题目

单项选择题

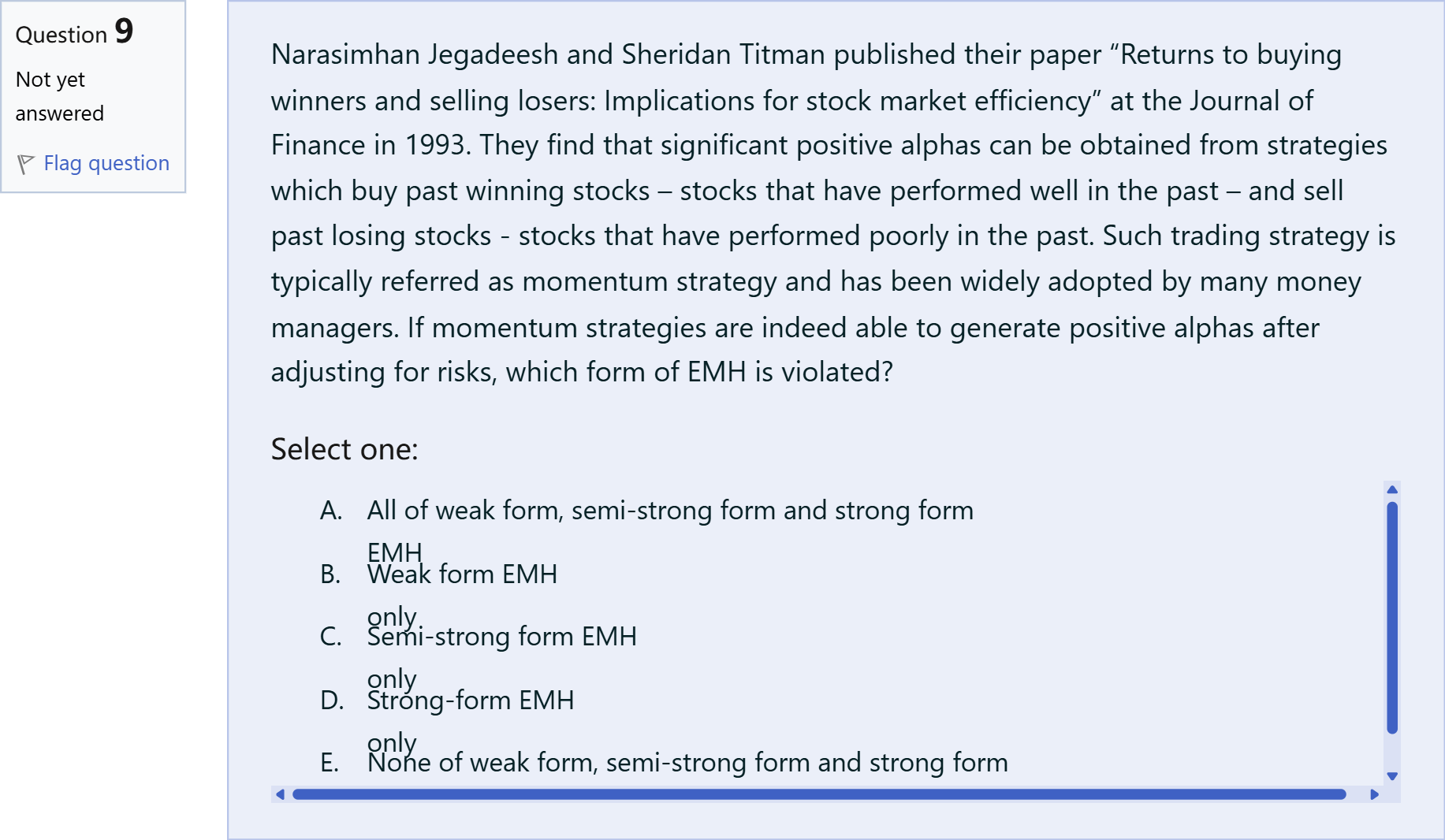

Narasimhan Jegadeesh and Sheridan Titman published their paper “Returns to buying winners and selling losers: Implications for stock market efficiency” at the Journal of Finance in 1993. They find that significant positive alphas can be obtained from strategies which buy past winning stocks – stocks that have performed well in the past – and sell past losing stocks - stocks that have performed poorly in the past. Such trading strategy is typically referred as momentum strategy and has been widely adopted by many money managers. If momentum strategies are indeed able to generate positive alphas after adjusting for risks, which form of EMH is violated?

选项

A.A. All of weak form, semi-strong form and strong form EMH

B.B. Weak form EMH only

C.C. Semi-strong form EMH only

D.D. Strong-form EMH only

E.E. None of weak form, semi-strong form and strong form EMH

查看解析

标准答案

Please login to view

思路分析

The key idea in this question is to map the empirical finding (positive abnormal returns from a rule that buys past winners and sells past losers) to the appropriate EMH form.

Option A: All of weak form, semi-strong form and strong form EMH. This is too strong a claim. If momentum profits exist, it does not automatically imply that all three forms are violated; the evidence is most directly about past price information, not about ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

The market price of a share of common equity reflects

位置13的问题 Evidence seems to support the view that studying public information to identify mispriced stocks is:effective only in strong form efficient markets.effective provided the market is only weak form efficient or if the market is strong form efficient.ineffective only in strong form efficient markets.effective as long as the market is only semistrong form efficient.ineffective.清除选择

Question23 In an efficient share market, which of the following is false: If new accounting information had been expected earlier it can still have a significant impact on share prices upon its release If new (unexpected) accounting information does not impact share prices now, then it has no incremental information value above other information currently available. New accounting information must be unexpected to have any impact on share prices Two of the other answers are false Unexpected accounting information that impacts share prices upon its release, will not impact share prices later if the information is later proved to be incorrect, for example due to accounting errors. ResetMaximum marks: 1 Flag question undefined

An efficient market does not require that:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!