题目

FINS5547-Cryptocurrency & Decentralised Finance - T3 2025

单项选择题

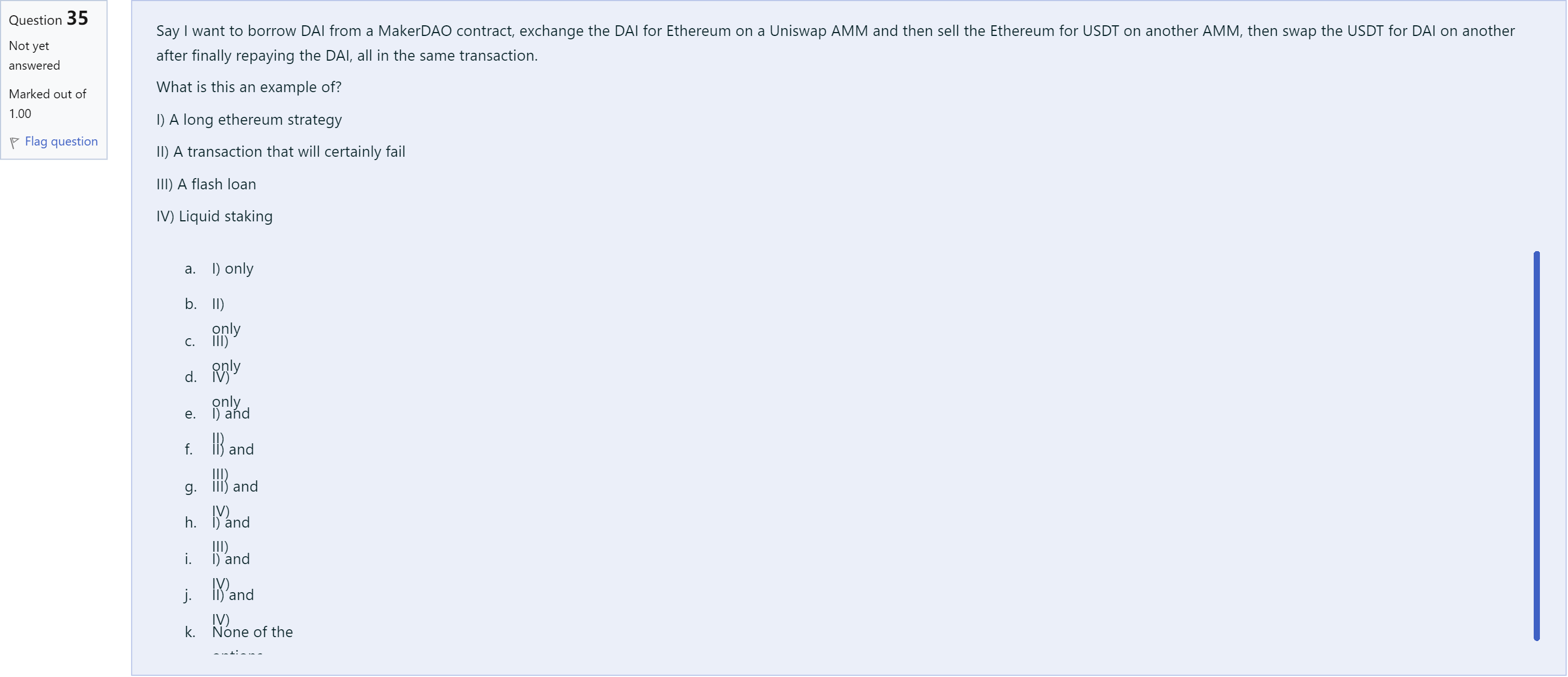

Say I want to borrow DAI from a MakerDAO contract, exchange the DAI for Ethereum on a Uniswap AMM and then sell the Ethereum for USDT on another AMM, then swap the USDT for DAI on another after finally repaying the DAI, all in the same transaction. What is this an example of?I) A long ethereum strategyII) A transaction that will certainly failIII) A flash loanIV) Liquid staking

选项

A.a. I) only

B.b. II) only

C.c. III) only

D.d. IV) only

E.e. I) and II)

F.f. II) and III)

G.g. III) and IV)

H.h. I) and III)

I.i. I) and IV)

J.j. II) and IV)

K.k. None of the options

查看解析

标准答案

Please login to view

思路分析

Let's parse the scenario carefully and assess what each option would imply in this context.

Option a: I) only — A long ethereum strategy. This would imply the user is taking a long position in Ethereum (holding ETH expecting its price to rise) and engaging in the described steps. However, the sequence starts with borrowing DAI, exchanging for ETH, selling ETH for USDT, swapping back to DAI, and repaying DAI all within one transaction. There is no explicit holding of ETH as an investment stance within the same transaction; the core pattern is borrowing and repaying rather than a directional bet on ETH’s price. So labeling this as a "long Ethereum strategy" doesn’t capture the main mechanism at play.

Option b: II) A transaction that will certainly fail — This assertion would claim the entire sequence is guaranteed to fail in all circumstances. In prac......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

In a consumer society, many adults channel creativity into buying things

Economic stress and unpredictable times have resulted in a booming industry for self-help products

People born without creativity never can develop it

A product has a selling price of $20, a contribution margin ratio of 40% and fixed cost of $120,000. To make a profit of $30,000. The number of units that must be sold is: Type the number without $ and a comma. Eg: 20000

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!