你还在为考试焦头烂额?找我们就对了!

我们知道现在是考试月,你正在为了考试复习到焦头烂额。为了让更多留学生在备考与学习季更轻松,我们决定将Gold会员限时免费开放至2025年12月31日!原价£29.99每月,如今登录即享!无门槛领取。

助你高效冲刺备考!

题目

Macro 3A mock exam

单项选择题

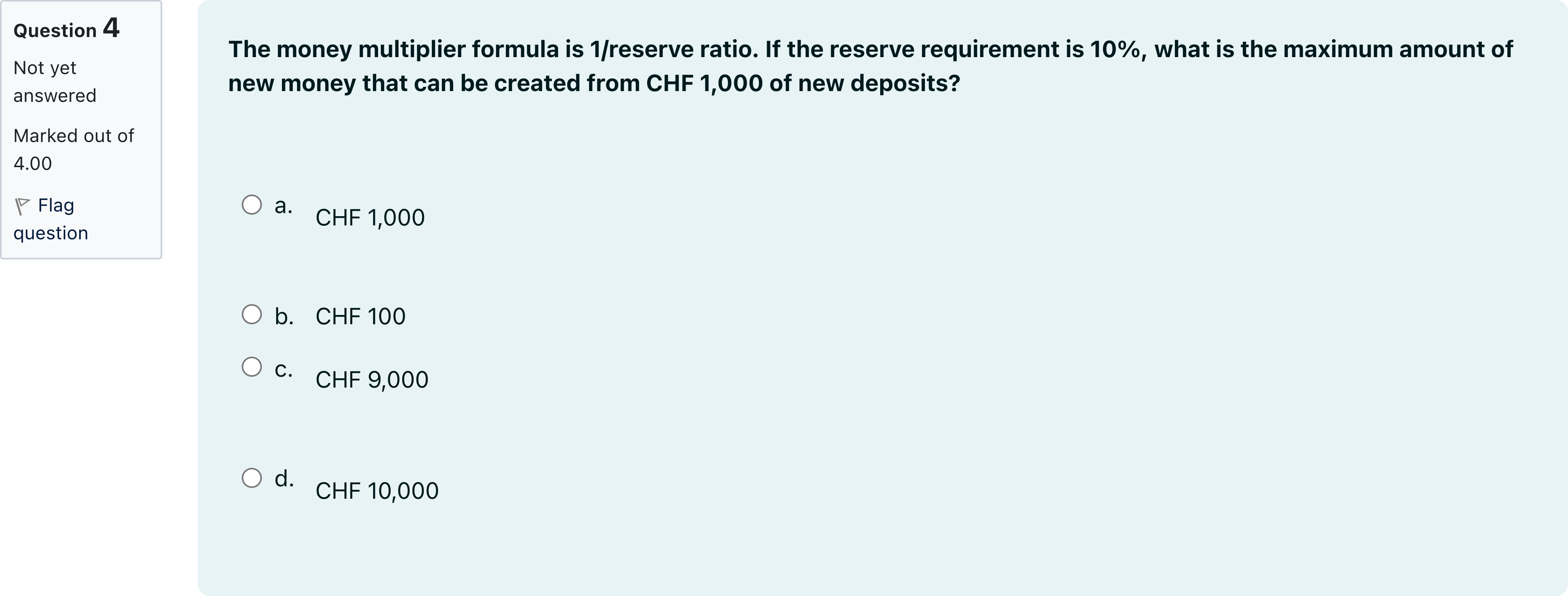

The money multiplier formula is 1/reserve ratio. If the reserve requirement is 10%, what is the maximum amount of new money that can be created from CHF 1,000 of new deposits?

选项

A.a. CHF 1,000

B.b. CHF 100

C.c. CHF 9,000

D.d. CHF 10,000

查看解析

标准答案

Please login to view

思路分析

The question describes the money multiplier formula as 1 / reserve ratio. With a reserve requirement of 10%, the money multiplier is 1 / 0.10 = 10.

Option a: CHF 1,000. This would represent just the initial deposit, not the total potential money created through the banking system’s le......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Suppose the reserve requirement is set at 11 percent and excess reserves are $28 million. What is the money multiplier?

Use the following balance sheet for the New Bank of Catawba to answer the next question. Assume the required reserve ratio is 0.10 and the bank receives $50,000 in new checking deposits. Assets Liabilities Total Reserves $50,000 Checking Deposits $200,000 Loans $150,000 If the banking system as a whole had been loaned up prior to the new deposit, how much new money can the banking system now create?

If the Fed were to decrease the required reserve rate from ten percent to five percent, the simple deposit multiplier would

The money multiplier formula is 1/reserve ratio. If the reserve requirement is 10%, what is the maximum amount of new money that can be created from CHF 1,000 of new deposits?

更多留学生实用工具

希望你的学习变得更简单

为了让更多留学生在备考与学习季更轻松,我们决定将Gold 会员限时免费开放至2025年12月31日!