题目

多项填空题

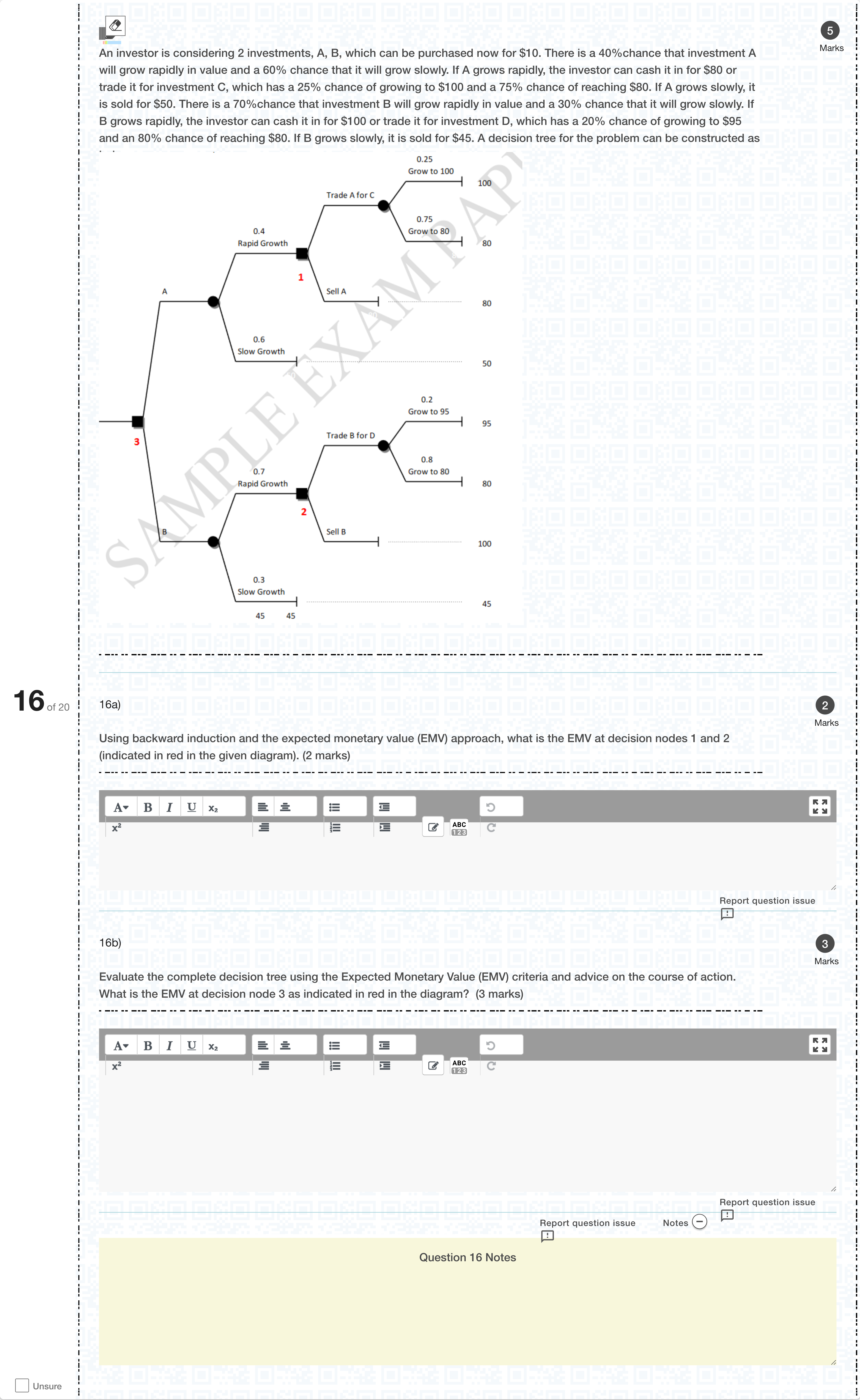

An investor is considering 2 investments, A, B, which can be purchased now for $10. There is a 40%chance that investment A will grow rapidly in value and a 60% chance that it will grow slowly. If A grows rapidly, the investor can cash it in for $80 or trade it for investment C, which has a 25% chance of growing to $100 and a 75% chance of reaching $80. If A grows slowly, it is sold for $50. There is a 70%chance that investment B will grow rapidly in value and a 30% chance that it will grow slowly. If B grows rapidly, the investor can cash it in for $100 or trade it for investment D, which has a 20% chance of growing to $95 and an 80% chance of reaching $80. If B grows slowly, it is sold for $45. A decision tree for the problem can be constructed as below.[Fill in the blank] Using backward induction and the expected monetary value (EMV) approach, what is the EMV at decision nodes 1 and 2 (indicated in red in the given diagram). (2 marks)[Fill in the blank] Evaluate the complete decision tree using the Expected Monetary Value (EMV) criteria and advice on the course of action. What is the EMV at decision node 3 as indicated in red in the diagram? (3 marks)[Fill in the blank]

查看解析

标准答案

Please login to view

思路分析

The problem asks us to use backward induction and EMV to fill in three values along the decision tree.

First, focus on the A branch when A grows rapidly. At that node, the investor can either cash in for 80 or trade A for investment C, which has a 25% chance of reaching 100 and a 75% chance of reaching 80. The EMV of the trade option is 0.25×100 + 0.75×80 = 25 + 60 = 85, which is greater than the sure ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Decision trees are useful for sequential decision-making under demand uncertainty.

Decision trees are useful for sequential decision-making under demand uncertainty.

Suppose that the decisionmaker takes the personal retreat. For some values of p and q, suppose that the payoff associated with decision H is 258.2 if she senses consolation, and the payoff associated with decision H is 165.8 if she senses desolation. What is the payoff associated with sensing consolation in a decision tree corresponding to the decisionmaker's problem? (Choose the most correct answer.)

For some value of p, the payoff associated with node F is 4045.16, and the payoff associated with G is -842.99. What is the optimal decision if the marketing research firm predicts “bad”?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!