题目

单项选择题

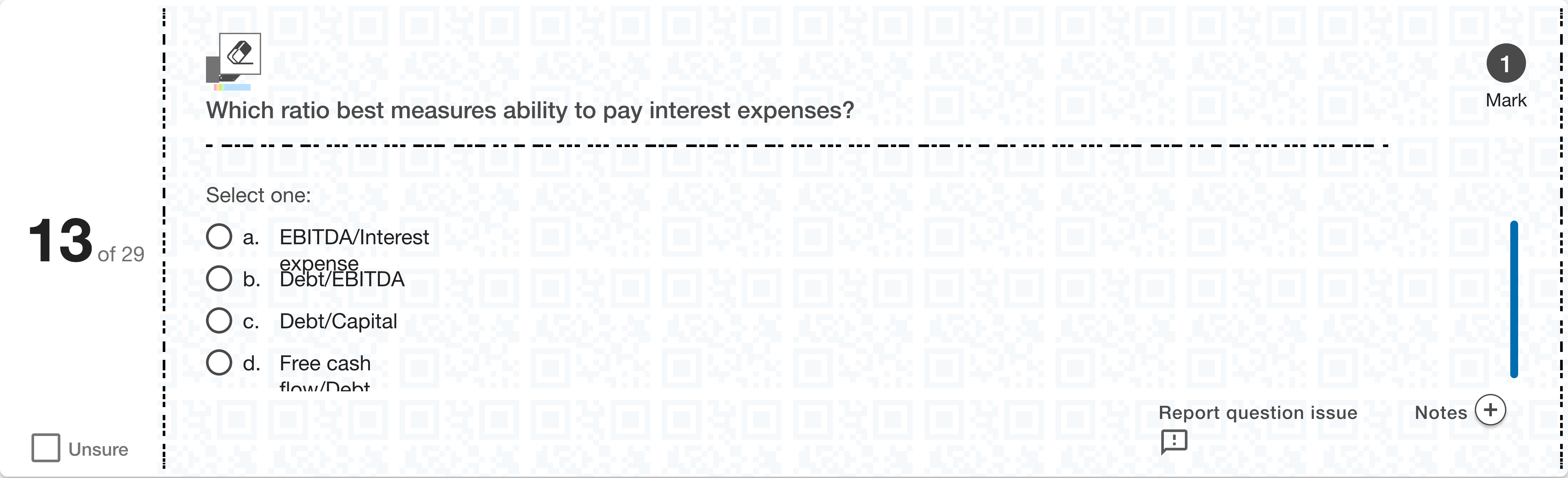

Which ratio best measures ability to pay interest expenses?[Fill in the blank]

选项

A.a. EBITDA/Interest expense

B.b. Debt/EBITDA

C.c. Debt/Capital

D.d. Free cash flow/Debt

查看解析

标准答案

Please login to view

思路分析

To determine which ratio best measures ability to pay interest expenses, we evaluate how each metric relates to the company’s capacity to cover interest costs.

Option a: EBITDA/Interest expense. This is a common interest-coverage measure, using earnings before interest, taxes, depreciation, and amortization to see how many times a company can cover its interest payments. Since EBITDA (or EBIT) represents operating ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

CANADIAN TIRE- Part 5 of 11 Use two decimal points. Do not add percentage (%), or times (X) with the number. Calculate Times Interest Earned in 2020

A times interest earned ratio of 7.0 indicates that the firm

Here is some financial statement information for a business. Calculate the times interest earned for the current year. Prior year Current year Cash 10,070 11,416 Accounts receivable 5,244 6,464 Accounts payable 9,505 13,479 Sales revenue 202,729 244,199 Gross profit 103,420 114,713 Interest expense 1,592 2,071 Profit before tax 63,698 68,747 Net profit 46,694 41,525 Round the answer to one decimal place.

Caulfield Ltd.’s net profit after tax was $2,500. Its interest expense was $500 and the depreciation expense was $200, Assuming that corporate tax is $600, what is Caulfield Ltd’s interest coverage ratio?keep one digit after decimal.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!