题目

FINS5512-Financial Markets & Institutions - T3 2025

单项选择题

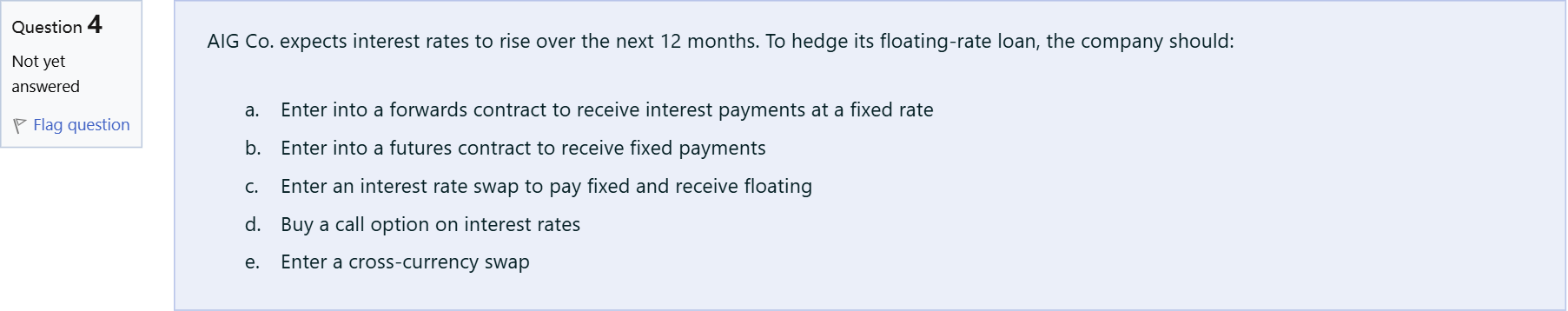

AIG Co. expects interest rates to rise over the next 12 months. To hedge its floating-rate loan, the company should:

选项

A.a. Enter into a forwards contract to receive interest payments at a fixed rate

B.b. Enter into a futures contract to receive fixed payments

C.c. Enter an interest rate swap to pay fixed and receive floating

D.d. Buy a call option on interest rates

E.e. Enter a cross-currency swap

查看解析

标准答案

Please login to view

思路分析

When a company has a floating-rate loan, its interest payments rise as market rates rise. The goal of hedging is to offset this exposure by gains on another instrument.

Option a: A forwards contract to receive a fixed rate would lock in fixed payments, but forwards on interest rates are typically used to hedge or speculate on the level of rates directly, not to convert a floating borrowing into a fixed payment stream in a standard corp......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

GHI Industries has issued $180 million worth of long-term bonds at a fixed rate of 14%. GHI Industries then enters into an interest rate swap where it will pay LIBOR and receive a fixed 6% on a notional principal of $180 million. After all these transactions are considered, GHI's cost of funds is:

Two corporate borrowers enter into an interest swap agreement with a notional amount of $25M and annual net payments. Party A takes the fixed side of the swap at a rate of 3.25%, while Party B takes the floating rate side of the swap at a rate of LIBOR plus 125 bp. If at the end of the year, LIBOR is at 1.5%, who will owe money to the other party and how much?

The interest rate swap strategy of a firm with fixed rate debt and that expects rates to go up is to:

An agreement to swap a fixed interest payment for a floating interest payment would be considered a/an:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!