题目

My home Progress Check

单项选择题

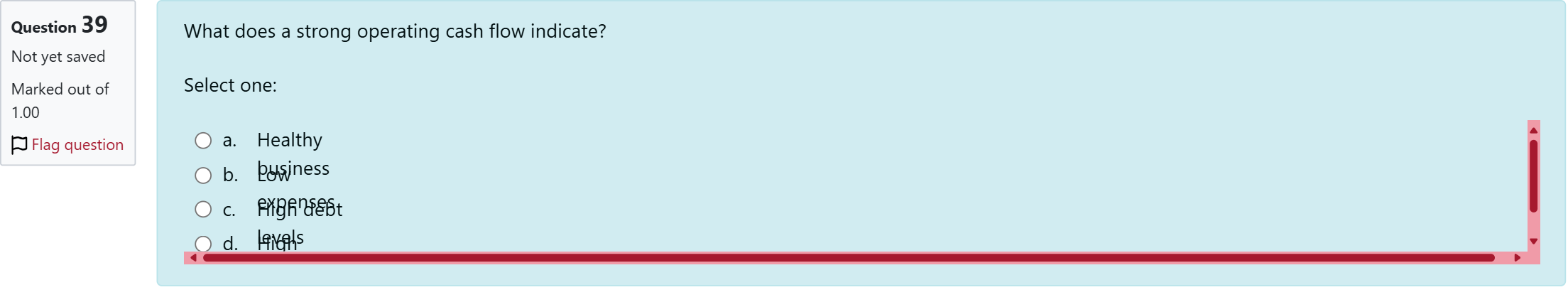

What does a strong operating cash flow indicate?

选项

A.a. Healthy business

B.b. Low expenses

C.c. High debt levels

D.d. High profitability

查看解析

标准答案

Please login to view

思路分析

To tackle this question, consider what operating cash flow (OCF) measures: the amount of cash generated by the core business operations over a period.

Option a: 'Healthy business' — A strong OCF generally signals that the company is able to generate cash from its primary activities, which is a hallmark of a healthy ongoing operation. This support comes from consisten......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

MC algo 9-26 Calculating OCF Bad Company has a new 4-year project that will have annual sales of 8,600 units. The price per unit is $20.10 and the variable cost per unit is $7.85. The project will require fixed assets of $96,000, which will be depreciated on a 3-year MACRS schedule. The annual depreciation percentages are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. Fixed costs are $36,000 per year and the tax rate is 22 percent. What is the operating cash flow for Year 3?

Rock Haven has a proposed project that will generate sales of 1,740 units annually at a selling price of $24 each. The fixed costs are $13,900 and the variable costs per unit are $6.75. The project requires $29,200 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the 4-year life of the project. The salvage value of the fixed assets is $7,300 and the tax rate is 21 percent. What is the operating cash flow?

Rock Haven has a proposed project that will generate sales of 1,740 units annually at a selling price of $24 each. The fixed costs are $13,900 and the variable costs per unit are $6.75. The project requires $29,200 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the 4-year life of the project. The salvage value of the fixed assets is $7,300 and the tax rate is 21 percent. What is the operating cash flow?

A project is expected to generate annual revenues of $124,100, with variable costs of $77,200, and fixed costs of $17,700. The annual depreciation is $4,250 and the tax rate is 23 percent. What is the annual operating cash flow?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!