题目

FIN.256.M016.FALL25.Principles of Finance Final Prep LockDown Browser FIN.256.M016.FALL25.Principles of Finance Final Prep LockDown Browser

多项填空题

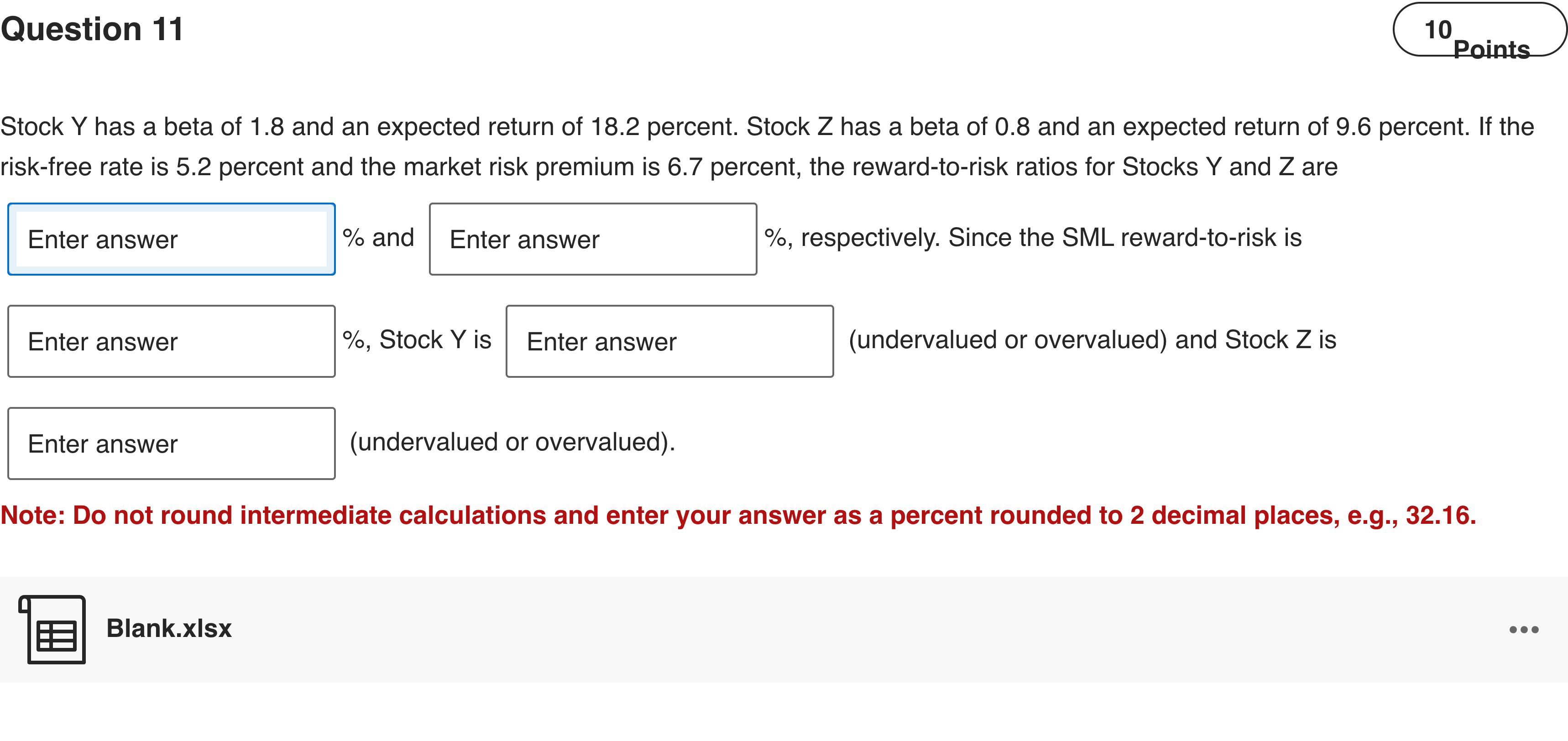

Stock Y has a beta of 1.8 and an expected return of 18.2 percent. Stock Z has a beta of 0.8 and an expected return of 9.6 percent. If the risk-free rate is 5.2 percent and the market risk premium is 6.7 percent, the reward-to-risk ratios for Stocks Y and Z are [input]% and [input]%, respectively. Since the SML reward-to-risk is [input]%, Stock Y is [input] (undervalued or overvalued) and Stock Z is [input] (undervalued or overvalued).Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

查看解析

标准答案

Please login to view

思路分析

The question asks us to compute the reward-to-risk ratios for Stocks Y and Z using the given data, identify the SML reward-to-risk, and then classify each stock as undervalued or overvalued.

First, determine the reward-to-risk ratio for Stock Y. The formula is: (Expected Return − Risk-free Rate) / Beta.

- For Y: E(R_Y) = 18.2%, ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

In the CAPM regression: 𝑅 𝑖 − 𝑅 𝑓 = 𝛼 𝑖 + 𝛽 𝑖 × ( 𝑅 𝑚 − 𝑅 𝑓 ) + 𝜖 𝑖 which statement is the most accurate?

Assume that CAPM holds. An analyst estimated the following risk-reward ratio for the market: 𝐸 [ 𝑅 𝑀 ] − 𝑅 𝑓 𝜎 𝑀 2 =20% The covariance of Stock A and the market portfolio is -0.45%. The risk-free rate is 3%. What is Stock A's expected return? Enter your final answer as a percentage rounded to two decimal places, and input only the number (no “%” sign). For example, enter -5.41 (not -5.41%) or 7.35 (not 7.35%).

Assume that CAPM holds. ETF Z combines only Stock X and Stock Y. According to the market, the expected return of ETF Z is 15% and its alpha is 3%. You know that Stock X's beta is 1.0 and Stock Y's beta is 2.0, the expected return of the market is 9% and the risk-free rate is 4%. Determine Stock X's alpha if 𝛼 𝑋 = 3 𝛼 𝑌 . Enter your final answer as a percentage rounded to two decimal places, and input only the number (no “%” sign). For example, enter -5.41 (not -5.41%) or 7.35 (not 7.35%).

Select all of the below statements that are true.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!