题目

多项填空题

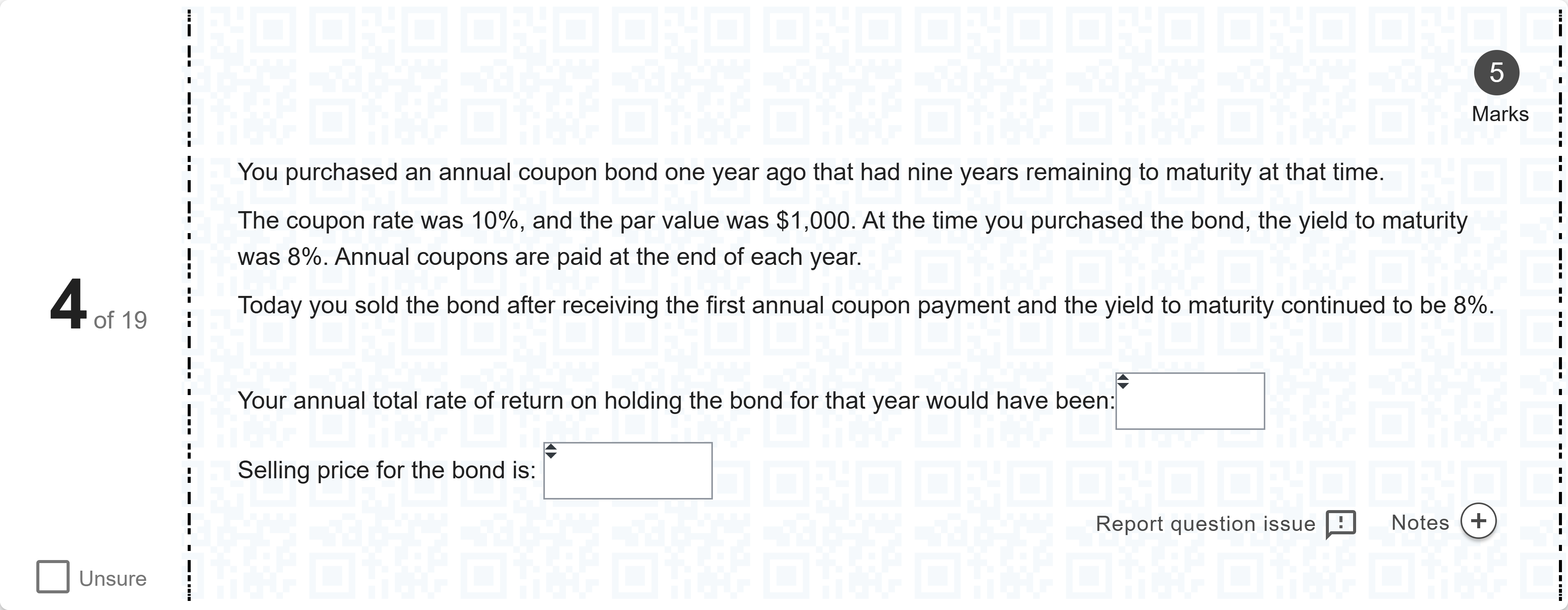

Question text 5Marks You purchased an annual coupon bond one year ago that had nine years remaining to maturity at that time. The coupon rate was 10%, and the par value was $1,000. At the time you purchased the bond, the yield to maturity was 8%. Annual coupons are paid at the end of each year. Today you sold the bond after receiving the first annual coupon payment and the yield to maturity continued to be 8%. Your annual total rate of return on holding the bond for that year would have been:Answer 13[select: , 8.00%., 7.82%., -7.00%., 11.95%., -6.88%] Selling price for the bond is: Answer 14[select: , $1,114.93, $1,124.94, $1,000, $948.75, $1,100]Notes Report question issue Question 4 Notes

查看解析

标准答案

Please login to view

思路分析

To tackle this problem, I will break down the key pieces and work through them step by step before identifying the final values.

First, recall the bond details: par value = $1,000, annual coupon rate = 10%, so annual coupon = $100. When you bought the bond, the yield to maturity (YTM) was 8%. One year has passed, you received the first $100 coupon, and you sell the bond right after that. The YTM at the time of sale remains 8%.

Next, determine the selling price. After one year, the bond has 8 years remaining to maturity. The price today (just after receiving the coupon) is the present value of 8 years of $100 coupons plus the $1,000 face value repaid at the end of year 8, all discounted at the new/continuing ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

ACR'TERYX- Part 1b of 11 Arc’teryx is looking to raise cash to complete the full-development of their new retail store in Langley. The firm decides to issue a bond to finance this project. The face value of the bond is $3.5 million, which is issued on January 1, 2021. The 5% bond pays interests annually, and matures in 6 years. On January 1, 2021, bonds in the market with same maturity and risk as the Arc’teryx bond, had an interest rate of 8%. After issuing the bond, the corporate office of the firm decides to use the effective-interest rate method for amortizing the bond. Do not use symbols like $ or %, or text such as million, in your answers. Round to two decimal points. If the answer is 2.58456784 million, please write 2,584,567.84 What is the total borrowing cost of the bond for Arc’teryx?

Question2 A discount bond can be characterised as a bond with: All of the options are correct Has a par value that is lower than its face value A yield to maturity higher than its coupon rate Is selling for more than its principal amount but at a deep out-of-the-money discount None of the options are correct ResetMaximum marks: 1 Flag question undefined

What is the value of a bond?

Question20 On 1 July 20X6 VantaCore Ltd purchased bonds with the following conditions: Maturity periods: 5 years Face value on redemption = $ 7,000,000 Coupon rate = 5% (payable on 30 June each year) Effective interest rate = 10% VantaCore Ltd classifies the bond as a debt instrument and uses the amortised cost method. In your answers, include numbers only. No text, no commas, no signs, or symbols etc. The fair value of the bonds on 1 July 20X6 is: [input] The increase in the balance of the bonds at the end of the first year is: [input] On 30 June 20X7, the effective interest rate has changed to 5%. What is the change in the fair value of the bond (i.e. fair value versus amortised cost at 30 June 20X7) caused by the interest rate change for the year ended 30 June 20X7? (Enters a negative number when it is a decrease change. For example, decrease 100 enters as -100. Otherwise increase 100 enters as 100) [input] ResetMaximum marks: 6 [input]

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!