题目

SESS0026_25-26 MCQ TEST (30%) in-class 11th December 2025, 1pm

单项选择题

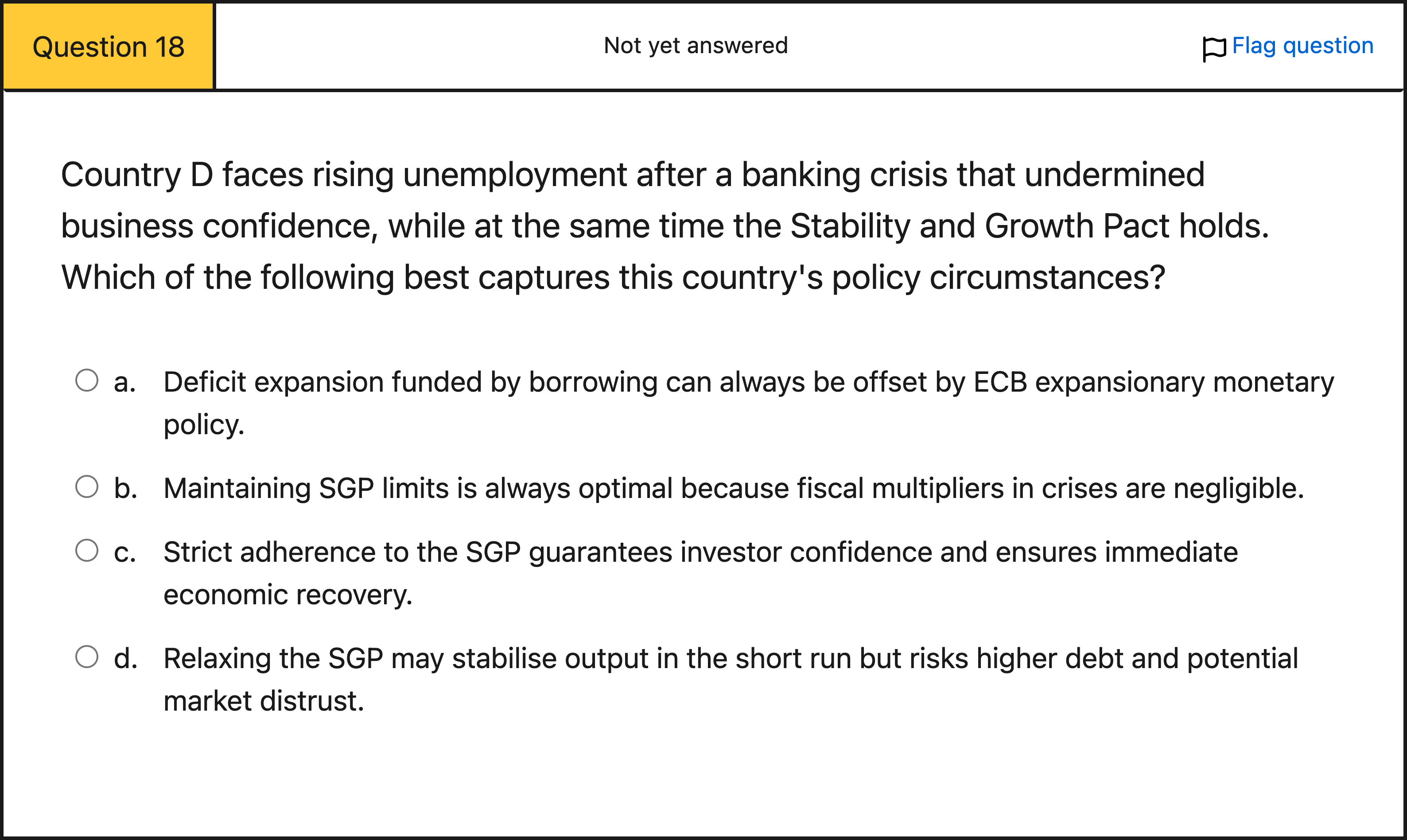

Country D faces rising unemployment after a banking crisis that undermined business confidence, while at the same time the Stability and Growth Pact holds. Which of the following best captures this country's policy circumstances?

选项

A.a. Deficit expansion funded by borrowing can always be offset by ECB expansionary monetary policy.

B.b. Maintaining SGP limits is always optimal because fiscal multipliers in crises are negligible.

C.c. Strict adherence to the SGP guarantees investor confidence and ensures immediate economic recovery.

D.d. Relaxing the SGP may stabilise output in the short run but risks higher debt and potential market distrust.

查看解析

标准答案

Please login to view

思路分析

Question restatement: Country D faces rising unemployment after a banking crisis that undermined business confidence, while at the same time the Stability and Growth Pact holds. Which of the following best captures this country's policy circumstances?

Option a: Deficit expansion funded by borrowing can always be offset by ECB expansionary monetary policy. This is overly optimistic and inaccurate. It assumes the ECB can always perfectly offset fiscal loosening with monetary stimulus, which ignores limits of monetary policy......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Fiscal policy refers to the idea that changes in:

Consider the following graph. Suppose the economy is currently at a point like A. Assume the central bank in this economy remains idle. What type of policy can the Government conduct to reach point B?

______________ are changes in federal taxes and government purchases that are intended to achieve macroeconomic policy goals, and ______________ are changes in federal taxes and government spending that respond to the Business Cycle without direct government action.

The graph above shows the AD, LRAS, and SRAS functions for a country. The Fed is following an inflation targeting policy. Its target inflation rate is Π* = 5.00 percent and the potential GDP equals YP = 100,000. The Fed is quite successful in achieving its inflation target in the long run. Okun's alpha equals 2. Currently the economy is in the state of long-run equilibrium. Marginal propensity to consume is MPC = 0.80. The government increases the purchase of goods and services (G) by 1,600 units. If the Fed does not follow the inflation targeting policy, and if this increase in G turns out to be permanent, private spending will be crowded out by X units. What is the value of X? Assume no change in net exports.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!