题目

单项选择题

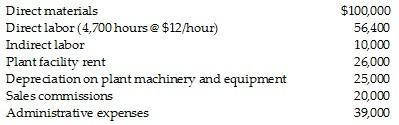

Question at position 8 Franklin Inc. manufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect-cost rate of $15 per direct labor-hour. The following data are obtained from the accounting records for June 2020:For June 2020, manufacturing overhead is: overallocated by $29,500underallocated by $9,500underallocated by $29,500overallocated by $9,500题目解析

选项

A.overallocated by $29,500

B.underallocated by $9,500

C.underallocated by $29,500

D.overallocated by $9,500

查看解析

标准答案

Please login to view

思路分析

To analyze overhead, first identify the components that comprise manufacturing overhead and the method used to apply it.

Step 1: Determine the overhead rate and applied overhead.

- Budgeted indirect-cost rate: $15 per direct labor-hour.

- Direct labor-hours incurred: 4,700 hours.

- Overhead applied to product......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Which of the following is considered an element of manufacturing overhead?

Which of the following costs would not be considered part of the manufacturing overhead of a furniture manufacturer?

Which of the following is not included in factory overhead?

Question at position 15 Which of the following statements is correct?When the manufacturing overhead cost was overapplied, it means that the unadjusted cost of goods sold is equal to the adjusted cost of goods sold.When the manufacturing overhead cost was overapplied, it means that the unadjusted cost of goods sold is higher than the adjusted cost of goods sold.When the manufacturing overhead cost was underapplied, it means that the unadjusted cost of goods sold is higher than the adjusted cost of goods sold.When the manufacturing overhead cost was overapplied, it means that the adjusted cost of goods sold is higher than the unadjusted cost of goods sold.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!