题目

单项选择题

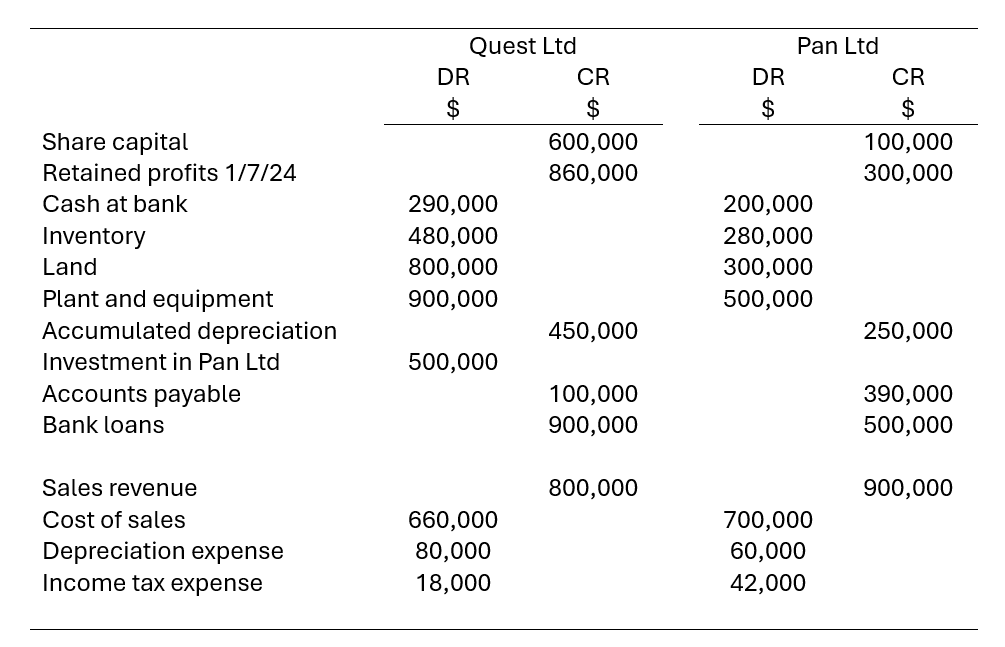

Question1 On 1 July 2024, Quest Ltd acquired 60% of the share capital of Pan Ltd for a cash consideration of $500,000. At the date of acquisition, Pan Ltd’s total equity was comprised of: [table] Share capital | $100,000 Retained profits 1/7/24 | $300,000 [/table] At the acquisition date all identifiable assets and liabilities of Pan Ltd were recorded at their fair values. The company tax rate is 30%. An extract of trial balances of Quest Ltd and Pan Ltd as at 30 June 2025 (one year after acquisition) are provided below: The group balance sheet at 30 June 2025 will include in the equity section: [table] Share capital | $600,000 Retained profits | $960,800 Non-controlling interest (NCI) | $227,200 [/table] [table] Share capital | $600,000 Retained profits | $860,000 Non-controlling interest (NCI) | $227,200 [/table] [table] Share capital | $600,000 Retained profits | $1,000,000 Non-controlling interest (NCI) | $246,800 [/table] [table] Share capital | $600,000 Retained profits | $860,000 Non-controlling interest (NCI) | $160,000 | [/table] [table] Share capital | $700,000 Retained profits | $1,000,000 Non-controlling interest (NCI) | $246,800 [/table] ResetMaximum marks: 1 Flag question undefined

选项

A.Share capital

$600,000

Retained profits

$960,800

Non-controlling interest (NCI)

$227,200

B.Share capital

$600,000

Retained profits

$860,000

Non-controlling interest (NCI)

$227,200

C.Share capital

$600,000

Retained profits

$1,000,000

Non-controlling interest (NCI)

$246,800

D.Share capital

$600,000

Retained profits

$860,000

Non-controlling interest (NCI)

$160,000

E.Share capital

$700,000

Retained profits

$1,000,000

Non-controlling interest (NCI)

$246,800

查看解析

标准答案

Please login to view

思路分析

First, restate the information provided to set the context for evaluating the group equity allocation.

- Quest Ltd acquired 60% of Pan Ltd on 1 July 2024 for $500,000. Pan Ltd’s equity at acquisition time (1/7/24) consisted of Share capital $100,000 and Retained profits $300,000, i.e., total equity $400,000.

- At acquisition, all Pan identifiable assets and liabilities were fair valued; the question implies standard acquisition accounting will apply (including any goodwill if there is a difference between consideration and 60% of Pan’s net identifiable assets).

- The trial balance extracts as at 30 June 2025 (one year after acquisition) are given, but the exact line-by-line totals from the question are simplified in the answer choices. The group balance sheet at 30 June 2025 will report Equity for Quest and Pan, including Non-controlling Interest (NCI).

Now evaluate each answer option step by step, noting what each one implies about Quest’s consolidated equity and the NCI, and why these would or would not fit a typical post-acquisition consolidation scenario.

Option A:

Share capital $600,000; Retained profits $960,800; Non-controlling interest (NCI) $227,200

- Why this could be plausible: The group’s share capital is shown as $600,000, which would be the parent Quest’s contributed capital plus any adjustments from subsidiary ownership; the retained profits value $960,800 would represent Quest’s retained earnings plus Pan’s post-acquisition retained earnings attributable to the group (i.e., 60% of Pan’s post-acquisition profits added to Quest’s retained profits, with the remaining 40% allocated to NCI). The NCI of $227,200 would be 40% of Pan’s post-acquisition net assets or a proportionate share of Pan’s post-acquisition equity at 30 June 2025 (depending on fair value adjustments and post-acquisit......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Question5 According to AASB 10 / IFRS 10 Consolidated Financial Statements, which of the following factors indicate the existence of control by an investor over an investee? [table] I. | Possessing existing rights that give the current ability to direct the relevant activities. II. | Shared power in the governance of financial and operating policies of another entity so as to obtain benefits. III. | The power to have significant influence over the operating policies of an entity so as to obtain benefits. IV. | Ownership of more than 50% of the voting rights in the subsidiary. [/table] I, II and III only II and IV only I and IV only None of the options are correct IV only ResetMaximum marks: 1 Flag question undefined

At balance date, Company A has 40% of the voting rights in Company B. In addition Company A holds potential voting rights in Company B amounting to 6% that are currently exercisable, and a further 9% of voting rights in Company B that can be exercised in two years’ time. Which of the following statements is correct?

In a consolidated group of entities, control over the subsidiaries in the group:

The key characteristic that determines when consolidated financial statements should be prepared is:

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!