题目

Homework:Final Practice

多项填空题

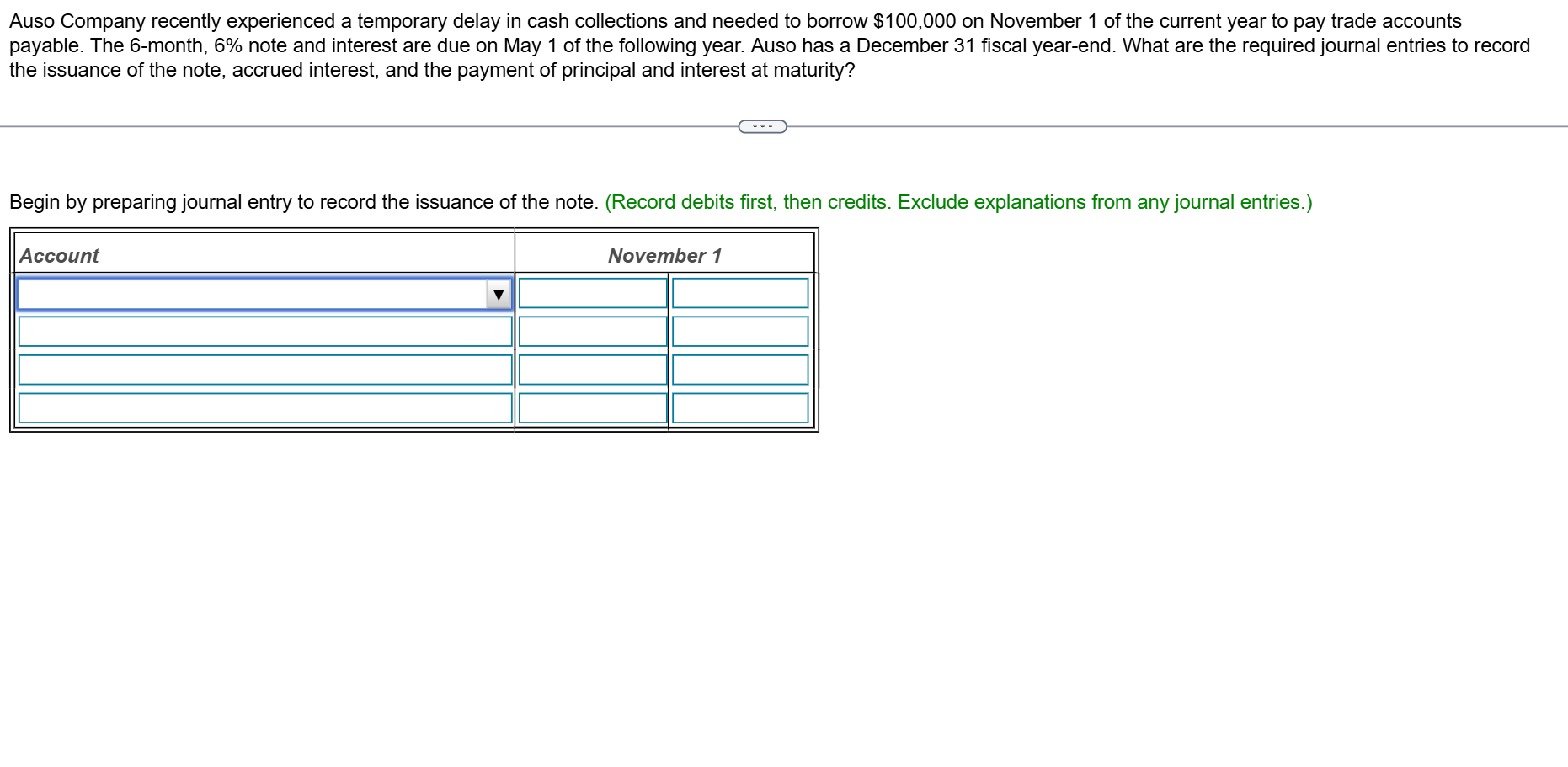

Part 1Auso Company recently experienced a temporary delay in cash collections and needed to borrow $ 100,000$100,000 on November 1 of the current year to pay trade accounts payable. The 6-month, 6 %6% note and interest are due on May 1 of the following year. Auso has a December 31 fiscal year-end. What are the required journal entries to record the issuance of the note, accrued interest, and the payment of principal and interest at maturity? Part 1Begin by preparing journal entry to record the issuance of the note. (Record debits first, then credits. Exclude explanations from any journal entries.) [table] | Save Accounting Table... | | + | Copy to Clipboard... | | + [/table] [table] Account | November 1 | | | | | | | | [/table] Save Accounting Table...+Copy to Clipboard...+AccountNovember 1[Fill in the blank][Fill in the blank][Account][Fill in the blank][Fill in the blank][Account][Fill in the blank][Fill in the blank][Account][Fill in the blank][Fill in the blank] [IMPORTANT INSTRUCTION] When returning answers, provide an array for [Fill in the blank] positions ONLY. Skip [Account] cells (these are dropdowns). If a [Fill in the blank] should be empty, return an empty string "" as a placeholder. The array length should equal the number of [Fill in the blank] cells, not total cells.

查看解析

标准答案

Please login to view

思路分析

The scenario involves Auso Company borrowing to cover a temporary cash delay, with a 6-month, 6% note issued on November 1 and due May 1 of the following year, and a December 31 year-end. To answer, we walk through the journal entries step by step and explain why each part is recorded as shown.

First, when the note is issued on November 1, the company receives cash from the loan and incurs a note payable to reflect the obligation. The correct recording is a debit to Cash for the amount received and a credit to Notes Payable for the same amount, recognizing the liability created by borrowing. In this case: Debit Cash 100,000; Credit Notes Payable 100,000. No other accounts are affected at this ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

An asset is acquired using a noninterest-bearing note payable for $225,000 due in three years. Which of the following statements most likely is correct?

Part 1Pegasus Corp. signed a threeminus−month, 99% note on November 1, 2023 for the purchase of $ 293,000$293,000 of inventory. If Pegasus makes adjusting entries only at the end of the year, the entry made at January 31, 2024 will include a ________. (Do not round any intermediary calculations. Round your final answer to the nearest dollar.) Part 1 A. debit to Interest Expense for $ 4,395$4,395 B. debit to Interest Expense for $ 6,593$6,593 C. debit to Note Payable for $ 293,000$293,000 D. credit to Note Payable for $ 293,000$293,000

Part 1Pegasus Corp. signed a threeminus−month, 1010% note on November 1, 2023 for the purchase of $ 210,000$210,000 of inventory. If Pegasus makes adjusting entries only at the end of the year, the entry made at January 31, 2024 will include a ________. (Do not round any intermediary calculations. Round your final answer to the nearest dollar.) Part 1 A. credit to Note Payable for $ 210,000$210,000 B. debit to Interest Expense for $ 3,500$3,500 C. debit to Note Payable for $ 210,000$210,000 D. debit to Interest Expense for $ 5,250$5,250

Part 1Pegasus Corp. signed a threeminus−month, 77% note on November 1, 2023 for the purchase of $ 280,000$280,000 of inventory. If Pegasus makes adjusting entries only at the end of the year, the entry made at January 31, 2024 will include a ________. (Do not round any intermediary calculations. Round your final answer to the nearest dollar.) Part 1 A. credit to Note Payable for $ 280,000$280,000 B. debit to Interest Expense for $ 3,267$3,267 C. debit to Interest Expense for $ 4,900$4,900 D. debit to Note Payable for $ 280,000$280,000

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!