题目

FINS5530-Financial Institution Mgmt - T3 2025

数值题

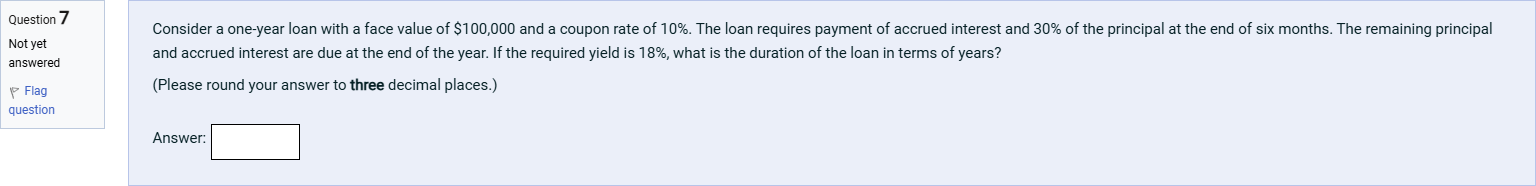

Consider a one-year loan with a face value of $100,000 and a coupon rate of 10%. The loan requires payment of accrued interest and 30% of the principal at the end of six months. The remaining principal and accrued interest are due at the end of the year. If the required yield is 18%, what is the duration of the loan in terms of years? (Please round your answer to three decimal places.)

查看解析

标准答案

Please login to view

思路分析

We start by identifying the cash flows and the timing.

- The loan has a face value of $100,000 and a coupon rate of 10% annually. Since payments are described at 6 months and at 1 year, the coupon is effectively 5% of face value for each half-year period.

- At the end of 6 months, the borrower pays accrued interest for the first 6 months plus 30% of the principal. Accrued interest for 6 months = 0.10 × $100,000 ×......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

An investor allocated $10,000 to a one-year zero-coupon bond, $20,000 to a two-year zero-coupon bond, and $10,000 to a three-year coupon bond that pays coupons semi-annually. If the Macaulay duration of this bond portfolio is 1.77 years, what is the Macaulay duration of the coupon bond? Round your answer to two decimal places. If your answer is "2.34567", enter it as 2.35.

Select ALL of the below statements that are TRUE.

What is a reasonable way to define Duration for an asset with cash flows CF over times t and a present value function PV? We have 4 possible answers Answer A Answer B Answer C Answer D

Suppose that you purchase a bond that matures in four years and pays a 13% coupon rate annually. The bond is priced to yield 10%. Assume the par value of $1,000. What is Macaulay’s Duration? If the market yield decreases by 50 basis points, what would be a percent change in the bond price? Click to open: Download Q15.xlsx

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!