题目

Dashboard Practice Quiz 1 - Accounting for foreign currency transactions

单项选择题

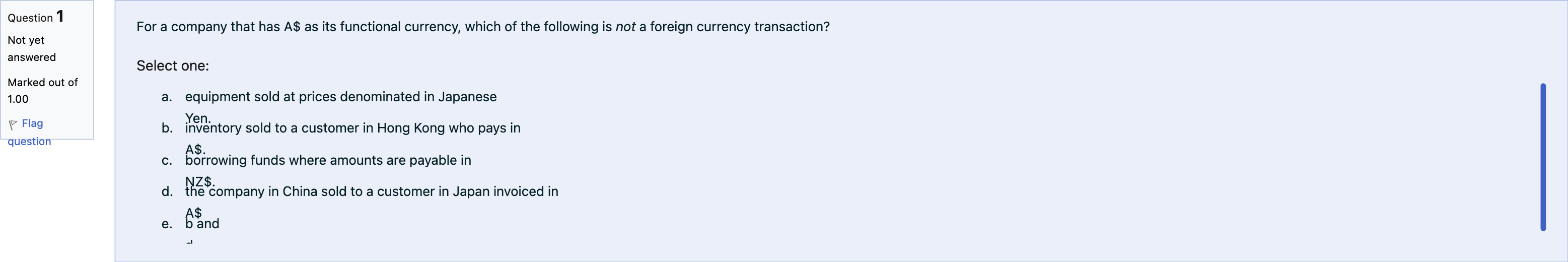

For a company that has A$ as its functional currency, which of the following is not a foreign currency transaction?

选项

A.a. equipment sold at prices denominated in Japanese Yen.

B.b. inventory sold to a customer in Hong Kong who pays in A$.

C.c. borrowing funds where amounts are payable in NZ$.

D.d. the company in China sold to a customer in Japan invoiced in A$

E.e. b and d.

查看解析

标准答案

Please login to view

思路分析

We start by restating the question and listing the options to evaluate each one.

Option a: 'equipment sold at prices denominated in Japanese Yen.' Since the denominated currency is Japanese Yen, which is different from the company’s functional currency (A$), this is indeed a foreign currency transaction.

Option b: 'inventory sold to a customer in Ho......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Question19 Which of the following is correct in relation to foreign currency transactions? Trade payable is a monetary item. If an Australian company has USD-denominated sales to be received in 14 days, the company is exposed to the risk of USD appreciation (i.e. AUD depreciation). There is more than one correct answer. Exchange differences relating to monetary items are recognised in P/L with no exceptions. At the end of the reporting period, both monetary and non-monetary items shall be translated. ResetMaximum marks: 1 Unflag question undefined

Question23 Twinkle Star Ltd, an Australian company with AUD functional currency, sold inventory to a customer in Singapore, Merlion Pte Ltd, for SGD 100,000, with the customer invoiced in Singapore dollars. At the date of the order the exchange rate was AUD 1 = SGD 0.90. A 20% deposit was paid upfront on 12 June 20X5 at the time of the order. The order was shipped and invoiced on 19 June, and the customer paid the balance of the invoice on 15/07/20X5. The relevant exchange rates are:[table] Cut off date | Exchange rateAUD 1 = SGD 12/06/20X5 order date | 0.90 19/09/20X5 delivery date | 0.92 30/06/20X5 year-end reporting | 0.95 15/07/20X5 payment date | 1.00 [/table] Choose the option that correctly shows the journal entry (in AUD) for Twinkle Star Ltd, on 15 July 20X5: Select one alternative: Dr. Cash 100 000Cr. Exchange gain 5 000 Cr. Accounts Receivable 95 000 Dr. Cash 80 000Dr. Exchange loss 4 211Cr. Accounts Receivable 84 211 Dr. Cash 100 000Dr. Exchange loss 5 263Cr. Accounts Receivable 105 263 Dr. Cash 80 000Cr. Exchange Gain 4 211 Cr. Accounts Receivable 75,789 Dr. Cash 80 000Cr. Accounts Receivable 80 000 ResetMaximum marks: 3

Question text Accounting for Foreign-Currency-Denominated Receivable and Payable Assume that on November 2, 2021, we purchase product from a manufacturer located in Ireland and that the manufacturer requires payment in Euros (€). Our company purchases 9,000 units of product at a sales price of €9 per unit, and the assumed exchange rate on the date of sale is $1.20:€1 The invoice terms are 90 days, and the due date for payment is January 31, 2022. Assume that the exchange rate rises to $1.25:€1 on December 31 and to $1.30:€1 on January 31, 2022. a. Prepare the journal entries for the date of purchase, December 31, and the date of payment. [table] Date | Journal entry | Debit | Credit November 2, 2021 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 1CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 2CorrectMark 1.00 out of 1.00 | (to record purchase of inventory) | | December 31, 2021 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 3CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 4CorrectMark 1.00 out of 1.00 | (to record adjustment of the payable) | | January 31, 2022 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 5CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 6CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 7CorrectMark 1.00 out of 1.00 | (to record payment of the payable) | | [/table] b. Prepare the journal entries for the date of purchase, December 31, and the date of payment assuming that we are selling the inventory instead of purchasing it. [table] Date | | Debit | Credit November 2, 2021 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 8CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 9CorrectMark 1.00 out of 1.00 | (to record the sale) | | December 31, 2021 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 10CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 11CorrectMark 1.00 out of 1.00 | (to record the adjustment of the receivable) | | January 31, 2022 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 12CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 13CorrectMark 1.00 out of 1.00 | Accounts payableAccounts receivableAOCI—Foreign currency transaction gainCashForeign currency transaction gainForeign currency transaction lossForward contract (asset)Forward contract (liability)Hedged firm commitment (asset)InventoriesOCI—Foreign currency transaction gainSalesNo entry - DebitNo entry - Credit | | Answer 14CorrectMark 1.00 out of 1.00 | (to record collection of the receivable) | | [/table]

Macro Industries Ltd. sold some goods to a U.S. customer for US$4,000 when the exchange rate was US$1.00 - CDN$1.03. Macro has a U.S. bank account and deposited the payment to the account. The journal entry required to record this transaction will be a debt to cash and a credit to sales for what amount? 题目解析 X 正 在 帮 您 自 动 填 写 . . . Journal Entry for Macro Industries Ltd. To determine the correct journal entry, let's analyze the transaction step-by-step. 1. Transaction Details Sale Amount: US$4,000 Exchange Rate: 1 USD = 1.03 CAD Bank Account: U.S. dollar account 2. Calculating the CAD Equivalent To record the transaction in CAD, we need to convert the sales revenue from USD to CAD using the given exchange rate. Sales Revenue in CAD: 4000 USD × 1.03 CAD USD = 4120 CAD 4000USD×1.03 USD CAD =4120CAD 3. Journal Entry The journal entry will reflect the increase in cash (in the U.S. dollar account) and the corresponding increase in sales revenue. Both are recorded in CAD. Account Debit Credit Cash (U.S. bank account) $4,120 CAD Sales Revenue $4,120 CAD Answer 2. $4,120 点赞

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!