题目

25728 Fixed Income Analysis - Autumn 2025 FIA Quiz 5.1 Bond Duration

多项选择题

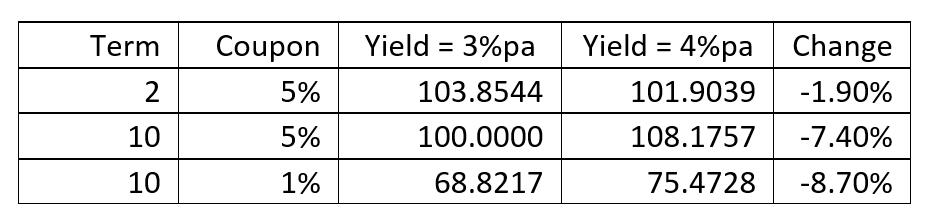

The table illustrates a number of general points in relation to a bond’s reaction to a change in interest rates/yields.

选项

A.The price of longer term bonds is more sensitive to changes in yields than the prices of shorter maturity bonds

B.The prices of low coupon bonds are more sensitive to a given change in market yields than the prices of high coupon bonds

C.Bonds with higher coupons have lower prices

D.The longer the term of a bond the greater is its price.

查看解析

标准答案

Please login to view

思路分析

To tackle this question, we first restate what the table conveys about price sensitivity to changes in yields across term and coupon structures.

Option 1: 'The price of longer term bonds is more sensitive to changes in yields than the prices of shorter maturity bonds.' This aligns with the standard concept of duration: longer maturities generally exhibit greater percentage price movement for a given yield shift because cash flows are spread further in time and are discounted more heavily when yields rise. The table shows bonds with a longer term (e.g., 10 y......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Suppose you were in charge of prudential regulation and encountered this bank: Assets Liabilities Loans to SMEs $ 60 Retail Deposits $40 T-bills $30 Seven-year long-term bonds: $40 Cash $10 Equity Paid in capital: $5 Retained earnings: $15 The loans, bonds and deposits are all floating rate. The bank pays fixed for seven years on a interest rate swap with a notional of $40 to secure its funding costs. What would you tell the bank?

The repricing gap model has significant limitations including all of the following EXCEPT:

A bank has $500 millionin rate-sensitive assetsand, 400million in rate-sensitive liabilities within a one-year time horizon. If interest rates increase by 1.5% (150 basis points), what is the predicted change in annual net interest income?

Question3 Which of the following statements is FALSE? Select one alternative: a. For a typical depository institution, interest rate risk can be minimised if duration of assets is always maintained above the leverage adjusted duration of the liabilities. b. Immunisation requires portfolio rebalancing when interest rates move. c. Measurement of an FI's interest rate risk is rendered inaccurate due to the presence of off-balance sheet assets and liabilities. d. Duration model estimates the change in market value of an FI when interest rate changes. e. A manager should consider the cost of restructuring the balance sheet before deciding to immunise the interest rate risk sensitivity gap of the FI. ResetMaximum marks: 2 Flag question undefined

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!