题目

MUF0062 Economics Unit 2 - Semester 2, 2025 Revision Quiz - Currency Exchange Rates (10 - 15 minutes)

单项选择题

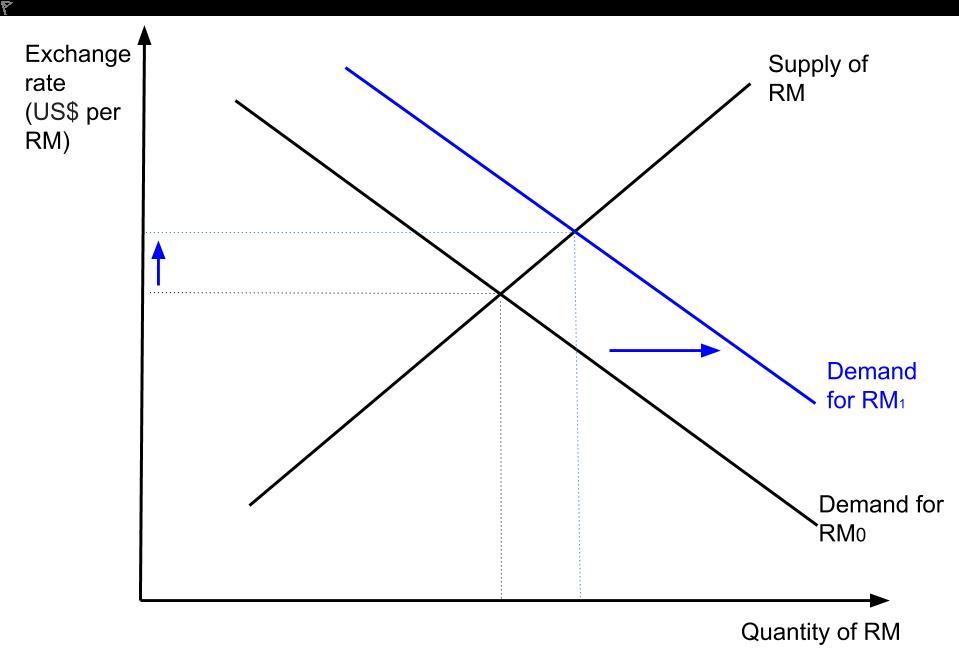

Which of the following factors is most likely to have caused the change shown in the diagram below? The Market for Malaysian Ringgit

选项

A.a. Incomes in Malaysia are growing at a faster rate than incomes in the US.

B.b. Inflation in the United States is lower than inflation in Malaysia.

C.c. The Malaysian central bank has decreased interest rates while the US central bank has increased them.

D.d. US demand for holidays in Malaysia increases.

查看解析

标准答案

Please login to view

思路分析

The diagram shows a rightward shift in the demand curve for RM from RM0 to RM1, with the price (exchange rate) moving upward as a result of the increased quantity demanded at a given price. Now, let's evaluate each option to assess which scenario best explains a rise in the demand for Malaysian Ringgit in this context.

Option a: Incomes in Malaysia are growing at a faster rate than incomes in the US.

If Malaysian incomes rise faster, domestic demand for imports could increase, potentially increasing the supply of RM relative to demand ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Which of the following events may result in the Appreciation of AUD against the U.S.dollar?

If the Australian dollar depreciates against the US dollar, holding other factors constant, which one of the followings may likely happen?

In November 2020, the price level in the U.S. was 𝑃 𝑈 𝑆 = 120 . At the same date, the price level in the Eurozone was 𝑃 𝐸 𝑈 = 105 . One year later, the price levels were 𝑃 𝑈 𝑆 = 125 and 𝑃 𝐸 𝑈 = 108 . During this 12-month period, the real exchange rate was constant. The nominal exchange rate (E) is reported in euros per dollar (i.e., how many euros do we need to purchase one dollar). Using the information above, calculate the rate of change of E during this time (in percent). Round your answer to the nearest tenth of a percent.

In November 2020, the price level in the U.S. was 𝑃 𝑈 𝑆 = 132 . At the same date, the price level in the Eurozone was 𝑃 𝐸 𝑈 = 98 . One year later, the price levels were 𝑃 𝑈 𝑆 = 128 and 𝑃 𝐸 𝑈 = 102 . During this 12-month period, the real exchange rate was constant. The nominal exchange rate (E) is reported in euros per dollar (i.e., how many euros do we need to purchase one dollar). Using the information above, calculate the rate of change of E during this time (in percent). Round your answer to the nearest tenth of a percent.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!