题目

254_AC360 Financial & Managerial Accounting

数值题

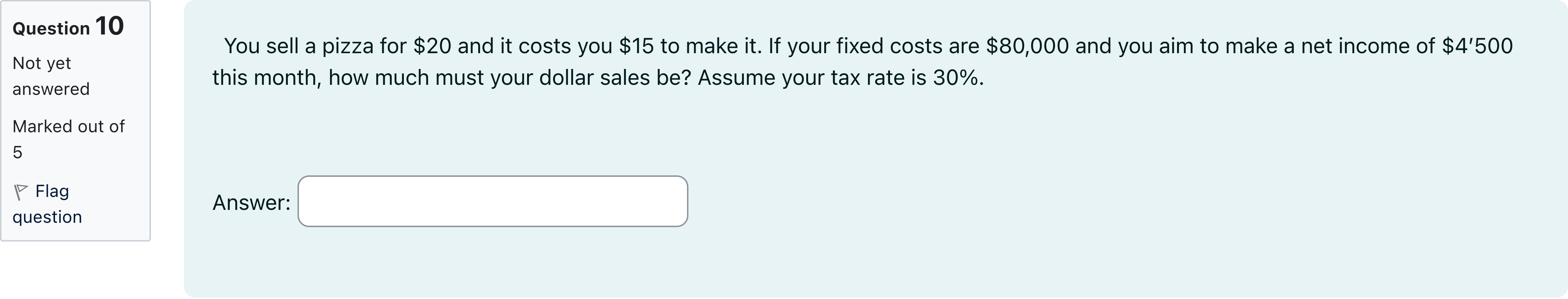

You sell a pizza for $20 and it costs you $15 to make it. If your fixed costs are $80,000 and you aim to make a net income of $4’500 this month, how much must your dollar sales be? Assume your tax rate is 30%.

查看解析

标准答案

Please login to view

思路分析

Step-by-step analysis of the given problem and options (even though no options are provided, I will show the full reasoning):

- First, identify the relevant financial relationships. Each pizza sells for $20 and costs $15 to produce, so the contribution margin per pizza (sales minus variable cost) is 20 - 15 = $5 per pizza. This $5 contributes toward covering fixed costs and generating net income.

- Let n be the number......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Under the assumptions used in cost-volume-profit analysis, as the activity increases:

The CVP and break-even analysis are supported by a range of important assumptions. Which of the following is not an assumption of the CVP:

Eastwood Corporation manufactures numerous products, one of which is called Beta96. The company has provided the following data about this product: Unit sales (a) 60,000 Selling price per unit $ 88.00 Variable cost per unit $ 53.00 Fixed expense $ 1,980,000 Management is considering decreasing the price of Beta96 by 8%, from $88.00 to $80.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 60,000 units to 66,000 units. Assuming that the total fixed expense does not change, what net operating income will product Beta96 earn at a price of $80.96 if this sales forecast is correct?

Thomason Corporation has provided the following contribution format income statement. Sales (1,000 units) $ 40,000 Variable expenses 30,000 Contribution margin 10,000 Fixed expenses 7,000 Net operating income $ 3,000 If the variable cost per unit increases by $1, spending on advertising increases by $2,000, and unit sales increase by 50 units, the net operating income would be closest to:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!