题目

单项选择题

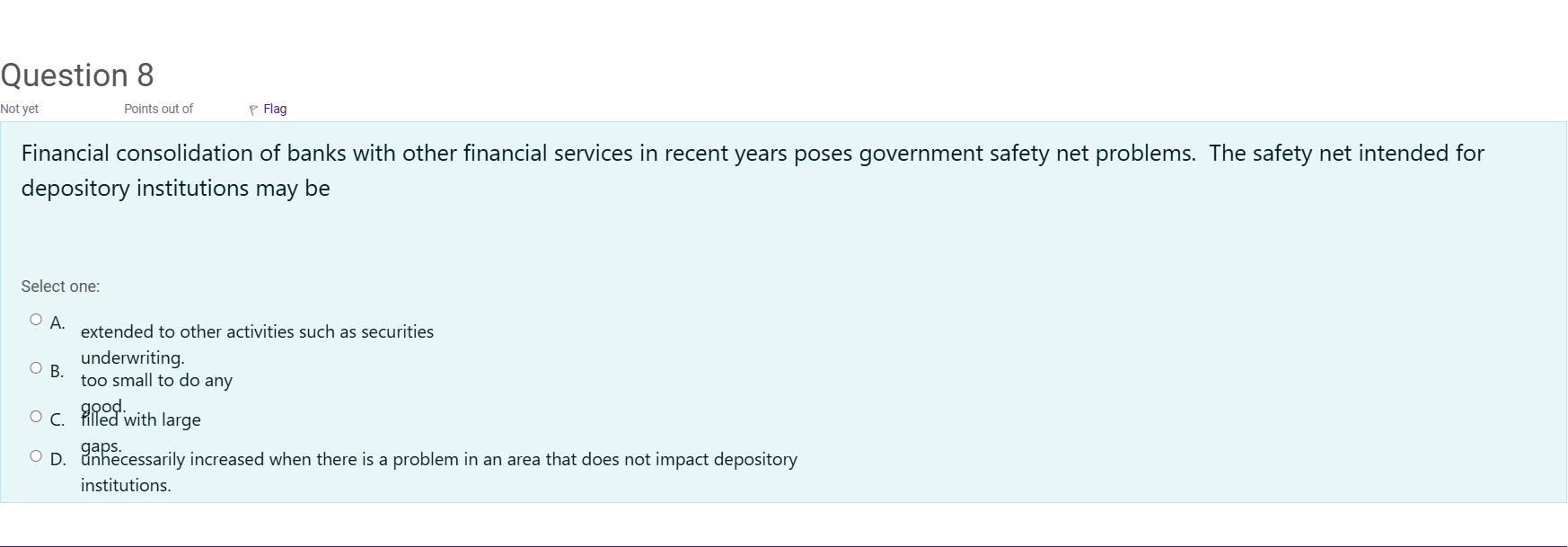

Financial consolidation of banks with other financial services in recent years poses government safety net problems. The safety net intended for depository institutions may be

选项

A.A. extended to other activities such as securities underwriting.

B.B. too small to do any good.

C.C. filled with large gaps.

D.D. unnecessarily increased when there is a problem in an area that does not impact depository institutions.

查看解析

标准答案

Please login to view

思路分析

The question examines how the government safety net for depository institutions has evolved in the context of bank consolidation with other financial services.

Option A: 'extended to other activities such as securities underwriting.' This choice reflects a widely observed concern: when a safety net covers depository institutions, the protections and guarantees can become relevant for related activities that these institutio......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Risk-based deposit insurance premiums help control moral hazard by:

Which of the following outcomes is most directly attributable to the absence of a fully mutualised European Deposit Insurance Scheme (EDIS)?

A key reason full European Deposit Insurance Scheme has faced political resistance is that:

A key reason full European Deposit Insurance Scheme has faced political resistance is that:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!