题目

单项选择题

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $300,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $6000 (paid at the end of each month). Your firm can borrow at 8.00% APR with quarterly compounding. The monthly discount rate that you should use to evaluate the truck lease is closest to ________.

查看解析

标准答案

Please login to view

思路分析

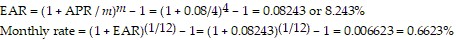

First, identify what the question is asking: we need the monthly discount rate that is consistent with an 8.00% APR with quarterly compounding, to evaluate a monthly lease payment.

Next, determine the effective per-quarter rate implied by the given APR with quarterly compounding......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

What effective interest rate per quarter is equivalent to 8% p.a. compounding semi-annually?

If the nominal per annum interest rate is 6%, then the interest rate per quarter is:

Complete the following calculations: 1: A 12% APR compounded monthly equates to an semi-annual effective rate of: 2: A 10% APR compounded semi-annually equates to an annual effective rate of: 3: An 8% APR compounded annually equates to an monthly effective rate of:

An interest rate is 5% per annum with continuous compounding. What is the equivalent rate with semi-annual compounding?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!