题目

FINS5530-Financial Institution Mgmt - T3 2025

单项选择题

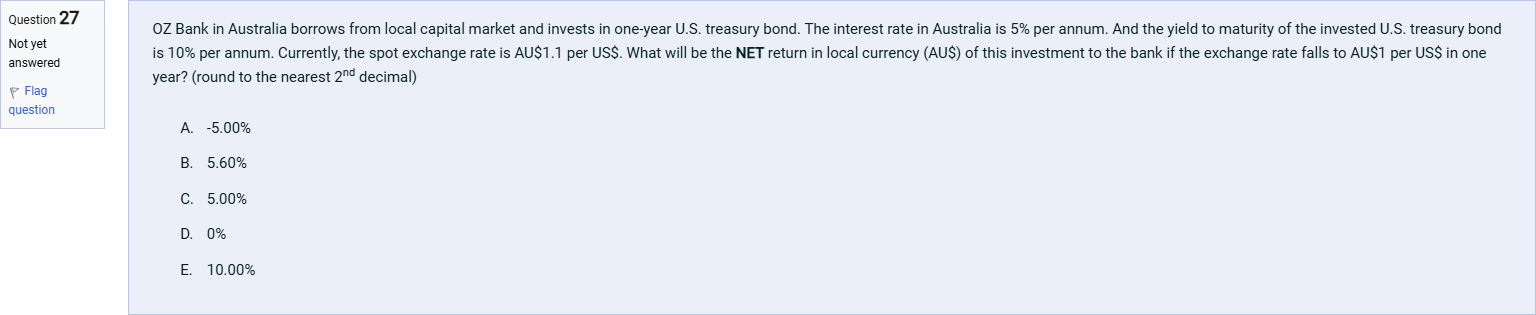

OZ Bank in Australia borrows from local capital market and invests in one-year U.S. treasury bond. The interest rate in Australia is 5% per annum. And the yield to maturity of the invested U.S. treasury bond is 10% per annum. Currently, the spot exchange rate is AU$1.1 per US$. What will be the NET return in local currency (AU$) of this investment to the bank if the exchange rate falls to AU$1 per US$ in one year? (round to the nearest 2nd decimal)

选项

A.A. -5.00%

B.B. 5.60%

C.C. 5.00%

D.D. 0%

E.E. 10.00%

查看解析

标准答案

Please login to view

思路分析

To begin, restate the scenario and the numbers involved to keep track of cash flows clearly. OZ Bank borrows 1.10 AU$ (the amount needed to invest in 1 US$ at the current spot of 1.1 AU$/US$) and uses it to buy 1.00 US$ worth of a one-year US Treasury, which yields 10% over the year. The ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

An American manufacturer with its corporate headquarters in New York City is purchasing goods from a French supplier. Which of the following statements is true regarding the exchange rate risk for this contract?

Question29 Assume that the exchange rate was AU$1.25/US$1 at 31/12/2006. One year later the exchange rate changed to AU$1/US$1. The rate of return in terms of US$ on the US$ assets was 10% from 12/31/2006 to 12/31/2007. What was the effective rate of return in terms of AU$ earned by this FI on the US$ assets? Select one alternative: a. -12% b. -10% c. +8% d. +10% e. +20% ResetMaximum marks: 3 Flag question undefined

An Indonesian student’s family purchased an apartment for AUD 1 million in the Melbourne CBD area for their son to stay in during his study at Monash College. The contract will be settled in 6 months. Which of the following statements is true regarding the exchange rate risk for the family?

An American manufacturer with its corporate headquarters in New York City is purchasing goods from a French supplier. Which of the following statements is true regarding the exchange rate risk for this contract?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!