题目

MCD2170 Foundations of Finance - Trimester 3 - 2025

单项选择题

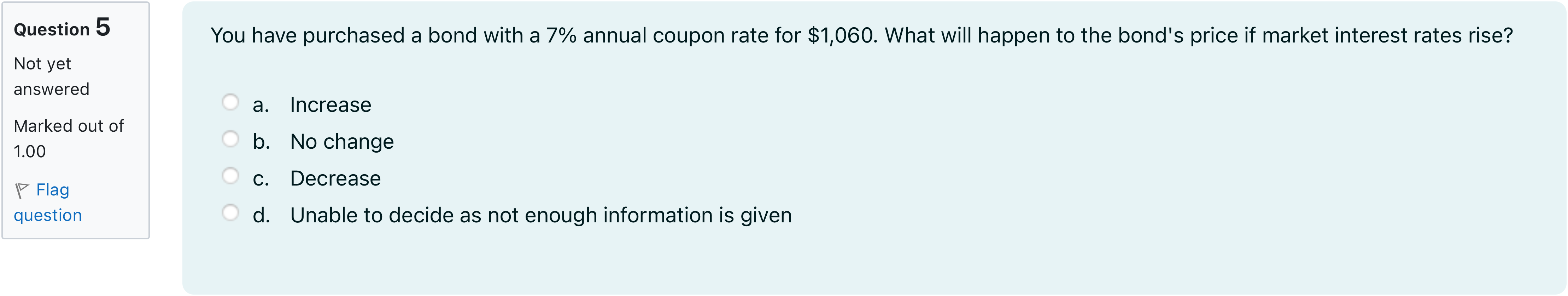

You have purchased a bond with a 7% annual coupon rate for $1,060. What will happen to the bond's price if market interest rates rise?

选项

A.a. Increase

B.b. No change

C.c. Decrease

D.d. Unable to decide as not enough information is given

查看解析

标准答案

Please login to view

思路分析

The scenario: a bond with a 7% annual coupon is purchased for $1,060. We are asked what happens to the bond's price if market interest rates rise.

Option a: Increase. When market interest rates rise, newly issued bonds will offer higher coupon payments relative to existing bonds. Investors would demand a discount on the older bond to reconcile its lower coupon with higher prevail......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

A bond will sell at a discount (below par value) if

As interest rates rise, the market price of your bond is also likely to rise.

ACR'TERYX- Part 1a of 11 Arc’teryx is looking to raise cash to complete the full-development of their new retail store in Langley. The firm decides to issue a bond to finance this project. The face value of the bond is $3.5 million, which is issued on January 1, 2021. The 5% bond pays interests annually, and matures in 6 years. On January 1, 2021, bonds in the market with same maturity and risk as the Arc’teryx bond, had an interest rate of 8%. After issuing the bond, the corporate office of the firm decides to use the effective-interest rate method for amortizing the bond. Do not use symbols like $ or %, or text such as million, in your answers. Round to two decimal points. If the answer is 2.58456784 million, please write 2,584,567.84 What is the price of the bond issued on January 1, 2021?

On January 1st, 2005, Borrower Limited sold a 10%, five-year, $100 million bond when bonds of equivalent risk and maturity were yielding 5% annually. Interest payments are made on January 1st next year. What is the Price of the Bond?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!