题目

FINS5530-Financial Institution Mgmt - T3 2025

单项选择题

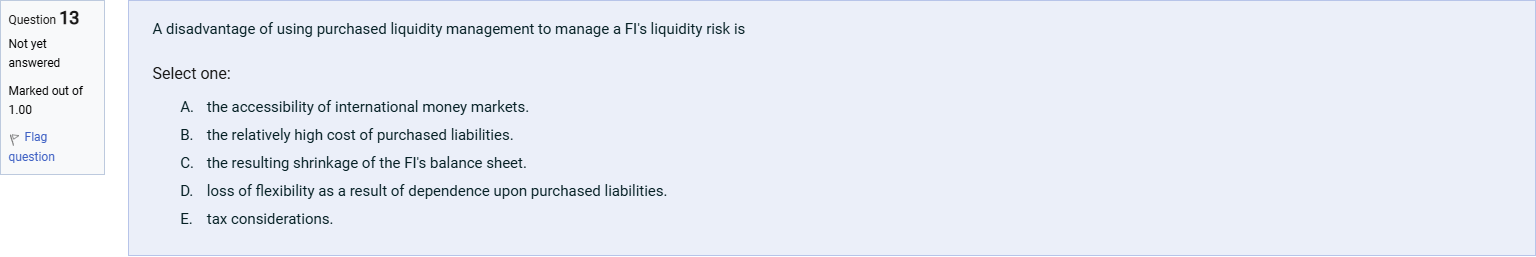

A disadvantage of using purchased liquidity management to manage a FI's liquidity risk is

选项

A.A. the accessibility of international money markets.

B.B. the relatively high cost of purchased liabilities.

C.C. the resulting shrinkage of the FI's balance sheet.

D.D. loss of flexibility as a result of dependence upon purchased liabilities.

E.E. tax considerations.

查看解析

标准答案

Please login to view

思路分析

The question asks for a disadvantage of using purchased liquidity management to manage a financial institution's liquidity risk.

Option A: the accessibility of international money markets. This is generally considered a potential advantage, since access to broader markets can improve liquidity options; thus it is not a disadvantage.

Option B......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

"Stored liquidity" management refers to:

Stored liquidity management is a liability-side adjustment to the balance sheet to cover a deposit drain.

Purchased liquidity management is a liability-side adjustment to the balance sheet to cover a deposit drain.

The challenge of liquidity management is to maintain enough liquidity to avoid a crisis but to sacrifice no more earnings than absolutely necessary.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!