题目

FIN.256.M016.FALL25.Principles of Finance Final Exam FIN.256.M016.FALL25.Principles of Finance Final Exam

简答题

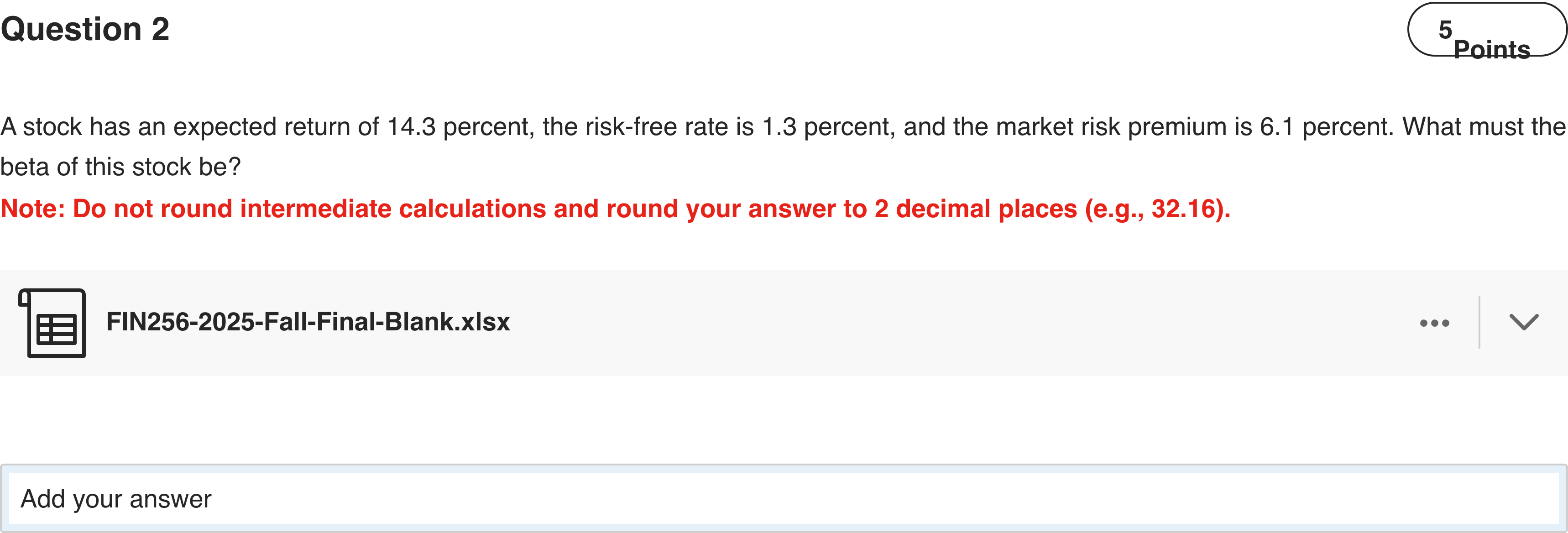

A stock has an expected return of 14.3 percent, the risk-free rate is 1.3 percent, and the market risk premium is 6.1 percent. What must the beta of this stock be?Note: Do not round intermediate calculations and round your answer to 2 decimal places (e.g., 32.16).FIN256-2025-Fall-Final-Blank.xlsx

查看解析

标准答案

Please login to view

思路分析

This question uses the CAPM framework to relate an asset's expected return to the risk-free rate and the market risk premium.

First, identify the formula: Expected Return = Risk-free Rat......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

In the CAPM regression: 𝑅 𝑖 − 𝑅 𝑓 = 𝛼 𝑖 + 𝛽 𝑖 × ( 𝑅 𝑚 − 𝑅 𝑓 ) + 𝜖 𝑖 which statement is the most accurate?

Assume that CAPM holds. An analyst estimated the following risk-reward ratio for the market: 𝐸 [ 𝑅 𝑀 ] − 𝑅 𝑓 𝜎 𝑀 2 =20% The covariance of Stock A and the market portfolio is -0.45%. The risk-free rate is 3%. What is Stock A's expected return? Enter your final answer as a percentage rounded to two decimal places, and input only the number (no “%” sign). For example, enter -5.41 (not -5.41%) or 7.35 (not 7.35%).

Assume that CAPM holds. ETF Z combines only Stock X and Stock Y. According to the market, the expected return of ETF Z is 15% and its alpha is 3%. You know that Stock X's beta is 1.0 and Stock Y's beta is 2.0, the expected return of the market is 9% and the risk-free rate is 4%. Determine Stock X's alpha if 𝛼 𝑋 = 3 𝛼 𝑌 . Enter your final answer as a percentage rounded to two decimal places, and input only the number (no “%” sign). For example, enter -5.41 (not -5.41%) or 7.35 (not 7.35%).

Select all of the below statements that are true.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!