题目

COMM_V 295 105 106 2025W1 2025W1 COMM 295 Final (December 13, 2025)- Requires Respondus LockDown Browser

单项选择题

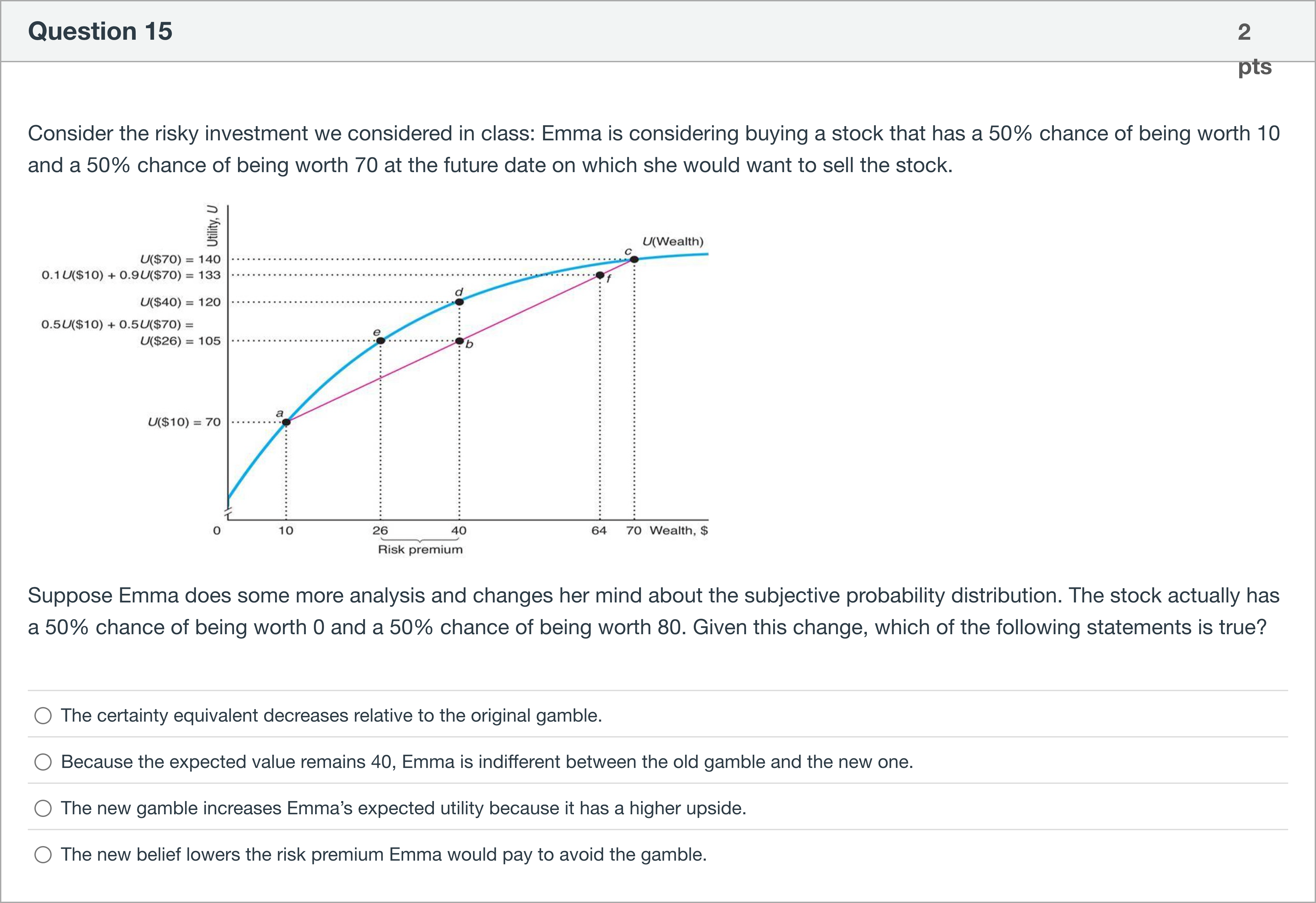

Consider the risky investment we considered in class: Emma is considering buying a stock that has a 50% chance of being worth 10 and a 50% chance of being worth 70 at the future date on which she would want to sell the stock. Suppose Emma does some more analysis and changes her mind about the subjective probability distribution. The stock actually has a 50% chance of being worth 0 and a 50% chance of being worth 80. Given this change, which of the following statements is true?

选项

A.The certainty equivalent decreases relative to the original gamble.

B.Because the expected value remains 40, Emma is indifferent between the old gamble and the new one.

C.The new gamble increases Emma’s expected utility because it has a higher upside.

D.The new belief lowers the risk premium Emma would pay to avoid the gamble.

查看解析

标准答案

Please login to view

思路分析

We start by restating the scenario and the options to ensure clarity. Emma compares two gambles:

- Original gamble: 50% chance of 10 and 50% chance of 70. EV = 0.5*10 + 0.5*70 = 40.

- New gamble after updating beliefs: 50% chance of 0 and 50% chance of 80. EV = 0.5*0 + 0.5*80 = 40.

Option 1: The certainty equivalent decreases relative to the original gamble.

- Why this could be true: Certainty equivalent (CE) reflects the guaranteed amount a person considers equally desirable as the gamble, given their risk preferences. Since the two gambles have the same expected value, the comparison hinges on risk. The ori......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Which bets would a rational person definitely want to take, assuming they maximize expected utility: I. Win $1.5 if a coin comes up heads and lose $1 if a coin comes up tails II. Win $1.5 million if a coin comes up heads and lose $1 million if a coin comes up tails III. Win $1.5 if the S&P 500 rises by more than 10% next year; lose $1 if the S&P falls by more than 10% next year

[continues question 5] Then, given Jordan utility function,

Consider the risky investment we considered in class: Emma is considering buying a stock that has a 50% chance of being worth 10 and a 50% chance of being worth 70 at the future date on which she would want to sell the stock. Suppose Emma does some more analysis and changes her mind about the subjective probability distribution. The stock actually has a 50% chance of being worth 0 and a 50% chance of being worth 80. Given this change, which of the following statements is true?

Consumers always make decisions rationally and select brands/products with the mostexpected utility.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!