题目

单项选择题

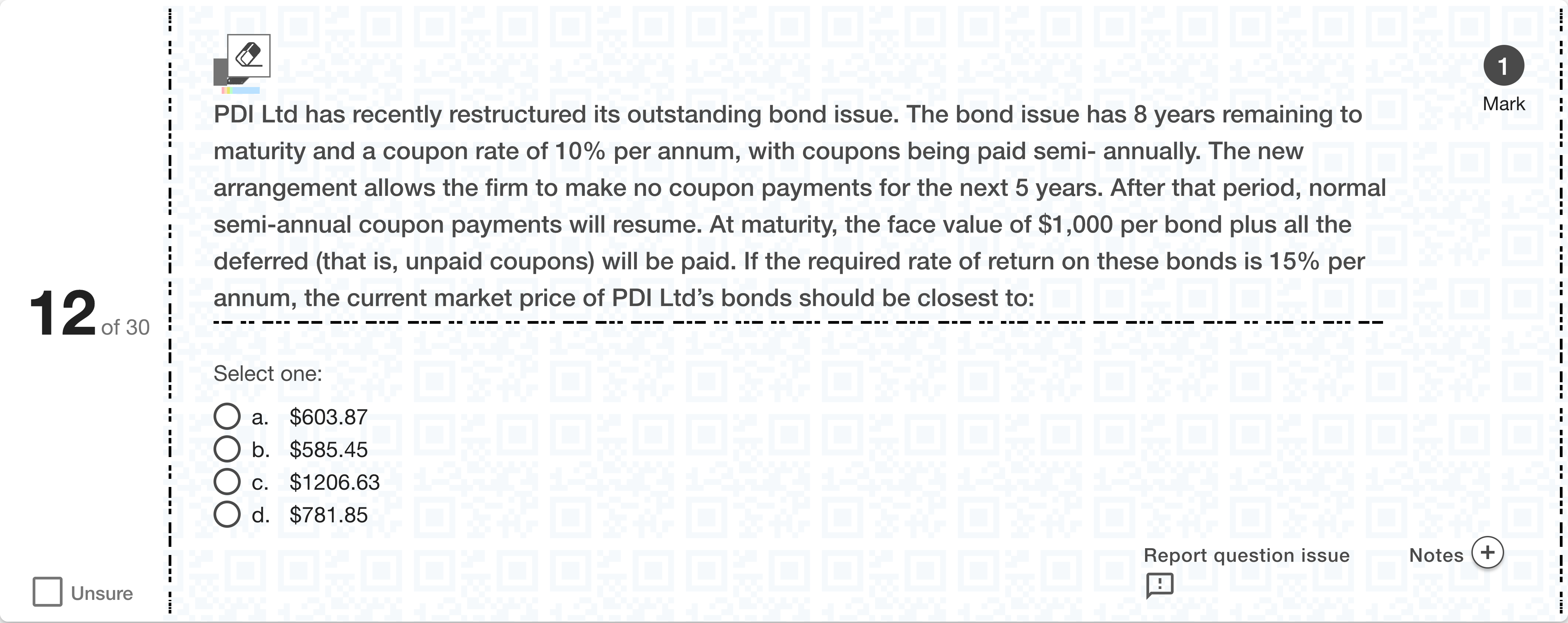

PDI Ltd has recently restructured its outstanding bond issue. The bond issue has 8 years remaining to maturity and a coupon rate of 10% per annum, with coupons being paid semi- annually. The new arrangement allows the firm to make no coupon payments for the next 5 years. After that period, normal semi-annual coupon payments will resume. At maturity, the face value of $1,000 per bond plus all the deferred (that is, unpaid coupons) will be paid. If the required rate of return on these bonds is 15% per annum, the current market price of PDI Ltd’s bonds should be closest to:[Fill in the blank]

选项

A.a. $603.87

B.b. $585.45

C.c. $1206.63

D.d. $781.85

查看解析

标准答案

Please login to view

思路分析

We start by restating the scenario to ensure clarity: the bond has 8 years to maturity, a 10% annual coupon paid semiannually (so 5% of 1000 = 50 every half-year), but for the first 5 years no coupon payments are made. After year 5, regular semiannual coupons resume for the remaining 3 years (6 semiannual periods). At maturity, the bondholder receives the face value of 1000 plus all the deferred (unpaid) coupons from the 5-year deferral. The required return is 15% per year, i.e., 7.5% per half-year, and we discount all cash flows at 7.5% per half-year.

Step-by-step analysis of each option:

Option a: $603.87

- To evaluate, note that the present value will consist of two parts: (i) the value of the six coupon payments of 50 starting ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

ACR'TERYX- Part 1b of 11 Arc’teryx is looking to raise cash to complete the full-development of their new retail store in Langley. The firm decides to issue a bond to finance this project. The face value of the bond is $3.5 million, which is issued on January 1, 2021. The 5% bond pays interests annually, and matures in 6 years. On January 1, 2021, bonds in the market with same maturity and risk as the Arc’teryx bond, had an interest rate of 8%. After issuing the bond, the corporate office of the firm decides to use the effective-interest rate method for amortizing the bond. Do not use symbols like $ or %, or text such as million, in your answers. Round to two decimal points. If the answer is 2.58456784 million, please write 2,584,567.84 What is the total borrowing cost of the bond for Arc’teryx?

Question2 A discount bond can be characterised as a bond with: All of the options are correct Has a par value that is lower than its face value A yield to maturity higher than its coupon rate Is selling for more than its principal amount but at a deep out-of-the-money discount None of the options are correct ResetMaximum marks: 1 Flag question undefined

What is the value of a bond?

Question20 On 1 July 20X6 VantaCore Ltd purchased bonds with the following conditions: Maturity periods: 5 years Face value on redemption = $ 7,000,000 Coupon rate = 5% (payable on 30 June each year) Effective interest rate = 10% VantaCore Ltd classifies the bond as a debt instrument and uses the amortised cost method. In your answers, include numbers only. No text, no commas, no signs, or symbols etc. The fair value of the bonds on 1 July 20X6 is: [input] The increase in the balance of the bonds at the end of the first year is: [input] On 30 June 20X7, the effective interest rate has changed to 5%. What is the change in the fair value of the bond (i.e. fair value versus amortised cost at 30 June 20X7) caused by the interest rate change for the year ended 30 June 20X7? (Enters a negative number when it is a decrease change. For example, decrease 100 enters as -100. Otherwise increase 100 enters as 100) [input] ResetMaximum marks: 6 [input]

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!