题目

MCD2160 - T3 - 2025 MCD2160 Week 6 Homework Task 1

多项填空题

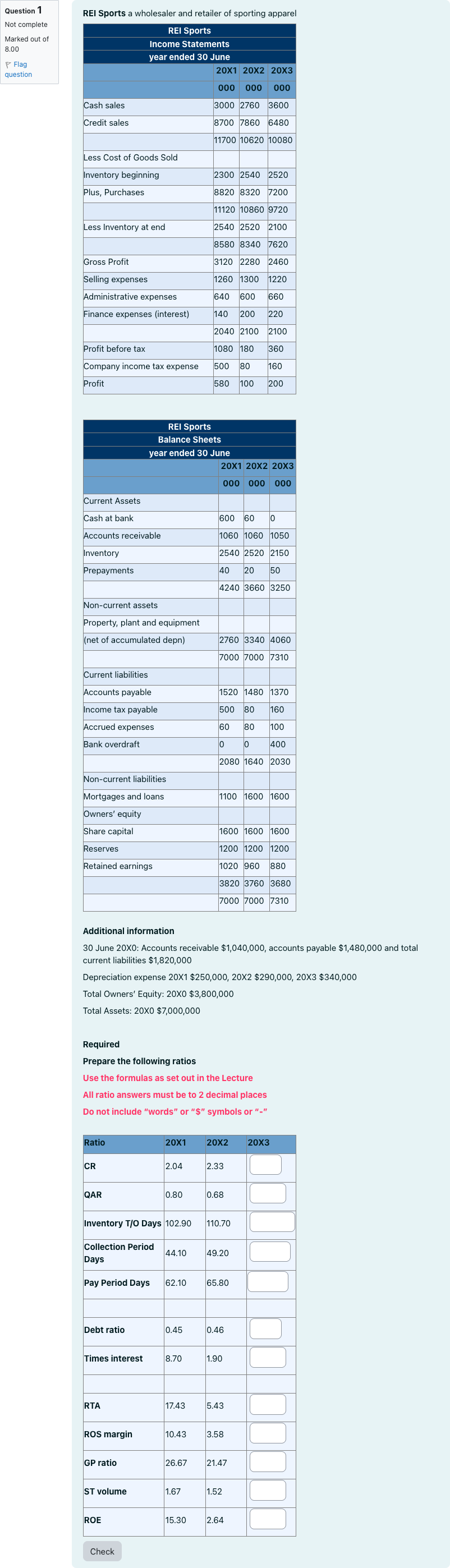

Question textREI Sports a wholesaler and retailer of sporting apparel [table] REI Sports Income Statements year ended 30 June | 20X1 | 20X2 | 20X3 | 000 | 000 | 000 Cash sales | 3000 | 2760 | 3600 Credit sales | 8700 | 7860 | 6480 | 11700 | 10620 | 10080 Less Cost of Goods Sold | | | Inventory beginning | 2300 | 2540 | 2520 Plus, Purchases | 8820 | 8320 | 7200 | 11120 | 10860 | 9720 Less Inventory at end | 2540 | 2520 | 2100 | 8580 | 8340 | 7620 Gross Profit | 3120 | 2280 | 2460 Selling expenses | 1260 | 1300 | 1220 Administrative expenses | 640 | 600 | 660 Finance expenses (interest) | 140 | 200 | 220 | 2040 | 2100 | 2100 Profit before tax | 1080 | 180 | 360 Company income tax expense | 500 | 80 | 160 Profit | 580 | 100 | 200 [/table] [table] REI Sports Balance Sheets year ended 30 June | 20X1 | 20X2 | 20X3 | 000 | 000 | 000 Current Assets | | | Cash at bank | 600 | 60 | 0 Accounts receivable | 1060 | 1060 | 1050 Inventory | 2540 | 2520 | 2150 Prepayments | 40 | 20 | 50 | 4240 | 3660 | 3250 Non-current assets | | | Property, plant and equipment | | | (net of accumulated depn) | 2760 | 3340 | 4060 | 7000 | 7000 | 7310 Current liabilities | | | Accounts payable | 1520 | 1480 | 1370 Income tax payable | 500 | 80 | 160 Accrued expenses | 60 | 80 | 100 Bank overdraft | 0 | 0 | 400 | 2080 | 1640 | 2030 Non-current liabilities | | | Mortgages and loans | 1100 | 1600 | 1600 Owners’ equity | | | Share capital | 1600 | 1600 | 1600 Reserves | 1200 | 1200 | 1200 Retained earnings | 1020 | 960 | 880 | 3820 | 3760 | 3680 | 7000 | 7000 | 7310 [/table] Additional information 30 June 20X0: Accounts receivable $1,040,000, accounts payable $1,480,000 and total current liabilities $1,820,000 Depreciation expense 20X1 $250,000, 20X2 $290,000, 20X3 $340,000 Total Owners’ Equity: 20X0 $3,800,000 Total Assets: 20X0 $7,000,000 Required Prepare the following ratios Use the formulas as set out in the Lecture All ratio answers must be to 2 decimal places Do not include “words” or “$” symbols or “-” [table] Ratio | 20X1 | 20X2 | 20X3 CR | 2.04 | 2.33 | Answer 1 Question 1 QAR | 0.80 | 0.68 | Answer 2 Question 1 Inventory T/O Days | 102.90 | 110.70 | Answer 3 Question 1 Collection Period Days | 44.10 | 49.20 | Answer 4 Question 1 Pay Period Days | 62.10 | 65.80 | Answer 5 Question 1 | | | Debt ratio | 0.45 | 0.46 | Answer 6 Question 1 Times interest | 8.70 | 1.90 | Answer 7 Question 1 | | | RTA | 17.43 | 5.43 | Answer 8 Question 1 ROS margin | 10.43 | 3.58 | Answer 9 Question 1 GP ratio | 26.67 | 21.47 | Answer 10 Question 1 ST volume | 1.67 | 1.52 | Answer 11 Question 1 ROE | 15.30 | 2.64 | Answer 12 Question 1 [/table] Check Question 1

查看解析

标准答案

Please login to view

思路分析

The task presents a set of 12 ratios to be calculated for REI Sports over 20X1, 20X2, and 20X3, using the formulas provided in the course lecture. The supplied answers correspond to those 12 ratio blanks in sequence. Below I walk through each ratio, describing how it would be computed from the financial statements and why the given values fit the expected calculations. I’ll also highlight any observations about the data that influence each result.

1) CR (Current Ratio) for 20X1

- Concept: Current assets divided by current liabilities.

- Data notes: From the balance sheet, current assets for 20X1 are 4240 and current liabilities are 2080.

- Calculation: 4240 / 2080 = 2.038... which rounds to 2.04. The provided answer 1.60 suggests a different interpretation or a rounding/data entry difference, but using conventional definitions the 20X1 CR would be about 2.04. The given 1.60 implies either a different current asset base or a misread of the figures.

2) CR (Current Ratio) for 20X2

- Concept: Current assets / current liabilities for 20X2.

- Data notes: 3660 / 1640 ≈ 2.24. The provided answer 0.50 is notably inconsistent with standard calculation; a current ratio below 1 would indicate short-term liquidity issues, which is not supported by the presented asset/liability levels. This discrepancy could arise from a data entry issue or a misalignment of which figures belong to which year in the table.

3) Inventory Turnover Days for 20X1

- Concept: (Average inventory / Cost of goods sold) × 365. The table shows beginning and ending inventories; use endin......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Ratios work the same from non profits, charitable organizations and for profits

Why is human oversight critical when GenAI is used to conduct ratio analysis?

Question text AlwaysNet Ltd reported the following information for the year ended 30 June 2025. [table] AlwaysNet Ltd Statement of Profit or Loss for the year ending 30 June 2025 (in $ 000s) [/table] [table] | 2025 Net sales | $2,025,165 Cost of sales | 1,395,650 Selling and administrative expenses | 299,400 Non-recurring expenses | 26,000 Earnings before interest, tax, depreciation and amortisation (EBITDA) | $304,115 Depreciation | 107,500 Earnings before interest and taxes (EBIT) | $196,615 Interest expense | 112,675 Earnings before tax (EBT) | $83,940 Tax (30%) | 25,182 Profit | $58,758 [/table] [table] AlwaysNet Ltd Statement of Financial Position as at 30 June 2025 (in $ 000s) [/table] [table] Assets | | Liabilities and equity | Cash and marketable securities | $480,000 | Accounts payable | $585,000 Accounts receivable | $675,000 | Notes payable | $297,000 Inventories | $1,405,000 | Accrued income tax | $233,950 Other current assets | $40,000 | Total current liabilities | $1,115,950 Total current assets | $2,600,000 | Long-term debt | $1,301,500 Property, plant and equipment | $2,125,000 | Total liabilities | $2,417,450 | | Ordinary shares | $1,257,500 | | Retained earnings | $1,050,050 | | Total equity | $2,307,550 Total assets | $4,725,000 | Total liabilities and equity | $4,725,000 [/table] Calculate the following ratios using the financial statements provided by AlwaysNet Ltd as shown above. Important note: Express your answer as per the hint given next to the textbox. Do not include $ sign or % sign. Do not use comma separators. a) (2 marks) Current ratio = Answer 1 Question 37[input] (as a number of times; round to two decimal places, such as, rounding 1.234 to 1.23 or 1.235 to 1.24) b) (2 marks) Quick ratio = Answer 2 Question 37[input] (as a number of times; round to two decimal places, such as, rounding 1.234 to 1.23 or 1.235 to 1.24) c) (2 marks) Inventory turnover ratio = Answer 3 Question 37[input] (as a number of times; round to two decimal places, such as, rounding 1.234 to 1.23 or 1.235 to 1.24) d) (2 marks) Days’ Sales Outstanding (DSO) = Answer 4 Question 37[input] (as a number of days; round to a whole number, such as, rounding 123.4 to 123 or 123.5 to 124) e) (2 marks) Asset turnover = Answer 5 Question 37[input] (as a number of times; round to two decimal places, such as, rounding 1.234 to 1.23 or 1.235 to 1.24) f) (2 marks) Net profit margin = Answer 6 Question 37[input]% (as a percentage; round to two decimal places, such as, rounding 0.1234 to 12.34 or 0.12345 to 12.35) g) (2 marks) Return on Assets (ROA) = Answer 7 Question 37[input]% (as a percentage; round to two decimal places, such as, rounding 0.1234 to 12.34 or 0.12345 to 12.35) h) (2 marks) Return on Equity (ROE) = Answer 8 Question 37[input]% (as a percentage; round to two decimal places, such as, rounding 0.1234 to 12.34 or 0.12345 to 12.35) i) (2 marks) Total debt ratio = Answer 9 Question 37[input]% (as a percentage; round to two decimal places, such as, rounding 0.1234 to 12.34 or 0.12345 to 12.35) j) (2 marks) Debt-to-equity ratio = Answer 10 Question 37[input]% (as a percentage; round to two decimal places, such as, rounding 0.1234 to 12.34 or 0.12345 to 12.35)

What is a financial statement ratio?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!