你还在为考试焦头烂额?找我们就对了!

我们知道现在是考试月,你正在为了考试复习到焦头烂额。为了让更多留学生在备考与学习季更轻松,我们决定将Gold会员限时免费开放至2025年12月31日!原价£29.99每月,如今登录即享!无门槛领取。

助你高效冲刺备考!

题目

单项选择题

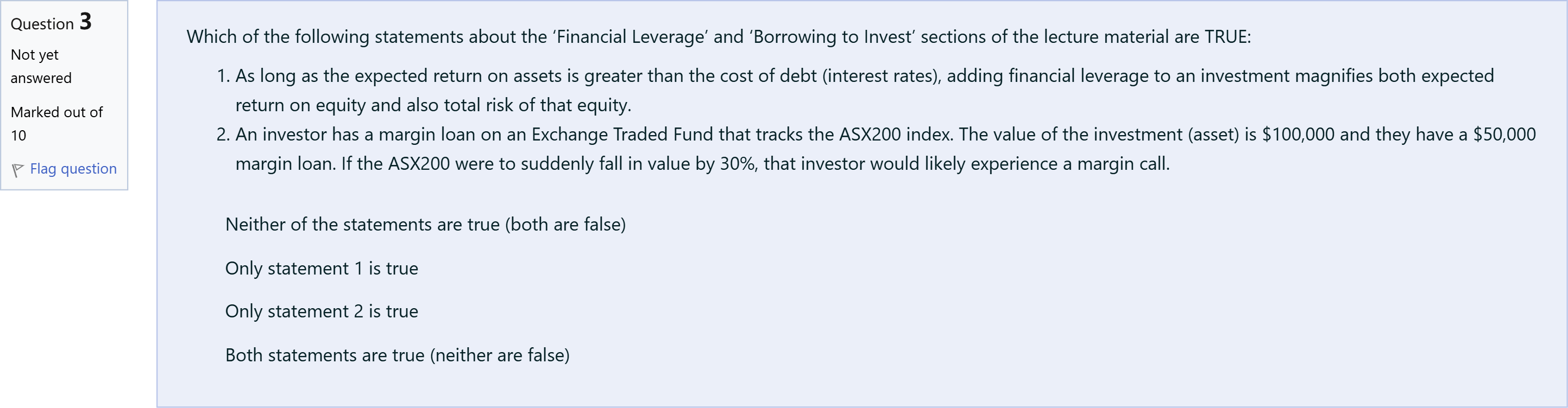

Which of the following statements about the ‘Financial Leverage’ and ‘Borrowing to Invest’ sections of the lecture material are TRUE: As long as the expected return on assets is greater than the cost of debt (interest rates), adding financial leverage to an investment magnifies both expected return on equity and also total risk of that equity. An investor has a margin loan on an Exchange Traded Fund that tracks the ASX200 index. The value of the investment (asset) is $100,000 and they have a $50,000 margin loan. If the ASX200 were to suddenly fall in value by 30%, that investor would likely experience a margin call.

选项

A.Neither of the statements are true (both are false)

B.Only statement 1 is true

C.Only statement 2 is true

D.Both statements are true (neither are false)

查看解析

标准答案

Please login to view

思路分析

Question restatement: You are asked about two statements regarding Financial Leverage and Borrowing to Invest. The answer options present four possible judgments about those statements.

Option A: Neither of the statements are true (both are false). Here, we would be claiming that neither the leverage effect on ROE/ risk, nor the margin-call scenario, holds under the given conditions. In standard leverage theory, if the return on assets exceeds the cost of debt, financial leverage tends to amplify both......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

When a company's ROE is greater than its ROA for a given time-period, it could be that

Sun Corp and Tri Corp have similar business operations, but Tri Corp always maintains a much higher debt-to-equity ratio than Sun Corp. If next year both firms experience an increase in their profit margins, then Tri Corp’s accounting return on equity (ROE) will likely increase much less than Sun Corp’s ROE, because Tri Corp's equity is more risky.

Which of the following statements about the ‘Financial Leverage’ and ‘Borrowing to Invest’ sections of the lecture material are TRUE: As long as the expected return on assets is greater than the cost of debt (interest rates), adding financial leverage to an investment magnifies both expected return on equity and also total risk of that equity. An investor has a margin loan on an Exchange Traded Fund that tracks the ASX200 index. The value of the investment (asset) is $100,000 and they have a $50,000 margin loan. If the ASX200 were to suddenly fall in value by 30%, that investor would likely experience a margin call.

Question at position 9 Leverage refers tothe use of an easement to limit land use.the use of a lease to increase yield to the owner.the use of borrowed funds to increase or decrease equity return.the use of an architectural tool to build improvements with doors and windows.

更多留学生实用工具

希望你的学习变得更简单

为了让更多留学生在备考与学习季更轻松,我们决定将Gold 会员限时免费开放至2025年12月31日!