consists of 575 shares of the stock. The call delta is 0.7. Which portfolio has a higher dollar exposure to a change in stock prices?

选项

A.a. Portfolio B

B.b. Portfolio A

C.c. The two portfolios have the same exposure.

D.d. A if the stock price increases and B if it decreases.

E.e. A if the stock price decreases and B if it increases.

查看解析

标准答案

Please login to view

思路分析

Restating the scenario: Portfolio A has 150 shares of the stock and 300 call options on that stock, with the call delta given as 0.7. Portfolio B holds 575 shares of the stock. We are asked which portfolio has a higher dollar exposure to a change in stock prices.

Option a. Portfolio B

- To compare dollar exposure to stock price moves, sum the equity-lik......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

When you performed the homework assignment, how did you compute the delta?

Which of the following is true for a call option on a non-dividend-paying stock?

N(d1) in the Black-Scholes-Merton model represents:

The current price of a non-dividend-paying stock is $40. Over the next year it is expected to rise to $46 or fall to $34. Assume the risk-free rate is zero. An investor buys a collar on the stock (i.e., buy 1 share of the stock, buy 1 European put option on the stock, and write 1 European call option on the stock). Both options have a one-year maturity and a strike price of $40. Which of the following is the hedge ratio of the collar position?

更多留学生实用工具

希望你的学习变得更简单

为了让更多留学生在备考与学习季更轻松,我们决定将Gold 会员限时免费开放至2025年12月31日!