题目

MCD2170 Foundations of Finance - Trimester 3 - 2025

单项选择题

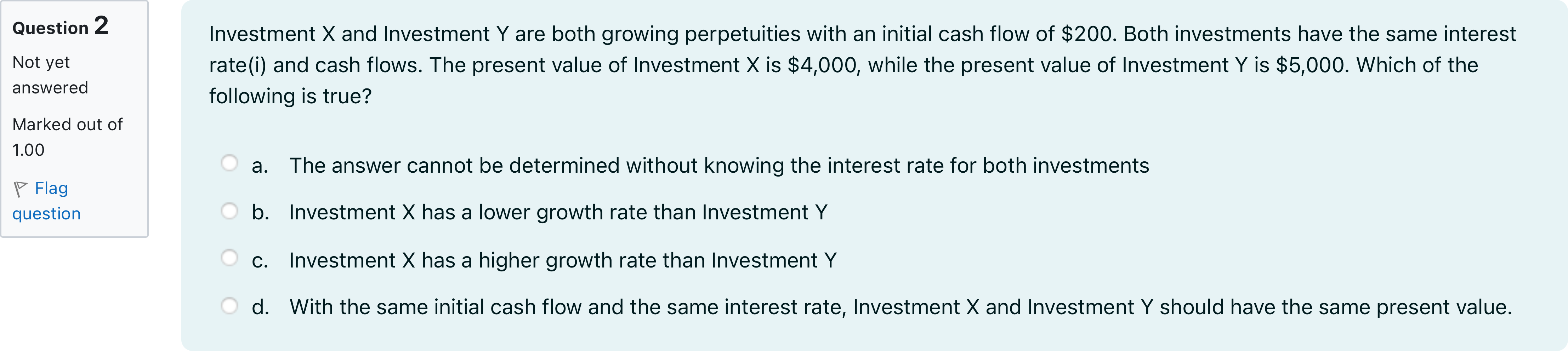

Investment X and Investment Y are both growing perpetuities with an initial cash flow of $200. Both investments have the same interest rate(i) and cash flows. The present value of Investment X is $4,000, while the present value of Investment Y is $5,000. Which of the following is true?

选项

A.a. The answer cannot be determined without knowing the interest rate for both investments

B.b. Investment X has a lower growth rate than Investment Y

C.c. Investment X has a higher growth rate than Investment Y

D.d. With the same initial cash flow and the same interest rate, Investment X and Investment Y should have the same present value.

查看解析

标准答案

Please login to view

思路分析

Let’s break down what the problem says and how the present value of a growing perpetuity is determined.

Option a: 'The answer cannot be determined without knowing the interest rate for both investments.' In this setup, the two investments share the same interest rate i and the same cash flow pattern, only the growth rate g differs. Since PV of a growing perpetuity is PV = CF1 / (i − g), if CF1 and i are the same for both......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Five years from today, you hope to donate $10,000 to the alumni association. Thereafter, you intend for your annual contributions to grow at a rate of 3 percent per year, forever. If you can earn 7 percent per year on your investments, how much must you invest today to fund this donation?

The annual payment of growing perpetuity starts at $2,000 in year 4 and grows at a rate of 4% per year thereafter. If the discount rate is 8%, what is the present value of the perpetuity at time 0?

You just won the lottery! Your prize begins with a payment of $10,000, which you will receive one year from today. Every year forever after, the payments will increase by 4 percent annually. What is the present value of your prize at a discount rate of 6 percent per year?

A wealthy donor invests $500,000 into an endowment fund that will pay a growing annual scholarship in perpetuity, starting one year from today. The fund earns an annual return of 6%, and the scholarship amount will grow by 2% each year to keep up with inflation. What will be the scholarship payment paid in year 3?[Fill in the blank]

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!