题目

MCD2170 Foundations of Finance - Trimester 3 - 2025

单项选择题

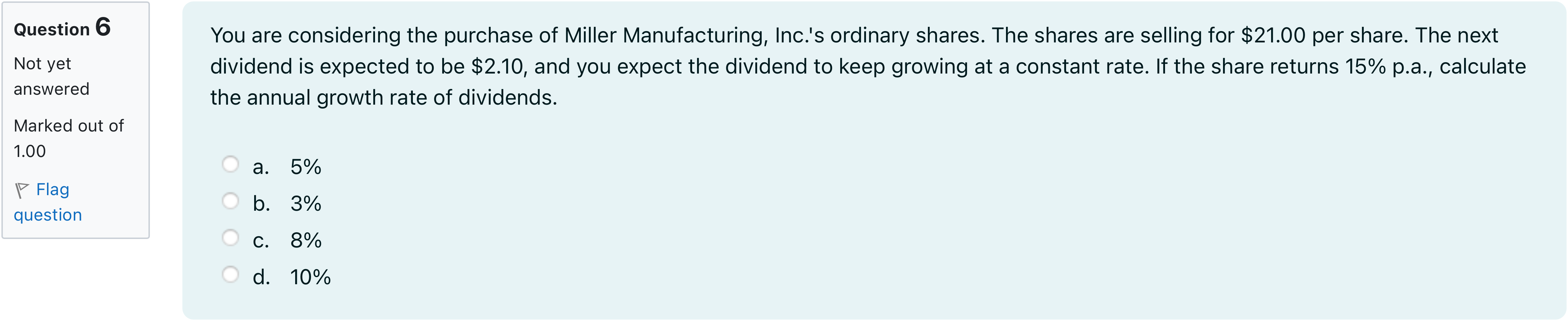

You are considering the purchase of Miller Manufacturing, Inc.'s ordinary shares. The shares are selling for $21.00 per share. The next dividend is expected to be $2.10, and you expect the dividend to keep growing at a constant rate. If the share returns 15% p.a., calculate the annual growth rate of dividends.

选项

A.a. 5%

B.b. 3%

C.c. 8%

D.d. 10%

查看解析

标准答案

Please login to view

思路分析

We start by restating the given data to keep the scenario clear: the current share price P0 is 21.00, the next dividend D1 is 2.10, and the required return (cost of equity) r is 15% or 0.15. The dividends are expected to grow at a constant rate g, which implies the ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Company ABC’s ordinary shares are currently selling at $24.00 per share. The company is expected to pay a dividend of $1.92 per share, which is predicted to grow at 4% per annum forever. What is the share's expected rate of return?

Company ABC’s ordinary shares are currently selling at $24.00 per share. The company is expected to pay a dividend of $1.92 per share, which is predicted to grow at 4% per annum forever. What is the share's expected rate of return?

Asgard Industries stock has a beta of 1.03. The company just paid a dividend of $0.7, and the dividends are expected to grow at 6.2 percent indefinitely. The expected return on the market is 13.3 percent, and Treasury bills are yielding 3.8 percent. The most recent stock price for the company is $9.04. Calculate the cost of equity using the Dividend Growth Model (DGM) method.Note: Do not round intermediate calculations and enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16 and not 32.16% or 0.3216).FIN256-2025-Fall-Final-Blank.xlsx

The Snow Owl Company just issued a dividend of $3.32 per share on its common stock. The company is expected to maintain a constant 8 percent growth rate in its dividends indefinitely. If the stock sells for $70 a share, what is the company’s cost of equity?Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!