题目

25_2 FIN376 Formative Online Test 7

多重下拉选择题

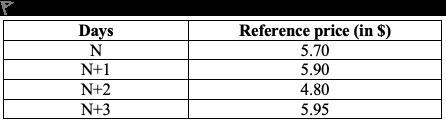

Suppose there is a future contract on stocks “ABC”. An investor bought one future contract on stocks “ABC” with a settlement date of 4 months, with a price of $5.65. The evolution of the reference price for future contracts on stocks “ABC” since the purchase day (day N) and during the following 3 days was as follows:Knowing that each future contract on stocks “ABC” has as underlying asset 100 stocks “ABC”, and the initial margin and the maintenance margin are, respectively, $500 and $400, determine the financial movement following the price changes on those days regarding the future’s buyer and the future’s seller, by filling in the tables below:Buyer: [table] Day | Price | Initial amount | Result | Interim result | Deposit | Withdrawal | Final amount N | $5.65 | ------ | ------ | $0 | Blank 1 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | ------ | Blank 2 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N | $5.70 | Blank 3 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 4 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 5 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 6 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 7 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 8 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+1 | $5.90 | Blank 9 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 10 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 11 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 12 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 13 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 14 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+2 | $4.80 | Blank 15 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 16 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 17 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 18 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 19 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 20 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+3 | $5.95 | Blank 21 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 22 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 23 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 24 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 25 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 26 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 [/table] Seller:[table] Day | Price | Initial amount | Result | Interim result | Deposit | Withdrawal | Final amount N | $5.65 | ------ | ------ | $0 | Blank 27 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | ------ | Blank 28 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N | $5.70 | Blank 29 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 30 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 31 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 32 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 33 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 34 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+1 | $5.90 | Blank 35 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 36 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 37 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 38 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 39 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 40 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+2 | $4.80 | Blank 41 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 42 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 43 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 44 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 45 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 46 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+3 | $5.95 | Blank 47 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 48 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 49 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 50 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 51 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 52 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 [/table]

查看解析

标准答案

Please login to view

思路分析

We start by clearly restating the scenario and what needs to be tracked for both the Buyer and the Seller.

- Each futures contract on ABC has an underlying asset of 100 shares of ABC.

- The investor buys one futures contract with a settlement date 4 months ahead at a price of 5.65 per share (the reference price at purchase day N is 5.70, which affects P&L as the price moves).

- Initial margin (deposit) required is 500 and the maintenance margin is 400. This means the trader must maintain at least 400 in the margin account; if the balance falls below this, a margin call would be triggered (not specified here, but the concept is key).

- We track, for each day, the change in the contract value due to the change in the reference price, and how this affects the buyer’s and the seller’s margin accounts. A long futures position gains when the reference price increases and loses when it decreases, relative to the purchase price.

Option-by-option analysis approach (without presuming the exact listed options):

- For any day ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Which of the following is NOT a contract specification for currency futures trading on an organized exchange?

Question29 (b) What is the gain or loss for Myles on this futures contract after the first trading day? [1 mark] 0[input] Your response must be entered as a positive (profit)/negative (loss) numerical value with 2 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 1 Flag question undefined

Question23 Mohamad shorted futures contracts on a US stock at $61.50 per share. Each contract is for the sale of 200 shares. The stock price at the end of the contract is $57. Mohamad has to pay a flat fee of $8000 as well as a trading commission of $7 per contract. If he has shorted 100 contracts, what is the net profit/loss to him? [4 marks] [input] Your response must be entered as a positive (profit)/negative (loss) numerical value with 0 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 4 Flag question undefined

Question29 (b) What is the gain or loss for Myles on this futures contract after the first trading day? [1 mark] Invalid input. Enter a numerical value.[input] Your response must be entered as a positive (profit)/negative (loss) numerical value with 2 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 1 Flag question undefined

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!