题目

Dashboard Quiz 7: Taxation Planning (Week 7)

数值题

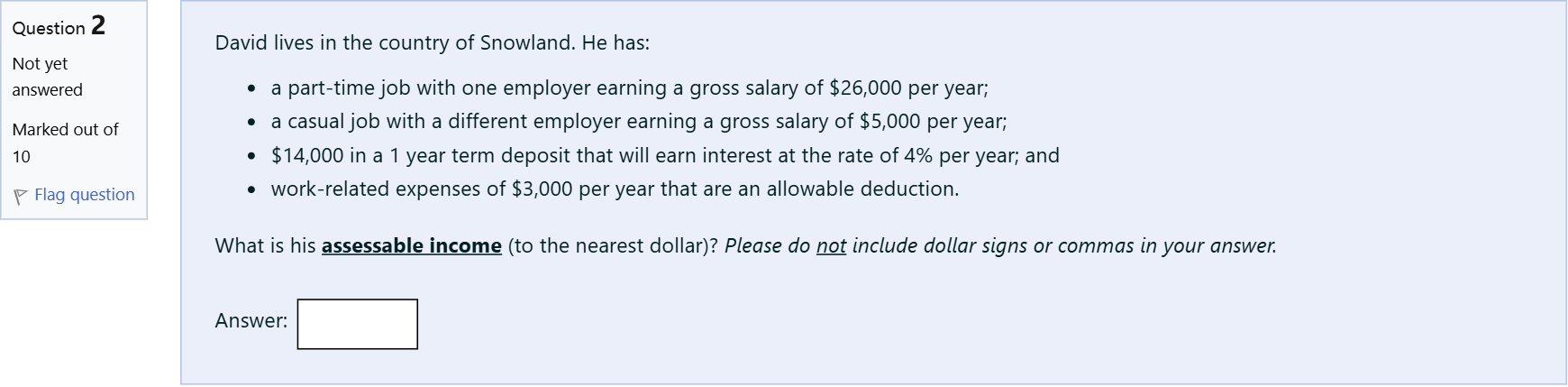

David lives in the country of Snowland. He has: a part-time job with one employer earning a gross salary of $26,000 per year; a casual job with a different employer earning a gross salary of $5,000 per year; $14,000 in a 1 year term deposit that will earn interest at the rate of 4% per year; and work-related expenses of $3,000 per year that are an allowable deduction. What is his assessable income (to the nearest dollar)? Please do not include dollar signs or commas in your answer.

查看解析

标准答案

Please login to view

思路分析

We start by identifying all components of David's income.

- Part-time Salary: 26,000 per year. This is gross employment income and is included in assessable income.

- Casual Salary: 5,000 per year. This is additional gross employment income and is included.

- Interest f......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Julie lives in the country of Snowland. She has: a full-time job earning a gross salary of $40,000 per year; $22,000 in a 1 year term deposit that will earn interest at the rate of 5% per year; and study expenses of $2,000 per year that are an allowable deduction. What is her assessable income (to the nearest dollar)? Please do not include dollar signs or commas in your answer.

David lives in the country of Snowland. He has: a part-time job with one employer earning a gross salary of $30,000 per year; a casual job with a different employer earning a gross salary of $7,000 per year; $17,000 in a 1 year term deposit that will earn interest at the rate of 5% per year; and work-related expenses of $3,000 per year that are an allowable deduction. What is his assessable income (to the nearest dollar)? Please do not include dollar signs or commas in your answer.

During the financial year James, a full-time science teacher received the following amounts: Salary income from working as a teacher $90,000 Winnings from entering an art competition $1,000 Rental income $26,000 An award for teacher of the year $10,000 What is Jame's assessable income

In a consumer society, many adults channel creativity into buying things

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!