题目

FINS5530-Financial Institution Mgmt - T3 2025

单项选择题

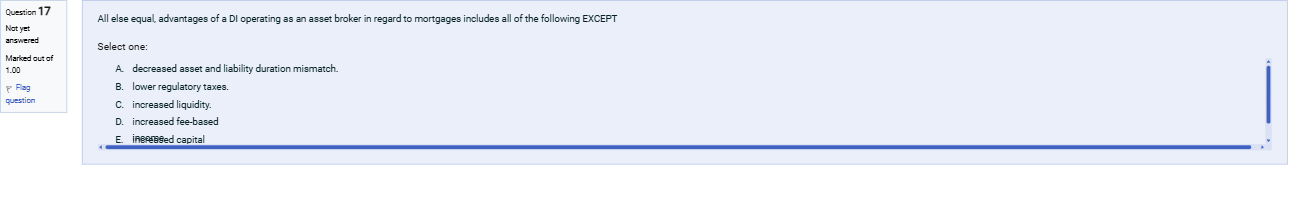

All else equal, advantages of a DI operating as an asset broker in regard to mortgages includes all of the following EXCEPT

选项

A.A. decreased asset and liability duration mismatch.

B.B. lower regulatory taxes.

C.C. increased liquidity.

D.D. increased fee-based income.

E.E. increased capital requirements.

查看解析

标准答案

Please login to view

思路分析

To tackle this question, we must evaluate which items represent advantages of a DI (depository institution) operating as an asset broker in mortgage activities, and identify the one that does not.

A. Decreased asset and liability duration mismatch. Thi......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Part 1"Bank managers should always seek the highest return possible on their assets." Is this statement true, false, or uncertain? A. True. The highest return possible on assets will guarantee the highest income for the bank. B. True. Seeking the highest return possible will always prevent a bank failure. C. False. A bank must also consider an asset's risk and liquidity when deciding which assets to hold. D. Uncertain. This statement is true only if the bank has more rate-sensitive liabilities than assets.

Balance sheet hedging is: 资产负债表对冲是:

Balance sheet hedging is:

In a consumer society, many adults channel creativity into buying things

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!