题目

多项填空题

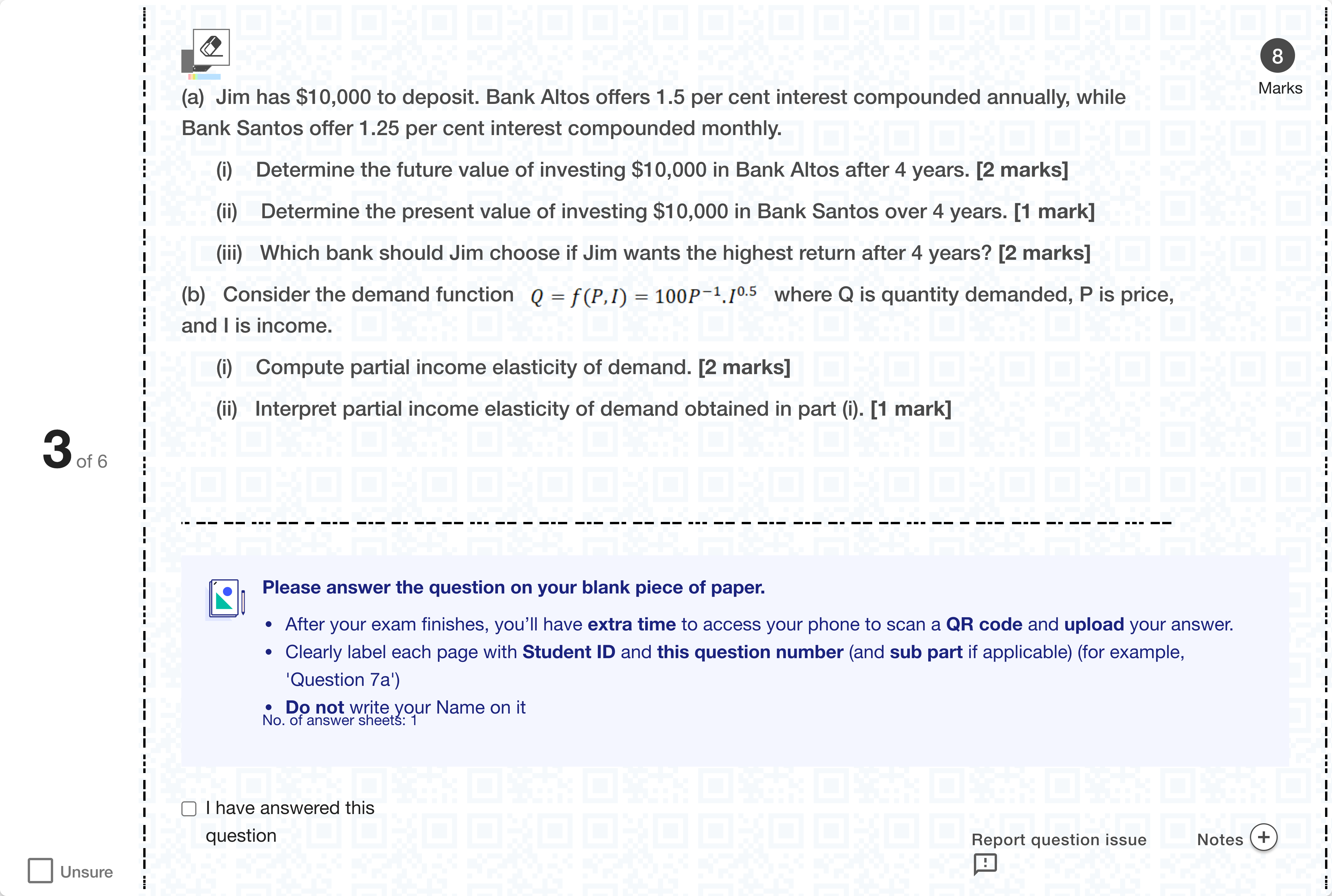

(a) Jim has $10,000 to deposit. Bank Altos offers 1.5 per cent interest compounded annually, while Bank Santos offer 1.25 per cent interest compounded monthly. (i) Determine the future value of investing $10,000 in Bank Altos after 4 years. [2 marks] (ii) Determine the present value of investing $10,000 in Bank Santos over 4 years. [1 mark] (iii) Which bank should Jim choose if Jim wants the highest return after 4 years? [2 marks] (b) Consider the demand function where Q is quantity demanded, P is price, and I is income. (i) Compute partial income elasticity of demand. [2 marks] (ii) Interpret partial income elasticity of demand obtained in part (i). [1 mark][Fill in the blank]

查看解析

标准答案

Please login to view

思路分析

We start by identifying all parts of the question and the data given across the blanks.

(a) (i) Future value of $10,000 at Bank Altos with 1.5% annual compounding for 4 years.

- The formula is FV = PV × (1 + r)^t. Here PV = 10,000, r = 0.015, t = 4.

- Compute: (1 + 0.015)^4 ≈ 1.0610, so FV ≈ 10,000 × 1.0610 = 10,610.00 (rounded to the nearest cent as $10,609.10 in the given answer).

- Therefore theFuture Value should reflect the annual compounding effect over 4 years. The reasoning shows why the final figure is just over $10,600.

(......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Two complements , shoes and socks will have a negative value of income elasticity of demand.

(a) Jim has $10,000 to deposit. Bank Altos offers 1.5 per cent interest compounded annually, while Bank Santos offer 1.25 per cent interest compounded monthly. (i) Determine the future value of investing $10,000 in Bank Altos after 4 years. [2 marks] (ii) Determine the present value of investing $10,000 in Bank Santos over 4 years. [1 mark] (iii) Which bank should Jim choose if Jim wants the highest return after 4 years? [2 marks] (b) Consider the demand function where Q is quantity demanded, P is price, and I is income. (i) Compute partial income elasticity of demand. [2 marks] (ii) Interpret partial income elasticity of demand obtained in part (i). [1 mark][Fill in the blank]

Part 1When income increases by 55 percent and all prices remain the same, the quantity of smartphones demanded increases by 1010 percent. Calculate the income elasticity of demand of smartphones. Part 1The income elasticity of demand of smartphones is [input]enter your response here . >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign.

If the income elasticity of demand for airline tickets is 1.8, this implies that:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!