题目

MCD2170 - T3 - 2025 Pre-Class Quiz Week 1

单项选择题

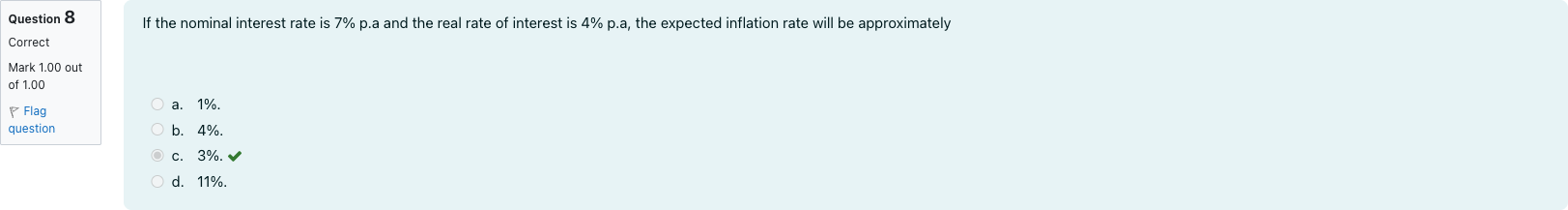

If the nominal interest rate is 7% p.a and the real rate of interest is 4% p.a, the expected inflation rate will be approximately

查看解析

标准答案

Please login to view

思路分析

To tackle the question, I first remind myself of the relationship between nominal rate, real rate, and inflation. The Fisher equation in its approximate form says: nominal rate ≈ real rate + expected inflation. This gives us a straightforward way to estimate inflation when the other ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Now assume that 𝑟 ¯ = 1 % and 𝜋 ¯ = 2.5 % . Using your answer from the previous question, you know that the nominal interest rate 𝑖 𝑡 = 𝑅 𝑡 + 𝜋 𝑡 is ______ percent. Use the policy rule and the Fischer equation to answer this question.

The central bank uses the simple monetary rule to set the real interest rate. You observe that the inflation rate is 2 percentage points below the target inflation rate of 3 percent. You also know that the marginal product of capital is 4 percent. If the central bank sets the real interest rate to 𝑅 𝑡 = 1 % , you know that the nominal interest rate is 𝑖 𝑡 = ______ percent. Hint: Calculate the value of 𝑚 ¯ first. Then compute the value of 𝑖 𝑡 .

Using the Fisher equation, calculate the nominal interest rate 𝑖 𝑡 (in percent). Round your answer to the nearest tenth of a percent.

According to the quantity theory and the Fisher equation, if the money growth increases by 3 percent and the real interest rate equals 2 percent, then the nominal interest rate will be:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!